When we talk about portfolio returns, asset allocation is the single biggest factor you can influence. That’s undisputed. In a study by Roger G. Ibbotson, published in the Financial Analysts Journal, The Importance of Asset Allocation,

The total return of a fund can be split into three parts: (1) the return from the overall market movement, (2) the incremental return from asset allocation policy of the specific fund, and (3) the active return (the alpha) from timing, selection, and fees.

We can also see how Multi-Factor Models explain the bulk of alpha. So what does this mean in simple words?

Your returns are mostly because of market movements, inherent factors (both are uncontrollable), and your asset allocation (controllable). This means the asset allocation decision is very important.

How do you determine your asset allocation? A good start is to understand the components that matter. This overview was meant for beginners and I hope I’m able to take the inherent complexity out of portfolio management theory.

Page Contents

What is meant by asset allocation?

Assets are what you invest in: stocks/equities, bonds/fixed income, etc. Asset types can be broken down into further categories (e.g., common stocks, preferred stocks, REITs), but the point is there are many asset classes.

The way you allocate your resources among these asset classes is your asset allocation.

For example, an investor may be 60-40 between stocks and bonds. (Meaning she has 60% invested in stocks and 40% invested in bonds.) Allocating more resources to riskier assets, like stocks, is an aggressive portfolio.

And yes, your portfolio returns depend heavily on this decision. More so than picking specific stocks.

Picking stocks vs. index funds

While selling stock-picking advice is a lucrative business, there’s evidence against trying to beat the market. Always reconsider joining subscription services that offer stock recommendations. You’re likely better off without them.

(Related: Make Money Trading Stocks? The Advice You Didn’t Want to Hear)

We gain market exposure by either buying different stocks or by buying an index of the market — an index is like a basket of stocks representing the entire market. This basically means we ride the ups and downs of the stock market.

An index represents the market’s risk. A riskier portfolio will increase, and decrease, in value more than an index. In other words, a riskier portfolio gains more when the market is up, but it also loses more when the market is down.

(Related: The Risk and Return Trade-off Applied in Real Life (Uncommon Examples))

Now, most stocks, specifically those from different industries, have low correlations (meaning they don’t move together). So to reduce our risks, we buy stocks from different industries. Some stocks will perform well when others don’t, and vice versa.

But this is an inefficient way of gaining market exposure if an index of the market is readily available.

And because the index merely mimics the market, maintaining the index doesn’t take much effort. This means lower fees for the investor.

Not to mention getting rid of diversifiable risks in one swoop. (You’d have to select the right stocks at the right weights to remove the diversifiable risks. This is both costly and an unsure way of ridding diversifiable risk.)

Overweighting factors

Some investors prefer the riskier but potentially rewarding route. This is also possible by starting with an index fund and then overweighting certain factors through ETFs. (Overweighting means allocating more, in percentage terms, than what the market has.)

For instance, studies show how small-cap companies outperform large-cap companies; and how value stocks outperform growth stocks. There is a premium to holding the former. (Depending on the time period selected, this may not be the case. But over long time horizons, academic researches show there are premia.)

An investor may gain exposure to specific factors by adding ETFs that target those factors.

I hear you. There aren’t ETFs in the Philippines. But it can be argued that you don’t need local ETFs for a truly diversified portfolio — a global portfolio.

Global allocation

It’s hard to say that there’s an optimal global portfolio. But due to the imperfect relationship between local and international stocks, it’s easy to see why investing globally offers reduced risks — there is a diversification benefit.

(Holding all things constant, combining imperfectly correlated assets should reduce your portfolio’s risk.)

If we also interpret a global portfolio as having weights representing the global stock market, then it certainly makes sense to add global exposure for Filipino investors.

According to TradingHours, the Philippine Stock Exchange has a market capitalization of $260 billion — July 20, 2021. Virtual Capitalist records the Global market capitalization at $89.5 trillion as of April 2020.

The PSE accounts for around 0.29% of the World’s market capitalization.

Holding 90% to 100% Philippine stocks is overweighting the PSE heavily, and maybe unnecessarily. A global portfolio invests more towards developed economies like the US, and emerging markets like China.

Taxes and foreign currency risks

But does that mean investing only in international stocks and forgetting domestic stocks? Not at all. There are costs and tax efficiencies to consider.

It also makes sense to weigh PSE stocks heavily due to the tax implications of holding foreign stocks. Domestic stocks should be more tax-efficient than foreign stocks.

On the other hand, currency risk is said to be a non-factor for a global portfolio. They increase, decrease, or have no impact on returns depending on the time period and currencies involved.

The tradeoff between convenience and fees

Local banks and brokerages know the benefits of investing globally. They offer Filipinos the opportunity to invest in international stocks and bonds through UITFs, mutual funds, etc.

If this is your preferred method, know that these come with higher management fees. But again, it’s a tradeoff between convenience and fees. Is it worth it? This is a choice you’ll have to make.

What does this mean for the Filipino investor?

Your specific asset allocation is a topic for another day. In fact, it’s an area of finance that’s yet to be solved by algorithms and fintech. Human factors matter. This means the best asset allocation is specific to you.

But here are a few key points I’d like to highlight for Filipino investors.

- Know that there are multiple asset classes

- Weigh the asset classes based on your objectives and risk tolerance

- An index is a cost-efficient way of investing

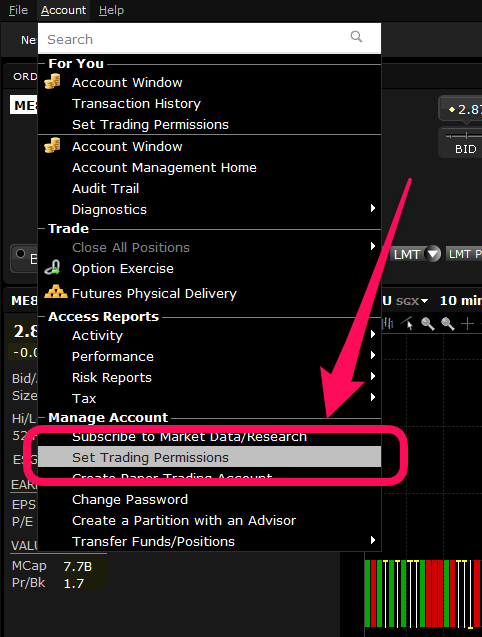

- Open a global brokerage account like Interactive Brokers (Related: Interactive Brokers from the Philippines: Waived Fees, Funding, and More) and gain access to international ETFs

- A little home country bias is totally fine due to cost efficiencies, but know that you’re likely overweighting the PSE right now

- Aim for a global portfolio that has exposure to the developed markets, emerging markets, bonds, and alternative investments

The ETFs I like

Let me preface this part by saying this isn’t financial advice and I am not giving you a recommendation. But I do think sharing the information creates awareness. These are the ETFs I like. They may or may not fit your needs. Please do your own research.

Philippines

- FMETF, First Metro Philippine Equity Exchange Traded Fund — This tracks the PSEi and is my way to gain exposure to the Philippine stock market.

- Alternative: Mutual funds that track the PSEi

US Stock Market

- VTI, Vanguard Total Market ETF — My preferred way to follow the US stock market, tracking the US total market index.

- Alternative: VUSD or VUAA, Vanguard S&P 500 UCITS ETF, an Irish-Domiciled ETF to take advantage of the tax treaty between the US and Ireland. Currently only possible via Interactive Brokers

Emerging Markets

- VWO, Vanguard FTSE Emerging Markets ETF — I like how it’s heavy on China, but it also tracks other emerging economies like India, Brazil, and South Africa.

- Alternative: EIMI via Interactive Brokers

Small-cap Value Factor

- VBR, Vanguard Small-cap Value ETF — Small-cap value exposure with a mix of mid-cap. Probably not the best if you’re hardcore on small-caps only.

- Alternative #1: IJS, iShares S&P Small-Cap 600 Value ETF has less weight in mid-caps

- Alternative #2 WSML, iShares MSCI World Small Cap, via Interactive Brokers

Portfolio Risk Reduction

- BND, Vanguard Total Bond Market ETF — Having bonds to lower risks.

- Alternative #1: TLT, iShares 20+ Year Treasury Bond ETF

- Alternative #2: AGGU, iShares Core Global Aggregate Bond UCITS ETF

(Vanguard’s low management expense ratios make it my preferred provider of ETFs.)

The way you construct your portfolio will determine the future returns you can potentially enjoy. Being aware of your portfolio construction is the foundation, and hopefully, the information here is a start.

Tell me about your portfolio construction and if there are ETFs that should be on this list! I’m always looking for ways to improve mine.