Details of the service

Who:

If you’re looking to buy an apartment but not sure if the price is right, then the Apartment Deal Analyzer service is for you. I will use my extensive managerial experience in business valuation at one of the largest accounting networks in the world, as well as my knowledge as a Real Estate Appraiser’s Board Exam placer.

But more than anything, your deal will go through the exact process I use to analyze my deals.

What:

The Apartment Deal Analyzer output will include the following:

- A short write-up of the output explaining how I see the deal.

- A maximum purchase price. It’s a useful base number you can use in the negotiations.

- A maximum “purchase price + renovation” budget that’s based on the estimated loanable value of a second loan. You can use the second loan to buy another property. (See BRRRR Investing)

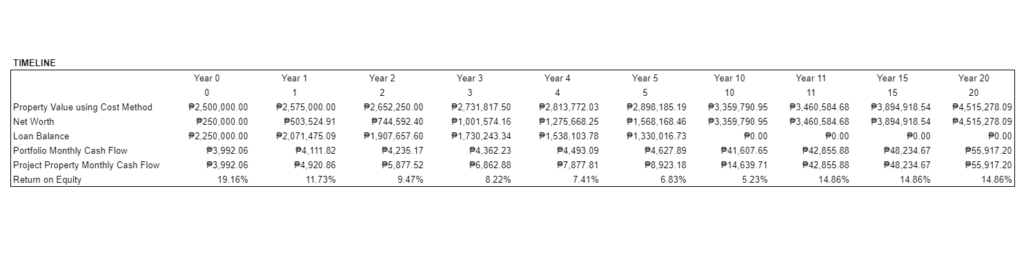

- Projected timeline in graph and table format. The timeline will show when you start to earn a positive return, the expected loan balance, and other relevant information. See the sample graph and table below.

Where:

Select the “Buy Now” button below to avail of the service.

When:

Please expect a turnaround time of 1 to 2 days.

Required information

Kindly send the following information to my email at dan@freedomlocker.ph. Should you have questions or comments, I’d be happy to help!

Area

- Lot area

- Number of floors

- Floor area coverage (in %) — Of the total lot area, how much area does the building cover? This is set at 100% if all walls are on the property line.

- Assumed common area — A percentage of the area not allotted to rooms. If you’re unsure, we assume a 20% to 30% allotment.

Rates

- Average monthly rent per unit — Please provide a weighted average. If you are unsure how to do this, please send us a list of the number of units and rate per unit.

- Number of units or rooms

- Assumed vacant rooms (average vacant unit or room per month)

- No renovation cash flow — What is the existing monthly cash flow assuming no improvements are made?

Costs

- Property manager cost per month

- Maintenance expense per month

- Taxes and fees (annual fees)

- Other monthly expenses

Financing

- LTV Ratio — What is your bank’s Loan-to-Value ratio?

- Bank Loan Terms — Please provide your bank’s interest rate and maximum tenure in years.

- Acquisition cost — What is the selling price?

- Renovation cost — How much do you expect to spend on renovating the property? This is the renovation necessary to arrive at your assumed monthly rent.

- Initial Equity — How much are you willing to spend in cash?

- Do you have a target Return on Equity? If yes, please indicate.

Liability disclaimer

The results of the analysis are for your reference only and are based on assumptions that may or may not hold up. You are free to act on your own and the consultant, nor freedom locker PH, will not be held liable and accountable for the results of your transaction, positive or negative.

Read more, select a topic: