I’m going to tell it as I see it, true financial freedom and having a job do not go together. I describe true financial freedom as doing whatever you want, whenever, wherever. It’s not just about being debt-free. True freedom is not worrying about debt, time, nor what unimportant people think. This is my opinion and it’s evolved over 15 years, from experiences as both employee and employer. I like to think I understand both sides fairly.

Don’t get me wrong, financial freedom while having a job can absolutely be achieved. I’m not saying it can’t. What I’m saying is having a job is a crutch. It’s borderline amusing how financial freedom is easier to achieve when you’re not tied to a job. Surely sounds counterintuitive until the moment of epiphany.

I am also against society’s indoctrination of what we should do:

Get good grades, get a good job, retire when you’re 60.

I understand this is one of those controversial topics and that I am on the losing side. Let me be very clear. I’m not saying be lazy and quit your job. In most cases, it’s even about working more hours before achieving financial independence! Instead, this is about the challenges to financial freedom that having a job carries. If you absolutely LOVE your job and don’t mind grinding it out until retirement, these may not apply. I’d still argue otherwise because there are ways to do what you love without being tied, but that’s just me. Let me know your thoughts. I love a good discussion.

Page Contents

True financial freedom and a job are contradicting points

On the clock

Having a job means working for a set number of hours per week. The keyword here is “set.” It’s fixed. A few leaves of absences here and there, sure, but you’re generally tied to your commitment. On the other hand,

freedom is all about having choices.

Freedom means having the choice to work 12 hours today and not work tomorrow. That’s probably a bad idea, but again it’s a choice that’s possible.

No stressing over the rush hour traffic and no calling off dinners for overtime work.

No work no pay

Having a job means if you don’t work, you don’t get paid. It’s “active income” as opposed to “passive income.” The more you work, the more you earn. But the problem is there’s a limit to the number of hours we can work.

Being financially independent through passive income means earning without working. Again this doesn’t mean being lazy. It just means the work was done ahead. Whether that’s in investing (i.e., work was done to earn you the money invested) or business (i.e., long hours working on your business and have it run on autopilot), passive income sources also entail a lot of work. But it’s work that bears evergreen fruits.

Beyond slaving away

If you had a choice, money not being an issue, would you be at your job today? Is it something you would gladly do for free? For most of us, we rarely find this. If you’re in one, congrats! (Are you sure there’s nothing else you’d rather be doing? A hobby perhaps?) I thought working in corporate finance was cool, to be honest. Probably convinced by the media.

John A. Shedd was quoted to have said, “A ship in the harbor is safe. But that is not what ships are built for.”

This quotation is about getting out of your comfort zone. But I also liken it to us, humans, not meant to be in a 9-5 job. Work is an ancillary fact of life, but I don’t believe it’s our ultimate purpose.

“Slavery” is a strong name, but I use it for lack of a better word. Our societies’ structures haven’t actually changed much. Pharaohs had enforcers and laborers working for them. Business owners have managers and workers working for them.

It’s the same structure except the incentives have changed, from negative reinforcement to positive reinforcement.

Pharaohs used coercion and intimidation (negative reinforcement) to force workers. Modern businesses use money and incentives (positive reinforcement) to encourage workers. It’s the same structure of working hard for someone else. The difference is we now have a choice. We can choose to be business owners.

Having a job breeds comfort

I understand that having a job is sometimes just a means to an end – towards financial freedom or some other goal. But I don’t think this takes away from my view. Having a job creates comfort, and comfort hinders progress.

Easy to pass up opportunities

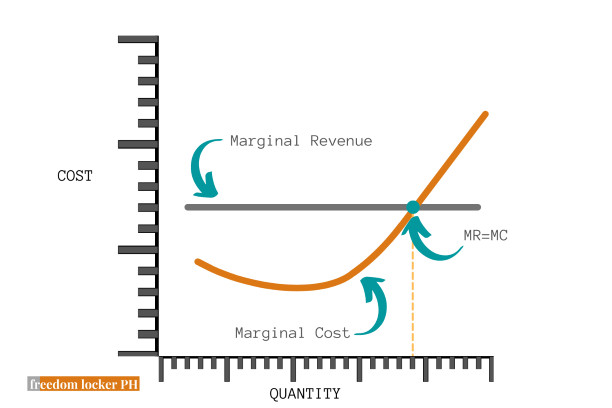

We understand how passive income is better than active income. In business, there’s even a suggested parity that “1,000 in passive income is (better than) 10,000 in active income.” Regardless of the amounts, we know that passive income is better.

Someone earning 100,000 in salary will find it easy to pass up on a project that earns 1,000 in passive income. It’s just not worth the effort. Remember, you’re not just attending to the project, you’re also working a full-time job and all the stresses that go with it. If you’re earning 100,000 and you have the chance to rent out, say, a condo drying cage at 1,000, you’re probably not going to want the hassles of marketing, entertaining clients, managing repairs, preparing contracts, and all that.

A person seeking passive income will go through all that without even thinking. It’s an opportunity, period. And this 1,000 is scalable and repeatable several times. We earn it without actively working. It’s also possible to create other passive income sources, sometimes simultaneously, like maybe writing an ebook or starting an e-commerce store.

The comfort trap

Some people who do eventually plan on starting a business first begin with a job. The idea is to learn from others before attempting to do it yourself. This is a great way to learn. But beware of the comfort trap. It’s easy to get stuck in the status quo when you’re earning good money. Why change things when nothing’s broken, right?

The tendency is to stay put when we’re comfortable. Discomfort forces us to move, but it is also where growth happens. We expand our comfort zones through the discomfort. Even muscles grow the same way.

Job security creates a comfort zone. Having that job can definitely be a means to an end (to financial freedom), but be wary of the comfort trap. And that’s easier said than done.

Active income vs. passive income

I’ve already mentioned that passive income is better than active income but here are the highlights.

How we earn it

Active income is earning money as you perform a service. If you don’t work, you don’t get paid. Passive income, as long as you have it set, earns you money, regardless.

Repeatability and scalability

The number of hours in a day limits what you earn in active income. Passive income is repeatable and scalable.

Taxes

The taxes on active and passive income also differ substantially. As an employee, taxes are deducted prior to getting your take-home pay. On the other hand, businesses expense relevant items first. For example, depreciation of a rental property is a major expense that’s deductible for lower taxable income. Or the laptop you use for the business, or even repairs. All these can be deducted first before computing what you owe the government in taxes, not the other way around.

How I might tie it up

I am blessed with loving and caring parents. They gave us the opportunity to run our businesses and I understand not everyone is given this chance. I wouldn’t have had the courage by myself and I understand where you’re coming from. But don’t let that be your excuse. If I had a stable job but aspired for financial freedom, here’s what I might do.

Save enough of a cushion

With the earned salary, I’d save a year’s worth of expenses and indulgences. (I’m actually just saying that for you. I’d personally save just for expenses. Indulgences can wait, I wouldn’t mind.) This cushion gives me more confidence in pursuing endeavors outside of my job.

When that’s done, I’d save a large portion into a business and investment fund. (But remember that your Monthly savings will NOT lead to financial freedom.)

Work on your plan and just do it

Once I’ve saved a nest I’m happy with, I’d try to take a step forward. This will involve long hours (work + side hustle). I’d try to resist the urge to stop here as this is probably where the temptation is greatest. I’d remind myself that there is no make or break moment.

Success is not final. Failure is not fatal.

Or, partner with knowledgeable and trusted people

Before partnering with anyone, I would try to really understand what I’m going into. Relationships fail because of miscommunication and a lack of understanding from both sides. I should know that a business has risks and by signing up for it, I am agreeing to bear these risks. I should also have everything in writing so the lines are clearly drawn.

It’s probably best I partner with people I trust. The money involved can be significant, and that inherently brings in temptation. Family and friends aren’t automatically spared, having a contract is still the best practice.

Invest in real estate

(Before I say anything else, let me point this out: NOT ALL real estate assets are good investments!! In fact, a lot of them are overpriced purchases masking as “investments.” Here are 9 Hidden Ways a Good Property Can Be a Bad Investment.)

Real estate has less of an upside but it’s also more manageable (though arguable) than running a business. It’s also good to aim for small apartments rather than single units like a condo unit or single-family house and lot. With small apartments, vacancies are easier to manage. But if a tenant leaves my condo, the vacancy rate shoots up to 100%.

That said, it still involves a lot of work, and partnering with knowledgeable (and available) people can be a better route. It’s easy to have a DIY mindset but I shouldn’t underestimate the property management work that goes with it. If it were easy, everyone would be doing it. Plus it’s better to split a positive number than endure a negative number – 50% of something is still more than 100% of nothing. Partnering with qualified people should give me a higher chance to succeed.

My thoughts on having a job

If you currently have a job, don’t quit for the sake of it. Remember that if you do, you’re on your own for the most part – internal motivation is crucial. You’ll need to motivate yourself every day. (Shameless plug, follow me on Instagram for some daily tips, updates, and inspiration. 😃)

I wouldn’t have had the courage to take the leap myself. But with the benefit of hindsight, I’m glad things happened as they happened. I hope this encourages you to take a step forward.

Life and freedom are all about having choices. To quote the French philosopher, Jean-Paul Sartre:

Life is C between B and D.

The lives we lead are the Choices we make between Birth and Death. This is more than just about career choices. We choose what sports we play, the friends we make, the person we marry. We can choose to run a business or work until we’re 60. Our ancestors did not have this choice. We do.

Read more, select a topic: