Thinking, Fast and Slow by Daniel Kahneman is a psychology book that offers a lot of business insights. We, as humans, have our biases. First accepting this fact, followed by an understanding of how these biases affect us, is an invaluable tool in business and life. Whether it’s in negotiations, forecasting, or investments, the lessons from Thinking, Fast and Slow are surprisingly relevant!

The book is full of information from tastes and decisions to averages and summations. Here are some very random but memorable takeaways from the book.

Page Contents

Biases affect you unknowingly

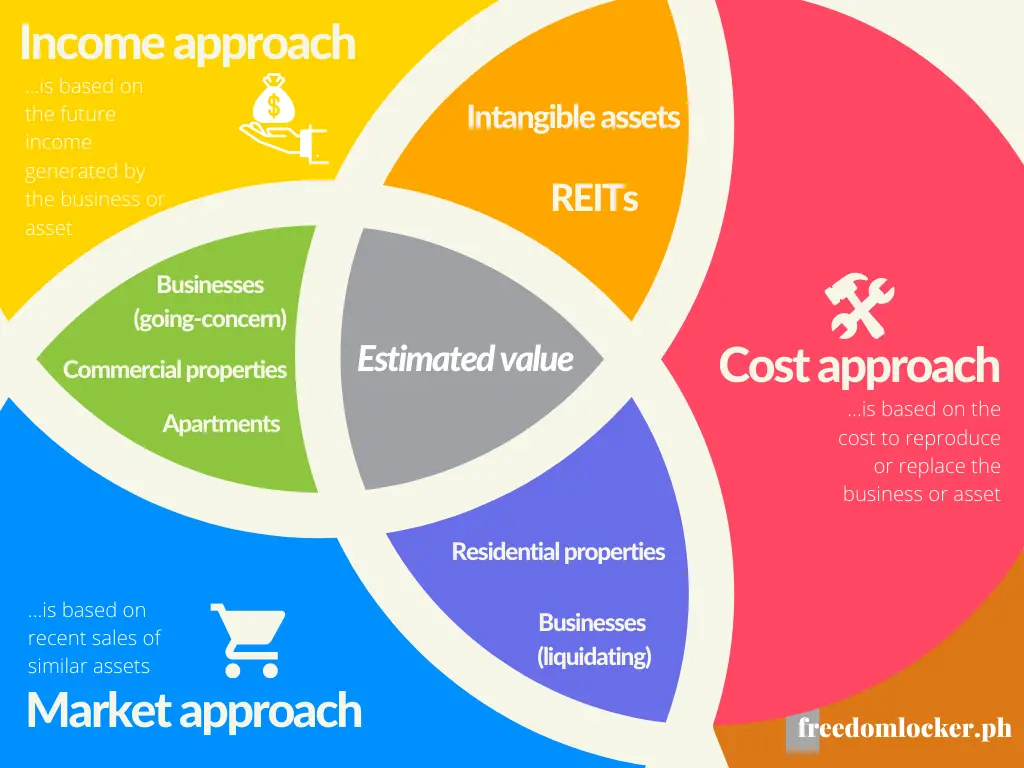

Let’s begin with a hypothetical example. Suppose you own an investment property you’d like to sell. You’ve yet to compute your valuation but a buyer approaches you with an offer of Php8 million. You then come up with your own independent valuation at Php12 million. You negotiate and meet halfway at Php10 million. Answering with a “yes” or “no,” was that a fair enough split?

Well, that depends, of course. But without knowing the conditions of the sale (i.e., buyer’s market vs. seller’s market, old property vs. new property, commercial vs. residential, etc.), most would assume that a split in the middle is fair. We must remember though, that the initial offer was subjective, to begin with, and could’ve been as low as Php2 million, or as high as Php11 million. What would’ve been the fair split then?

(Related: Options to consider before selling your property)

Anchoring bias

Anchoring is a bias where we rely heavily on the first information given to us — our minds are anchored to the first information. It’s when that $2,000 online course now selling at $20 suddenly looks cheap!

In his book, Kahneman quotes an example where two groups are asked to value real estate. The first group was a collection of real estate brokers while the second was a group of business students. The seller’s asking price is available to both groups.

The study’s conclusion? Anchoring bias affects both groups, with their average valuation anchored to the seller’s price. But how they perceived their performance is interesting. The real estate brokers knew they weren’t affected by the listed price while the business students admitted to having a bias towards the listed price. In other words:

Both groups were affected yet only one was aware of their bias.

Format matters

Formatting, as in the way you frame a question or present a brochure, has an influence that can be manipulated and create opportunities. It’s a simple fact that most humans miss and talented marketers make full use of. Kahneman states an example a lot of people relate to.

Consider the question “How happy is your life?” Your answer to this surprisingly (or unsurprisingly) depends on whether it is preceded or succeeded by the question “How’s your dating life?”

Scenario 1: How happy is your life? How’s your dating life?

Scenario 2: How’s your dating life? How happy is your life?

This technique can be applied to everything — flyers, polls, juice box labels, slogans, lyrics, and a whole lot more! It is a crafty way of influencing people and is known as a framing bias.

Humans don’t like losing

Most humans are okay with paying a commission on stock trading. But when our stock portfolios decrease in value by the same amount, we feel anxious. Apparently, losses evoke stronger negative feelings than costs despite being economically equivalent.

The book outlines how this could be caused by our evolutionary history — organisms that treat threats as more urgent than opportunities have a better chance to survive and reproduce.

In other words, the survivors are typically those who have a strong tendency to stay away from danger (i.e., losses).

We also see this when dealing with our investments. Positive and negative expectations are asymmetrical or unbalanced. A 20% loss has a greater impact on our psyche than a 20% gain. Humans don’t like losing and it’s a bias called loss aversion.

Inconsistent answers

One of the major assumptions in economic theory is that humans are rational and selfish. We make choices that are beneficial for us and make logical sense. Economic theory also assumes we have consistent preferences (i.e., if we prefer a risk-averse strategy, we will always choose the more risk-average strategy).

Prospect theory (c/o Kahneman et al) is a descriptive model that explains the recurring violations of the rationality assumption. It also shows that humans consider a reference point (e.g., starting point) when making decisions, and preferences may not be consistent as they are usually based on memories (and memories can be wrong).

Kahneman’s fourfold pattern

The fourfold pattern shows how inconsistencies in decision making arise at low and high probability extremes.

| Fourfold Pattern | GAINS | LOSSES |

| HIGH Probability | Risk Averse (e.g., 95% chance to win Php100 million) | Risk Seeking (e.g., 95% chance to lose Php100 million) |

| LOW Probability | Risk Seeking (e.g., 5% chance to win Php100 million) | Risk Averse (e.g., 5% chance to lose Php100 million) |

- High Probability + Gains: If you had a 95% chance to win Php100 million vs. a sure shot at Php90 million, would you take the risk? Most wouldn’t, showing risk-averse behavior. We see this in court settlements.

- Low Probability + Gains: If you had a 5% chance to win Php100 million, would you take it? Most would, showing risk-seeking behavior. We see this in lottery tickets.

- High Probability + Losses: If you had a 95% chance to lose Php100 million vs. a 5% chance to make Php100 million, would you take it? Most would, showing risk-seeking behavior. We see this in last-ditch gambles.

- Low Probability + Losses: If you had a 5% chance to lose Php100 million, would you take it? Most wouldn’t, showing risk-averse behavior. We see this when people buy insurance.

To read more about our inherent biases in Daniel Kahneman’s Thinking, Fast and Slow, grab yourself a copy at Amazon.

*This post contains affiliate links. You may read my affiliate disclosure on my Terms & Conditions page, #6 Links.

Read more, select a topic: