You and I might describe financial freedom differently. To me, it goes beyond being debt-free or earning a lot. True financial freedom is having the choice to do whatever, whenever, wherever, with whomever. It’s when you can retire early, not bound by time nor spending constraints. This is what it’s like to achieve financial freedom in its truest and best sense.

I am by no means saying these are easy steps, and no, this will NOT be just about setting up an emergency fund, paying off debt, and investing regularly. Those are steps for financial security when you’re 60. This also isn’t just about living below your means or other small-minded interpretations of financial freedom. If you’re restricted with what you can do with your money, then that’s not freedom.

What I hope to deliver are actionable steps that require hard work! If it doesn’t require hard work, something is amiss.

Each step is a time-block that’s clearly distinguished from the others (e.g., #1) or will take a while to complete (e.g., #4 and #5 are both about entrepreneurship).

There are other ways to achieve true financial freedom, for sure. This is just my approach, curated from experiences in corporate finance, as an entrepreneur, investor, and lessons learned from those who came before.

It’s a long read so feel free to bookmark this page (“Ctrl + D” on Windows; “Cmd + D” on Mac), and regularly visit the guide on your financial freedom journey. Select a topic to navigate this post.

Page Contents

- Step 1: Begin with the end in mind

- Step 2: Fix your budget leaks but beware of the frugality trap

- Step 3: Park your money where it works hard

- Achieve financial freedom the slow way: Some notes on steps 4 to 8

- Step 4: Have the guts to start a business

- Step 5: Strive for business-on-autopilot

- Step 6: Allocate funds to invest in real estate

- Step 7: Master property management

- Step 8: Accumulate more rental properties

- Step 9: Retire?

- Achieve complete financial freedom: My journey

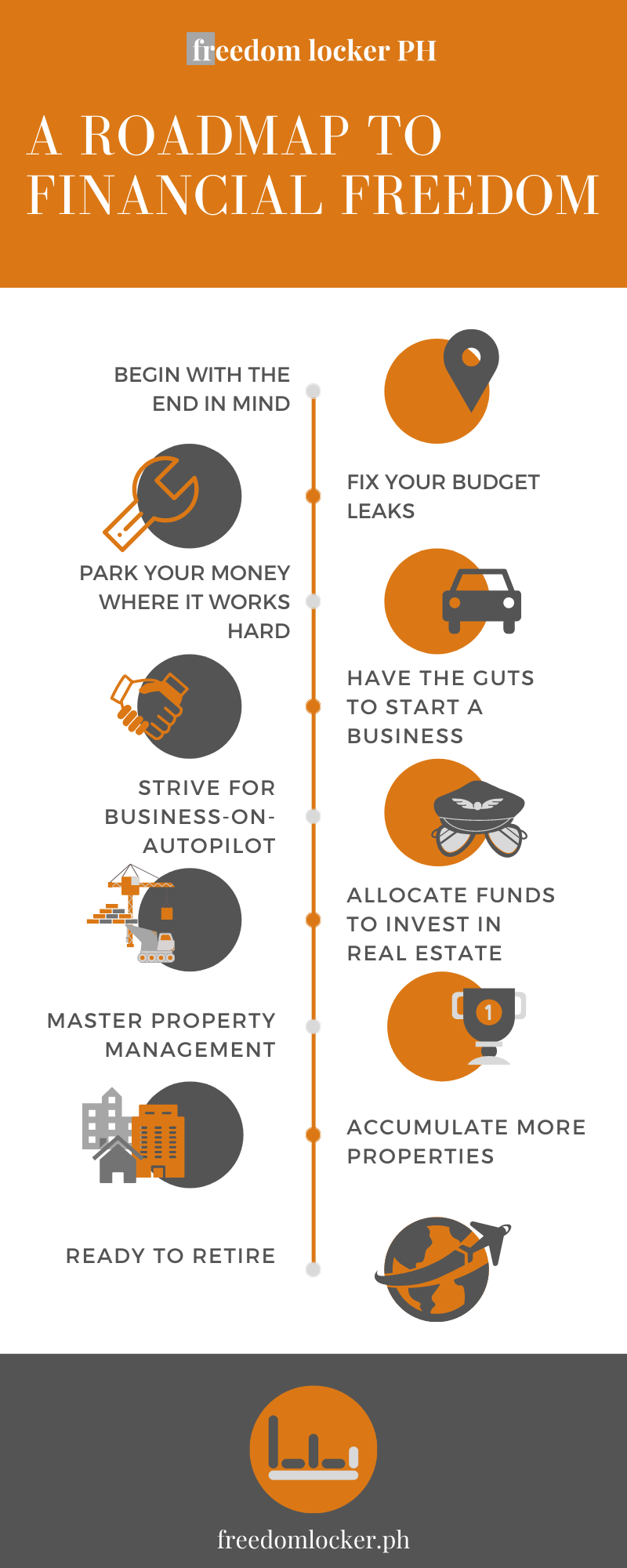

- Infographic: 9 Steps to Achieve Financial Freedom

Step 1: Begin with the end in mind

There are two parts to this step.

The first one is to ask yourself WHY you want to achieve financial freedom and the second is to compute how much that costs.

What is your WHY? (Here’s mine)

Having a shallow and superficial goal will lead to disappointment because it’s not sustainable. With shallow goals, we start strong only to see the effort wane over time. This is a crucial step. Without it, the other steps collapse like a house built on weak grounds. Here are 2 tips that have helped me.

Tip 1: Ask “why” several levels down

Asking “why” provides insights. But asking “why” several levels down leads to your compelling reason. For example, when you say “I want to save so I can provide for my family,” ask yourself “but why do I want to provide for my family?”. Or maybe “I want financial freedom so I can travel the world.” Why do you want to travel the world?

Doing this 2 to 3 levels down can teach you a lot about yourself and what’s important to you. Use this to know your compelling reason. We all would like to earn as much as we can.

But for the majority of us, building infinite wealth isn’t the answer to our WHYs.

Non-material things have been proven to be better for our happiness.

(Related books on happiness: Man’s Search for Meaning by Viktor Frankl; Flow by Mihaly Csikszentmihalyi)

Tip 2: Focus on yourself and the people who matter

I’m blessed to be at a point where I just don’t care what unimportant people think. A lot of people say that. Few really mean it.

I used to care how other people saw me. It’s probably why I had shyness issues as a kid. But as I got older and maturity settled in a bit (Friends and family might disagree. What can I say, I like kidding around! 🤷♂️), I got to know and accept the Spotlight Effect.

The Spotlight Effect is a term used in psychology. It explains how we exaggerate how much other people see us. We’re all the main protagonists in our own movies called life.

So guess what, no one actually cares! Your WHY should be about what’s truly important to you, not what you think is important to everyone else. They’re all too busy thinking about theirs anyway.

How much does it cost?

So how much do you need to achieve true financial freedom? How much does your WHY cost?

I like to go big here with a “shoot for the moon or land among the stars” mindset. Now, this may seem to conflict with my previous point on happiness, but I see it from a practical point-of-view.

Money cannot make us happy, but it does make being happy easier.

If you set a big-hairy-audacious goal (BHAG, Built to Last by Jim Collins) and miss, you’ll probably still end up in a better place than if you set a small-minded goal. Hitting a mere 10% of a 1-billion goal is still 100 million.

What I’m saying is, your WHY will dictate what it costs and don’t be afraid to dream big.

I will be using an arbitrary 1.2 million per year goal. If that is what’s needed per year, and a safe investment yields 3%, then you’ll need an asset base of 1.2 million / 3%, or 40 million. (If you don’t understand how this was calculated, I recommend reading Finance for people who hate math.)

These aren’t mutually exclusive plans either. In fact, they’re synergistic. The passive income feeds your asset base, and your asset base allows you to earn even more in passive income.

(Go to related posts on Begin with the end in mind.)

Step 2: Fix your budget leaks but beware of the frugality trap

You might be thinking here’s another “fix your budget tip.” But as I’ve said in many posts, being frugal is not sufficient for financial freedom aspirations, but it is arguably necessary.

What isn’t arguable is that frugality will make your financial freedom journey faster. (And when you’re there, you can stop the skimpiness and buy whatever you like.)

As you haven’t reached that point yet, it’s best you manage your household budget.

Mindset over technical competence

To some, this step comes naturally. But other people will find this step more challenging. I’m going to be completely honest, you’re on a steeper climb if household budgeting for you is a challenge. That said, it’s not like it’s impossibly daunting.

Household budgeting is very doable and I recommend the Kakeibo Japanese Budgeting technique. I like this technique for beginners because it’s focused on a mindset approach, and a mindset shift is what’s needed for people struggling with their budgets.

It truly is a matter of discipline and EQ over know-how and IQ.

Only you can do that for yourself.

Go beyond saving goals

When you’ve dialed in on household budgeting and frugality, I like to remind people not to get stuck with tipid tips, or having your focus centered on frugality. Being hyperfocused on tipid tips (frugality) can be a trap.

Frugality is a process goal, not the end goal. When you’re hyperfocused on frugality, it becomes your mission and you unconsciously develop a scarcity mindset. A scarcity mindset is the enemy of entrepreneurship and investing. (See steps below.) It ultimately becomes an avenue for small-minded goals.

I like to set aside 6 months’ worth of expenses in an emergency fund, but here’s how you can set yours: Building Your Emergency Fund: What No One Talks About

(Go to related posts on Fix your budget leaks.)

Step 3: Park your money where it works hard

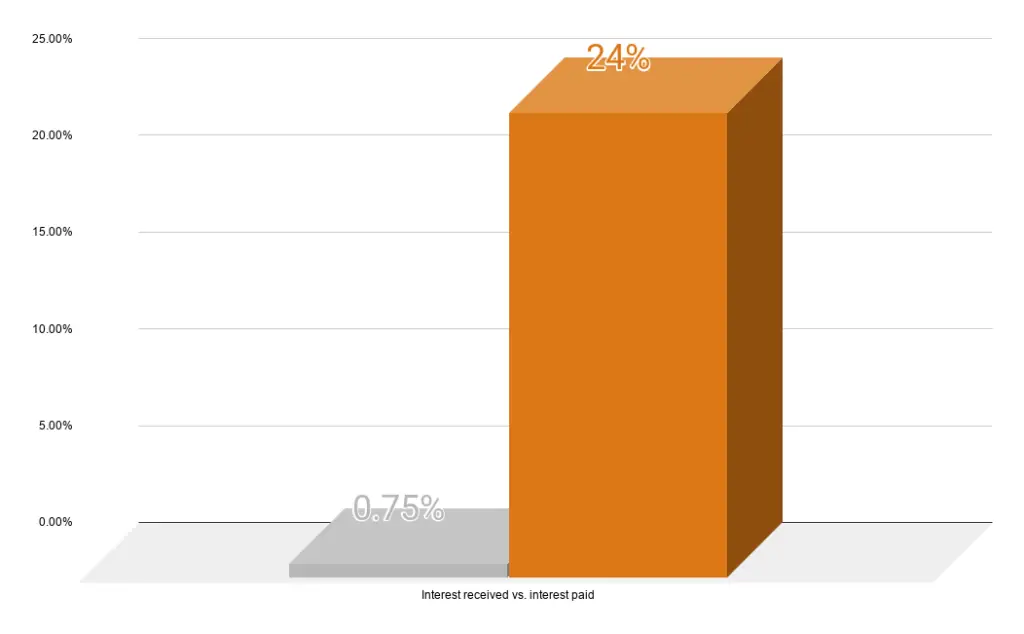

When you’ve saved enough of an emergency fund plus have sufficient liquidity to suit your needs, the rest should be invested where it works hard.

I call it “parking” because this step should not be rushed. Day-trading may earn you $400 in less than a minute, but it can also lose you $500 in a minute. Or at least that’s how I experienced it.

What does “money working hard” mean?

Working hard is a money analogy that relates to how every Peso (or USD) is an employee that works to grow your business. The harder they work, the more business and employees they bring in.

Keeping on with the employee analogy:

Inflation can be likened to the salary we pay our employees.

It is then only worth keeping an employee that brings in more than she costs to employ. We want her to work harder than inflation. (This is definitely not a perfect analogy but I hope it helps.)

In other words, your portfolio of investable funds (i.e., the money in excess of your savings and emergency fund) should earn a return that’s above inflation, if anything just to preserve the value of your money.

Where you park your money is a subject matter of its own. This will vary from person to person and is based on the investor’s risk tolerance. In fact, before an investor asks “where” to invest, it’s best to know these 3 things first: Knowing what returns are, what a weighted average is, and introspection to your goals.

Asset protection

Relatively safer investments offer lower returns. These include money market instruments through UITF or Mutual Funds, high-interest digital banks, and many more. The point of this investment group (i.e, asset protection group) is to protect your assets from losing money by keeping up with inflation.

They barely cover inflation but also rarely ever cause you to lose money.

A risk-averse investor should probably lean more towards these investments and take the lower returns that go with them. Also, understand that this is a longer but safer route to financial freedom.

Understanding your risk tolerance is key to finding the balance between asset protection and asset growth (next section) that you’re comfortable with.

I try to keep a 20-80 ratio between asset protection and asset growth (i.e., 80% invested in asset growth), but again your risk tolerance (and time horizon) will determine what’s optimal for you.

Asset growth

In contrast, asset growth investments try to deliver higher returns. Higher returns though, come at a cost, and not all types of risks are compensated (see diversifiable risk). This is just a long-winded way of saying “high risk, high return, most of the time.”

What’s appropriate for you also depends on your time horizon. A longer time horizon allows us to take on riskier assets that have performed well over time, such as traded stocks in a stock market.

My assumption is for most of us to take at least 5 years, probably 10 years, to achieve true financial freedom. That’s presumably a long enough time horizon for long-term gains.

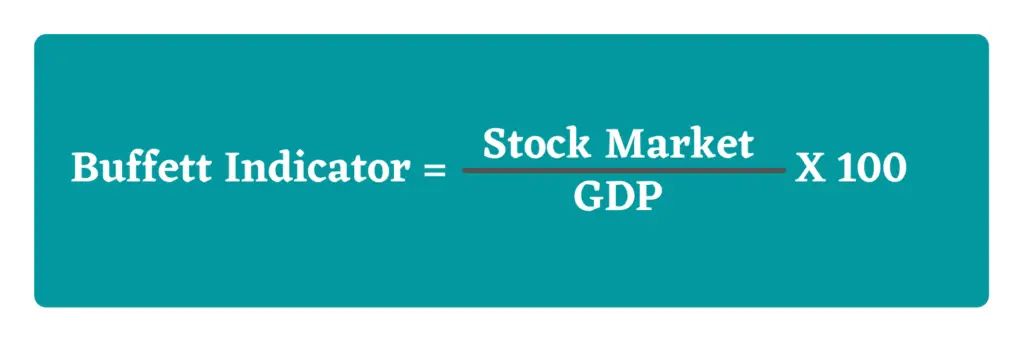

The temptation is to actively invest yourself but I prefer index fund investing. I specifically prefer a hybrid strategy that’s based on Warren Buffett’s indicator.

(Here’s a backtest I did on the Philippine Stock Exchange Index over 20 years, from 1999 to 2019. The hypothetical portfolio would’ve earned 19% p.a.)

I prefer the hybrid index fund investing strategy (i.e., buying or selling every quarter based on thresholds) over actively trading (i.e., actively buying and selling stocks) because of 3 reasons:

Reason 1: Daytrading is a full-time job

Earning from day-trading is possible, but keep in mind that it’s a job. You’d have to be really good to earn enough from it, meaning you’ll have to treat it as a full-time job. People who tell you otherwise are extremely lucky or are probably lying.

In fact, even full-time professionals with fancy degrees and equipment fail at it. (See 3.3)

I worked on business valuation projects for 4 years and I would like to think I understand how long it takes to gather data, sift through the irrelevant ones, revise a financial model, read the news, read between the lines, so on. And then do it all over again tomorrow.

Reason 2: I tried and failed at it

There was a point when I was hardcore on technical analysis. For those unfamiliar, technical analysis is about making decisions based on charts and price movements, regardless of what the financials say. It’s what traders use, or a mix of this and fundamental analysis (i.e., investing based on financial fundamentals).

They’re hard to use because:

The same information can be interpreted in different ways.

Emotions play a huge role and I’m not about to try understanding human emotions. It’s just too complex. For example, the same news might be interpreted differently by different reporters. Here’s a snippet from Howard Mark’s book, Mastering the Market Cycle, when news of a stock rally (uptrend) is out:

- Inflation spikes: will cause assets to appreciate — stocks rally

- Inflation drops: improves (the) quality of earnings — stocks rally

I understand trading is a skill and I might have gotten better over time, but I also understood this wasn’t something I could expect to make a lot on consistently. So kudos to the traders who earn a living from trading. It’s just not for me.

Reason 3: Warren Buffett and his bet

If you’re not a fan of Warren Buffett or what he believes in, then this unfortunately isn’t for you.

Buffett believes in index funds for investors like us, the casual non-full-time investment professionals. He believes in it so much that he placed a bet for $1 million. The bet was that in 10 years, an index fund would outperform an actively managed portfolio. A hedge fund took that bet and lost.

A hedge fund is basically a company of analysts with top-tier MBAs in the business of earning higher-than-average returns for large companies or high net-worth individuals. In other words, they’re as hardcore as it gets.

And yet, a measly index fund that’s accessible to everyone beat a hedge fund!

It’s just one case, and you might even say not statistically significant, but that’s just the tipping point for me to side with index funds.

Putting the pieces together

There’s no universally accepted best asset-allocation because our unique situations dictate what’s optimal. These include, but are not limited to:

- Objective (what you want to achieve)

- Risk tolerance (how much you’re willing to lose)

- Knowledge (familiarity with how the markets work)

- Current asset base (how much you have)

- Existing investment portfolio (where your current investments are)

Our unique situations dictate what’s optimal.

I recommend having a buffer invested in safer investments, just in case you guess wrong. Ultimately, it goes back to knowing yourself. There’s no better way to managing your portfolio — knowing what you want, what you can tolerate, and what specific asset classes can do for you. Having a professional manage it is a distant second.

I also recommend index funds not just for the reasons I’ve mentioned, but also because, in our quest to achieve complete financial freedom, stock investing is really just a preliminary step. I don’t see the need to spend time and make an exerted effort on stock selection when I can spend the freed-up time networking and learning what’s needed in Steps 4 to 8 (business and real estate).

(Go to related posts on Park your money where it works hard.)

Achieve financial freedom the slow way: Some notes on steps 4 to 8

Steps 4 to 8 are not strictly sequential. Some achieve true financial freedom at Step 4. Others skip directly to Step 6. I listed these in the order they are for a few reasons.

Entrepreneurship before real estate

My main reason for listing entrepreneurship first is that it requires less money to start. For a few thousand, you can start a small business that can grow exponentially. No one knows how large you can scale the business.

(I’m also talking about physical real estate assets, not REITs, which I categorize under Step 3, park where your money works hard.)

In reality, you can achieve financial freedom with just one wildly successful business! Which means the other steps are unnecessary. Mark Cuban is famous for his quote, “It doesn’t matter how many times you fail. You only have to be right once. And then everyone can tell you that you are an overnight success.”

Call me a realist or a pessimist, but I don’t believe I’ll ever create a wildly successful business. A successful business, that I believe. But not a business you list in a stock market. Besides, I don’t want the stress.

The good news is, true financial freedom does not require a wildly successful business.

This is where real estate comes in. The returns are lower, but so are the risks. (Remember Step 3? Yes, risk-return still applies.)

Real estate takes time to master

Real estate is the safer but slower route, and everyone can do it — especially once you have a business that runs on auto-pilot (Step 5).

Indeed, even wildly successful entrepreneurs diversify with real estate at some point. And 90% of millionaires over the last two centuries got their wealth by investing in real estate.

But real estate is not easy to master, which is why I dedicated a separate step to mastering property management (Step 7). Rather than grouping Steps 6 to 8, I recommend buying 1 or 2 properties first (Step 6). Once you have at least one property under your belt, I’d say it’s best to master property management first, before accumulating more. This avoids compiling problems from multiple properties.

Now, on to the next step.

Step 4: Have the guts to start a business

The reason why this is separated from Step 5 (“business on autopilot”) is that people usually suffer from analysis paralysis when thinking of starting a business. Corporate employees especially suffer from this.

As employees, a structure is provided to us and our deliverables are clear cut. This is in sharp contrast to having your own business.

(I also alluded to this in my review of the book, The E-Myth Revisited. Running a small business is a lot harder than giving managerial advice to large corporations.)

I understand if you’re a bit apprehensive. As a matter of fact, I don’t think I would’ve had the courage. Thankfully my parents gave me the opportunity and my cute ex-boss provided the final push by firing me. 😊

Your monthly savings and investments are not enough

Parking money in a savings account, even if you religiously save and invest monthly, will not lead you to financial freedom. (Here’s a post where I talk about how your monthly savings are not enough to achieve financial freedom.)

This is not saying it’s impossible. If you get super lucky trading, for example, you might pull it off. But that would also mean taking on extreme risks before getting lucky.

Instead, we’re all about creating our own luck by putting ourselves in the best positions to get “lucky.” The reality is, earning 10% p.a., probably isn’t enough for most to retire on.

Full-time business owner vs. part-time investor

I’m not one to say that you absolutely have to quit your job. There are other options such as partnering with trusted and capable people.

But with the benefit of hindsight, I strongly recommend doing this full-time. There are several reasons why I’m against having a job. In a nutshell, it’s because having a job and true financial freedom are conflicting goals. And that a job creates comfort that hinders your progress to true financial freedom. With a salary, it’s easier to pass up on seemingly trivial opportunities.

Besides, all other things being equal, a person relying solely on their business is probably going to work harder than someone with a salary to rely on.

Whatever you do though, please go through Steps 2 and 3 first and have your safety net ready. Should the business fail, you either have the funds to start again or enough of a lifeline to go back to work (and eventually try again).

Success is not final. Failure is not fatal.

Strive for progress, not perfection

When deciding on a business, it’s easy to get stuck planning and never actually taking action. Concerns range from choosing industries to logo design!

Once you’ve done enough research, the key is to just start and strive for progress. Fiverr is a great platform to outsource a lot of the work and get some tasks out of the way. (Know more about the platform in How to Use Fiverr to Boost Productivity.)

How do you know which tasks to outsource? If you procrastinate a task, it’s likely because you’re not good at it and you should probably outsource that!

In the end, it’s all about action over inaction. Progress over perfection. It’s okay if you fail. But remember to fail fast and fail forward.

Assess your business idea with the breakeven-point first

A quick way of knowing if a business idea is worth pursuing is to use the estimated breakeven point.

The calculation includes these 3 steps:

- Estimate total fixed costs (rent, base payroll, equipment amortization, etc.)

- Estimate the contribution margin (i.e., average price less average variable cost to produce)

- Compute the breakeven point as “fixed costs divided by contribution margin”

The breakeven figures provide a lot of insight and clues on what questions to ask next. If the estimated breakeven point is unreasonably high, then that’s an easy pass.

(Go to related posts on Have the guts to start a business.)

Step 5: Strive for business-on-autopilot

Starting a business is one thing.

Creating a system so your business doesn’t feel like a new job… that’s a whole other challenge.

Avoid pitfalls by learning from others

A business is really just a larger household with a few more quirks and pitfalls. By reading books or looking for mentors, you can avoid some of the common pitfalls of running a business. And there are a lot of blind spots.

For example, even a profitable business can be forced to shut down if it has cash flow problems. Or how it’s more costly to acquire new customers than retain existing ones. Or how cutting on some costs may actually lead to lower profit. In fact, depending on the circumstances, it’s sometimes even possible to earn more by selling less.

My point is there are a lot of seemingly obvious decisions that are actually wrong when you dive deeper. If you’re in this phase, you’re taking the right steps by educating yourself.

Treat it as a business, not a job

If your business relies on you, it’s bound to fail. To achieve true financial freedom, you must ultimately rid yourself of restraints from your business.

A business should not depend on you, and especially not on one particular employee. Rather, a business is a system that’s void of employee discretion and produces consistent results.

Think of a McDonald’s franchise and how every order is consistent. The employee doesn’t need to decide on things like how much lettuce to put. Every step is laid out in a manual.

The best book I’ve found for people in this phase is The E-Myth Revisited. It’s about how every entrepreneur should be working ON their business, not IN their business.

As business owners, we’re naturally passionate about how our business is marketed, how our finances are handled, and a whole slew of other worries. The tendency is to do things ourselves. But know that doing menial tasks takes time away from more meaningful work — work that grows your business.

(Go to related posts on Strive for business-on-autopilot.)

Step 6: Allocate funds to invest in real estate

As I’ve mentioned in A Note to Steps 4 to 8, investing in real estate may not be necessary when you have a wildly successful business. But this roadmap assumes you’re like the majority with a fairly successful business.

Knowing we can still achieve financial freedom without a wildly successful business is incredibly reassuring.

(Related: Building Wealth with Real Estate Through Property Accumulation)

Business income vs. real estate income

Besides, income from real estate, although lower than what you could potentially earn in a business, is more protected from cyles.

Consider a commercial lot along a highway. The best business to run will depend on the neighborhood and the type of commuters passing by.

So opening a nightclub would be markedly different from opening an education center. We do not know which type of business is best for this lot. But what we do know is that the landlord earns from its rent, regardless!

The stores may change, but the land they stand on remains.

Buying your first property

The returns you earn from real estate are inversely proportional to the amount you pay for it. That means all other things the same, paying more decreases your returns. A review of the 3 valuation methods might help you estimate if the asking price is reasonable.

It’s important not to overpay because even an attractive property, in a good location that’s developed by a reputable developer, can still be a poor investment choice. This is one of the 9 reasons I listed on how a good property can be a bad investment.

Other reasons are buying based on emotions and overdeveloping a property so that it doesn’t match the intended market. I am assuming you’re buying real estate to grow wealth, not as a place for you to live in.

You have limited funds so make sure it counts

If a property yields a 3% return, it’s a poor choice if one of your other choices was a property (or really any other investment) that yields 10%. This is the concept of opportunity cost that’s highlighted in Is a Condo a Good Investment.

Although I used a condo unit as an example, the learnings extend beyond just condominium projects. Subdivision projects by well-known developers, for instance, typically have high listing prices that make it hard to yield positive cash flow.

Keep an eye on vacancy costs

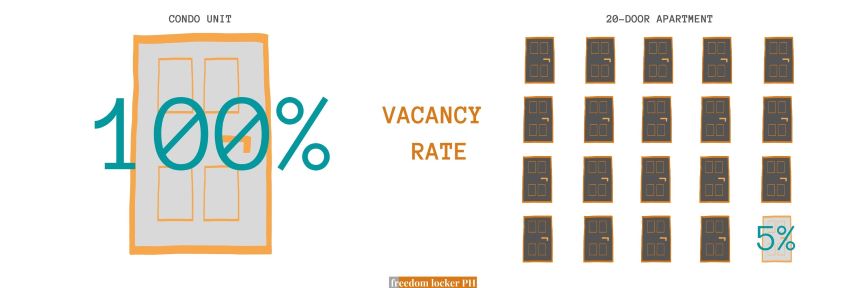

I also prefer multi-units over single-unit properties. For any given budget though, this may mean making an extra effort to look for comparable properties. For example, instead of a mid-market condo, you might instead buy a low-cost apartment.

One tenant moving out of a condo translates to a 100% vacancy. One tenant moving out of a duplex is a 50% vacancy. And one tenant moving out of a 20-unit apartment is just a 5% vacancy.

Multi-units are a hedge to vacancy costs. Yes, they’re harder to find. But remember what I said about hard work? If it doesn’t require hard work, then something is amiss, anyway.

(Go to related posts on Allocate funds invest to real estate.)

Step 7: Master property management

Before accumulating properties (Step 8), I suggest taking the time to master property management.

It’s basically learning to walk before you run. If you decide to skip this step, you might be setting yourself up for necessary stress — from non-paying, demanding, and deceiving tenants.

Don’t worry though because from my experience, it actually just takes a couple of months to get a hang of it. I don’t consider myself a master but I have picked up a few tricks that have helped tremendously.

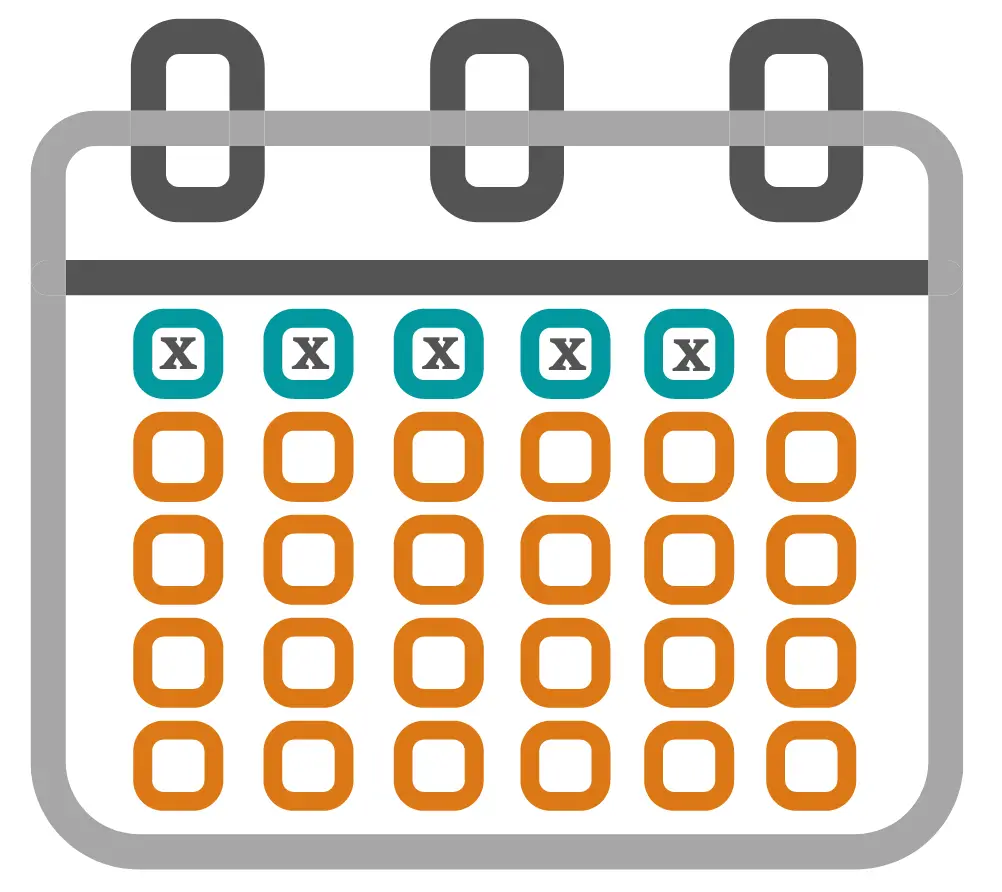

For example, by setting up every due date to the first day of the month, we’re able to assign someone to collect the rent in bulk (But there are more efficient ways to collect rent.) as well as dedicate the first 5 days to rent-related duties. All of the related-work is done during this week and that saves a lot of time.

Trust me, even with a property management tracker that alerts me of due dates, it’s still way easier to have everything batched up. We’re all about working hard, but it doesn’t preclude us from working smart to achieve financial freedom.

I recommend Brandon Turner’s book, The Book on Managing Rental Properties. It’s an easy conversational read that you can finish in a few days, even if you hate books.

(Go to related posts on Master property management.)

Step 8: Accumulate more rental properties

How do you exponentially increase rental income? By exponentially increasing your rental properties!

As easy as that may sound, most people get stuck renting just one property. Whether that’s from the trauma of your first property, or from not knowing how to fund it, or some other reason, 50% of landlords own only one property.

By mastering property management in Step 7, we’ve hopefully eliminated or reduced the trauma associated with your first property. So how do you finance the additional properties?

My two favorites ways are partnering with people and refinancing your existing properties. Both take advantage of Other People’s Money (OPM). Both are perhaps necessary to achieve true financial freedom in a shorter time — not overnight, just shorter.

Partnering with others

In a collaboration, you bring at least one of these three:

Expertise, Time, or Money.

This is also why money should never be an issue. You can always trade your time by doing the hard work or by educating yourself and becoming an expert.

No matter how you frame it, partnering with others speeds up the accumulation of properties because 50% of something is still more than 100% of nothing. You’re adding on to your passive income by collaborating with others.

This, of course, has risks, so make sure you do your due diligence before partnering. Setting up an escrow is expensive but lessens some of the risks.

Refinancing existing properties

Another option, if you can bear the risk, is to take on more debt by refinancing your existing properties. I first heard about this strategy on the BiggerPockets forum and they call it the BRRRR strategy. BRRRR is an acronym that stands for Buy, Rehab, Rent, Refinance, Repeat.

It’s where you buy a property below market value; rehab or renovate the property to increase its marketability, rent it out (make sure you do these steps to avoid bad tenants); refinance it with a bank, cooperative, or some other financial institution; and then buy another property.

A quick tip is that I’ve noticed the larger low-interest banks have stricter terms. It’s probably best you look around and not limit yourself to large banks. Remember, if a large bank tells you you can’t do it, ask yourself how you can. Cooperatives and smaller banks are good options.

(Go to related posts on Accumulate more rental properties.)

Step 9: Retire?

How do you know when you’ve achieved financial freedom? It’s really up to you if you wish to accumulate more properties or liquidate the majority and invest in government-backed securities.

Here are a few points to consider.

Liquidate or accumulate more?

I cannot say which approach is best. I frankly do not know. But the 2 options I’d consider are to continue adding more properties or liquidate (sell) a bulk.

Liquidation can be an option if the asset value of your portfolio, when invested in a government-backed investment such as the Pag-IBIG MP2, yields what you computed in Step 1.

In How much does it cost, we assumed a goal of 1.2 million per year. Let’s also retain the 3% yield assumption of our portfolio, invested in a mix of MP2, time-deposits, banks, and a few dividend stocks.

If we sold our properties to net us 40 million, we could then invest this amount at the 3% yield and make 1.2 million a year from paper investments. That’s 1.2 million without the hassle of managing people, meetings, and so on.

Happiness goes beyond material things

If done right, you know what your WHY is and what it takes to achieve financial freedom. You also understand that immense amounts of money cannot make you happy, it just helps.

Funding the life my family deserves will require me to do these steps. But the truth is, we’re not aiming for tremendous wealth. I cannot speak on your behalf. Your goals may be larger, or they may be smaller.

If it takes you 10 years, that’s 10 years of learning. Even if it does take you 10 years and you retire at 45, you still have a lot of years left to enjoy your life. I hope these steps help you achieve your goals.

Achieve complete financial freedom: My journey

These steps describe the path I’m currently on. I live a comfortable life and have no complaints at all. But it’s not quite true financial freedom as I’ve been describing it. I hope to achieve my dream in 5 years, and I hope we can sustain this blog long enough to hear about yours! Let’s be on this journey together. Keep me posted, I’d love to hear where you’re at!

PS: Did you enjoy this post? Would you be interested in a book that covers all of these in more detail? Let me know in the comments below or send me a DM on Instagram. Please also consider sharing this post with the people you love. Let’s all be on this journey together!

Infographic: 9 Steps to Achieve Financial Freedom

*The book links in this post either lead to my book reviews or will direct you to Amazon. Those that direct you to Amazon are affiliate links. You may read my affiliate disclosure on my Terms & Conditions page, #6 Links.

Read more, select a topic: