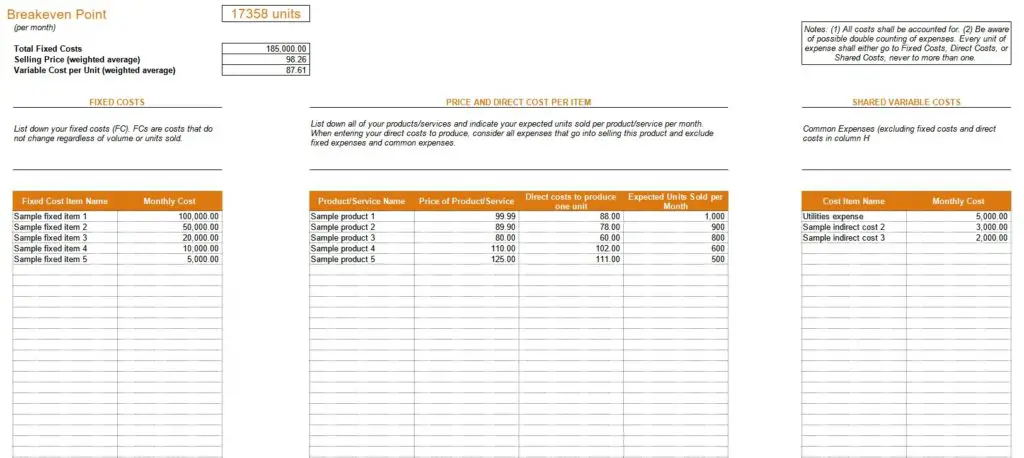

The breakeven point is possibly one of the most underutilized tools in business assessment and evaluation. As entrepreneurs, we obviously have the common sense to pursue businesses that have the potential to make a profit. What’s less commonly known is how to know if your business idea is worth pursuing. My favorite tool is the breakeven point.

It’s certainly just one of the many steps, but the breakeven point gives so many insights that I feel it should be at the top of the list, especially because it requires just 3 easy steps. So, how do you find the breakeven point?

This will not be one of those book definition posts. Wikipedia already provides an adequate explanation here. Instead, my presentation of the breakeven concept will be a practical guide with actionable steps. Whether you’re planning to start a business or have a business proposal on your plate, you can assess business viability in an instant with this basic formula.

Page Contents

Breakeven point basics

A breakeven point (“BEP”) is a point at which you neither make nor lose money. It is expressed in either (a) number of units sold or (b) the amount of sales revenue in your local currency. I like to use the number of units sold.

Why is this no-profit, no-loss point relevant? Simply because if you know your monthly breakeven point, and consequently your daily breakeven point, then you know the minimum sales level you’ll need to make money.

Using BEP to know if your business idea is worth pursuing

If, say, you’ve computed your breakeven point at 1000 units, the effective daily breakeven point is therefore 1000 divided by 30 days (or around 34 units sold per day). That is, if you sell more than 34 units per day on average, then your business should make a profit. If it’s less, then your business is expected to lose money.

Is this a high or low number? Well, that depends on your business proposal’s circumstances (i.e., product or service, location, etc.), and that is where your judgment and further research will come in.

For example, if your business is a food stall at a mall and you’re confident your team can sell more than 34 units per day, then that might be a viable business (emphasis on “might,” nobody really knows). But if you think the average units sold per day will be less, then it’s an easy rule out. It would be sensible not to pursue the business.

The formula you need to know

The breakeven point is equal to your total fixed costs divided by your contribution margin. If total fixed costs are, say, Php100,000 and your contribution margin is Php30 per unit (I’ll explain this in a bit), then your breakeven point is Php100,000 divided by Php30 = 3,333.33 units in a month. That’s around 112 units per day. Let’s dissect the formula.

Fixed Costs

Fixed costs are the costs that don’t change regardless of the volume sold. Examples include rent and payroll, but keep in mind that even these may have variable components (e.g., percentage rent over a minimum, overtime pay).

Contribution margin

Contribution margin is a fancy name for “selling price minus variable costs per unit.” Think of the contribution margin as the amount that goes back to you (or “contributes” to your business fund) for every unit sold. If your food stall sells snacks at Php100 each (i.e., selling price) and it costs you Php70 to buy the ingredients (and other variable costs) of that snack, then every unit sold will contribute Php30 to your business.

(We will ignore the technical differences of contribution margin, contribution margin ratio, or unit margin because I do not believe they add value to the targeted readers of this post.)

Knowing your costs

Here’s a non-comprehensive list of sample fixed and variable costs. Keep in mind that some of these may have mixed fixed or variable components to them:

- Fixed costs: rent, payroll (base rate), annual franchise fee, insurance, etc.

- Variable costs: cost of ingredients/cost of goods sold, utilities, payroll (overtime), percentage tax, commissions, etc.

If it’s hard to distinguish between the two,

ask yourself if that specific cost item increases or decreases when the number of units sold changes.

By definition, fixed costs remain fixed.

Practice: Assess business viability

There’s no getting around it. Computations will be necessary. We’ll keep it short.

You expect your food stall to incur the following fixed costs:

| Item | Cost per month |

| Rent | Php40,000 |

| Payroll | Php36,000 |

| Insurance, franchise, etc | Php24,000 |

| TOTAL | Php100,000 |

Let’s assume you sell one product type. Let’s also assume it costs you Php70 to be able to sell that product (i.e., total variable costs from ingredients, utilities, and all other costs not included under fixed costs). If your price is set at Php100, your contribution margin is Php100 – Php70 = Php30.

Your breakeven point is, therefore, Php100,000 divided by Php30, or 3,334 units per month, or 112 units per day.

The next step is to ask yourself if this figure is achievable. You may try to assess this with the following support questions:

- Is there high enough foot traffic for 112 units sold per day?

- How’s your selling proposition relative to competitors?

- Can I further reduce my expenses and, therefore, the breakeven point? (Related: 25 Smart Ways to Lower Your Break-Even Point and Profit Faster: Infographic)

- Are my estimates conservative or aggressive?

- Have I considered an escalation in costs?

- Have I included allowances for theft and spoilage?

- Do I need to build specific relationships with suppliers/customers?

- And so on.

(The example here assumes one product. For multi-product offerings, an acceptable approach is to use the weighted average of your selling prices and variable costs.)

Conclusion:

The important takeaway here is an understanding that breakeven is both easy to calculate and guides you to the next set of relevant questions. Lead with this formula, then carry on with the necessary research to know if your computed breakeven point is viable or not — and ultimately know if your business idea is worth pursuing.

Assessing business viability will then become a 3-step process that’s doable even with your phone’s calculator.

- Compute total fixed costs

- Estimate the expected contribution margin

- Determine if the daily breakeven point is reasonably achievable

You may download the freedom locker PH Starter Kit for free at the Locker. The breakeven point is automatically calculated given your inputs, plus this tool is FREE.

Notes: This post focuses on the daily breakeven point, but the monthly breakeven point might be a better metric for low turnover items. Either approach works as long as it’s applied consistently.

Read more, select a topic: