I blame consumerism, and here’s why. Financial discipline has more to do with emotional toughness than intelligence. People struggle with it not because they don’t understand how to be disciplined with money, but because the willpower’s not there. Now full disclaimer, I might not be the best person to talk about this because I’ve always found staying on a budget easy. And someone who’s gone through your same struggles might empathize better. But still, I’d like to share my thoughts, and please do take it as you will.

I also don’t mean for this to be a fight against consumerism, because I understand it’s an economic growth driver. But what I’m saying is this. Awareness is key to being smart about money. And I hope to stir better awareness.

To be disciplined with money, the one change I say is this: Genuinely stop caring about how others see you.

There’s certainly more than one change you can do. But this, in my opinion, has the greatest impact. It’s a foundation for financial savviness down the line. And as simple as it may sound, to me it’s all-encompassing and actually goes very deep. Let’s go on a deep dive then.

Page Contents

- Materialistic attachment

- Community’s role

- We care too much

- Imagine this

- Control overspending by wanting change

- Be disciplined with money tip #1: Track your budget

- Be disciplined with money tip #2: Know your avoidable expenses and eliminate

- Be disciplined with money tip #3: Accountability partners

- Consumerism is not all bad

Materialistic attachment

Sports cars, jewelry, mansions… Easy enough to know we don’t need these things, right? But how about birthday celebrations, organic food, or even (dare I say it) engagement rings? Going against these norms is borderline blasphemous. Who then says we HAVE to have these things?

Consumerism tells us… to be happy we must consume as many products and services as possible. If we feel that something is missing or not quite right, then we probably need to buy a product (a car, new clothes, organic food) or a service (housekeeping, relationship therapy, yoga classes).

Yuval Noah Harari

(Related: Takeaways from the book Sapiens by Yuval Noah Harari)

If you’re stressed, you probably need to travel more. Feeling down? A pint of ice cream might help. Got a huge bonus from work? The Omega Seamaster is a good investment.

Consumerism, in this context, is the materialistic attachment to possessions. It’s about getting the latest iPhone, or your father’s preferred car brand, or your favorite celebrity’s designer label.

And yes, marketing and advertisements certainly fuel consumerism. But it is the community that gives the decisive push.

Community’s role

Humans are one of many animals on this planet. Highly intellectual animals, of course. But I urge you to take a big step back and see how we fit in the grand scheme of things. We’re really no different from other social species.

We crave belonging to a community, and this means conformity or trying to get along, as well as shared beliefs. From religious beliefs to country borders, we look for societies to relate to. These also include brand loyalty and the “have-to-have X” community (e.g., card collectors club).

But who determines what’s right and wrong, and is it absolute? Should we be liberals or conservatives? Should you go for Windows, iOS, or Linux? How did society decide the importance of birthdays or engagement rings?

Those philosophical questions are hard to answer. But we do know that humans want to belong, be seen as attractive and desirable, or in general be one with the community. Those who don’t are ostracized and might start their own communities.

(Introverts also need communities, just to a lesser extent. Introversion is simply a greater focus on inner thoughts and imagination.)

We care too much

Humans are too aware not to care. I mean, who wouldn’t want to be admired and appreciated? This manifests in our obsession with social media affirmation through likes and shares. Or by buying, wearing, and using things of envy. Or through public affirmation with awards.

Sure, you might say you’re buying not for the affirmation, but simply because it makes you happy. Okay, that’s fine. Now let’s think about why it makes you happy. And let’s be 100% honest. Don’t worry about judgment. No one will know, all this is in your mind.

Maybe it’s because you saw it in a commercial endorsed by someone you like. Did a friend or loved one recommend it? And if they did, was it with society’s influence? Was this something that made you happy as a child, and why? I’d argue there’s usually a trail back to consumerism, direct or indirect. Even random food cravings are probably not truly random but rather (subconsciously) influenced by media.

Imagine this

Let’s humor ourselves a bit and imagine we’re the only person in the world. I certainly wouldn’t care about how my hair looked (goodbye hair products). Also, think about the last excessive purchase you made. Would you have done the same if you were the only person in the world?

Again, this isn’t saying you shouldn’t brush your teeth or shampoo. But the exercise puts things in perspective for smarter choices. It really highlights how some choices are made because of society, even if we think they’re not.

The financially disciplined person understands which purchases are fueled by societal influence. Sometimes she might give in, other times she might control the urge. But being disciplined with money starts with awareness.

Control overspending by wanting change

I hope by now I’ve highlighted the importance of wanting to be disciplined with money first (i.e., the emotional side of budgeting), before diving into the tips and strategies (i.e., the intellectual side of budgeting).

We don’t have to be smarter than the rest. We have to be more disciplined than the rest.

Warren Buffett

If you want to stop overspending, you have to have the right mindset. Your motivation is the foundation. It’s the key to having discipline in saving money. All other personal finance tips will fall without the right motive.

Be disciplined with money tip #1: Track your budget

3 Types of transactions

There are only 3 ways money moves around you. Be aware of these 3: (1) Inflow, (2) Outflow, and (3) Transfers

- Inflow: These include your business income, salary, rent, dividend, etc. Really anything that flows into your accounts.

- Outflow: These include expenses such as mortgage payments, transportation, food, etc. Anything that takes away from your account.

- Transfers: These are movements to your “account balances,” which include your bank accounts, credit cards, cash in your wallet.

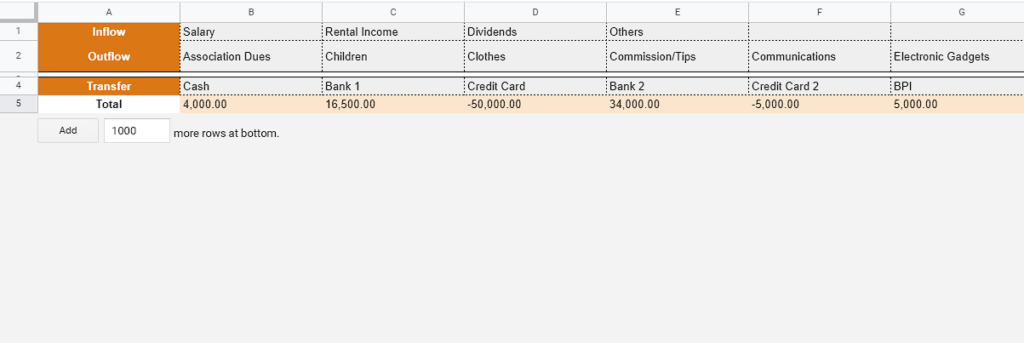

If you plan on tracking your budget, you should then have a list of Inflow Accounts, Outflow Accounts, Transfer Account. Here’s a sample list to get you started:

| Inflow –> | Salary | Rental Income | Dividends | Others |

| Outflow –> | Association Dues | Children’s | Clothes | Commissions paid |

| Transfer –> | Cash | Bank A | Bank B | Credit Card A |

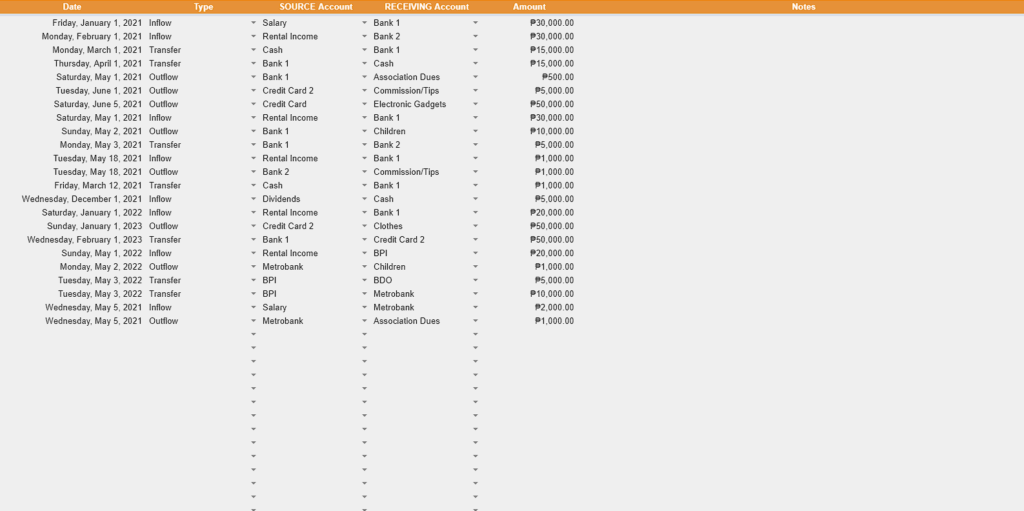

Recording transactions

All transactions involve 2 items, and there are no exceptions. There’s always the Source Account and the Receiving Account.

I find it helps to imagine the physical movement of cash. When you receive your salary and it’s deposited to your bank, the flow of money goes from your “Salary” account to your “Bank A” account. Or when you spend on groceries by using a credit card, the flow goes from the “Credit Card A” account to the “Groceries” account.

| The Transaction | Type of Transaction | Source Account | Receiving Account |

|---|---|---|---|

| Received salary, direct to the bank | Inflow | Salary | Bank A |

| Withdrawing salary from ATM | Transfer | Bank A | Cash |

| Groceries paid with a credit card | Outflow | Credit Card A | Groceries |

| Settling your credit card balance | Transfer | Bank A | Credit Card A |

Pay special notice to transactions 3 and 4. When you pay your groceries with a credit card, your Credit Card Account balance becomes negative (assuming you started at zero). This signifies debt. And when you settle your balance through bank transfer, the Credit Card Account balance goes back to zero (and your Bank Account reduced by the amount paid).

freedom locker PH budget tracker template

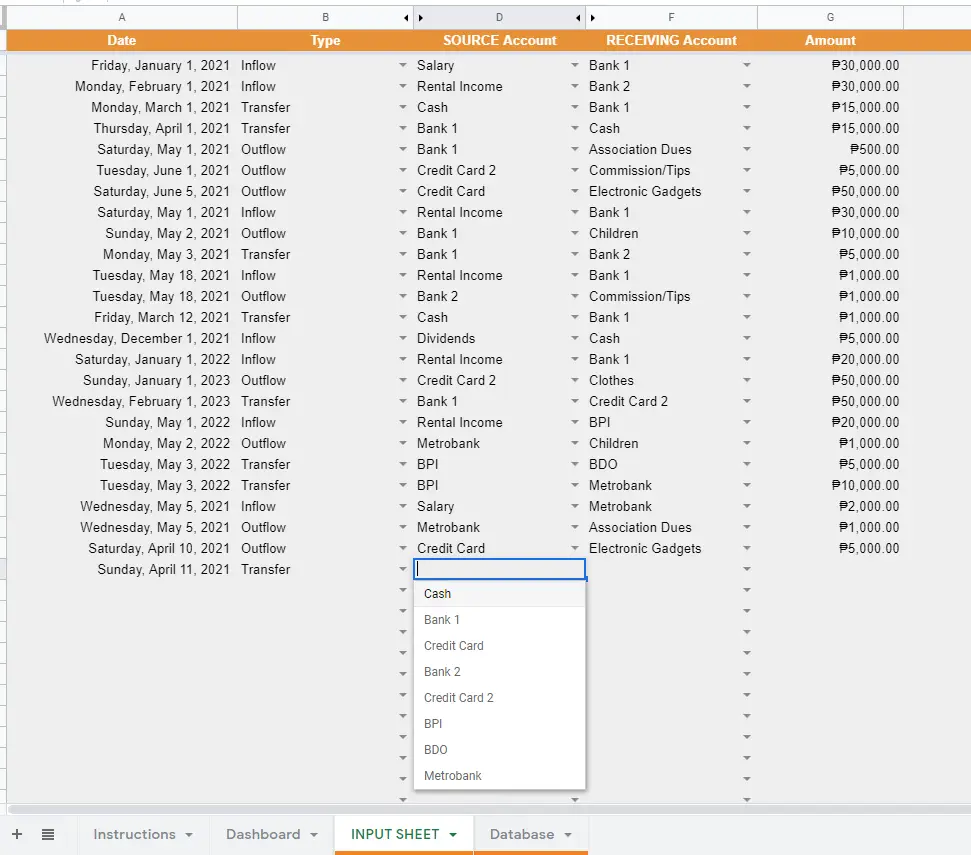

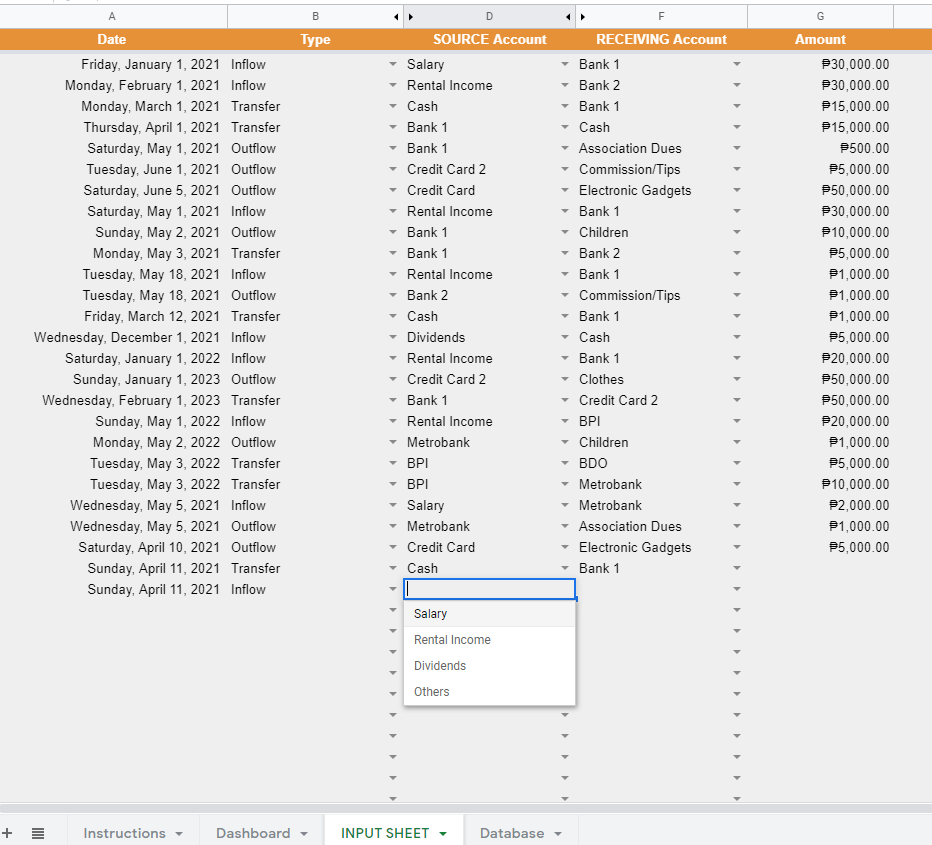

If recording transactions seem confusing, we’ve created a Google Sheets Budget Tracker that automates the selections per column (i.e., Source Account and Receiving Account), thereby avoiding mistakes.

Sample “Transfer” transaction

Sample “Inflow” transaction

The Budget Tracker is available here. (Use the promo code “financialdiscipline” for 50% off.)

It includes chart summaries, and you are also free to customize your inflow, outflow, and account items.

Of course, you can always make your own budget tracker. If you do, please don’t forget that the Source and Receiving accounts should be defined based on the type of transaction:

| Type | Source Account | Receiving Account |

|---|---|---|

| Inflow | Inflow Accounts | Transfer Accounts |

| Transer | Transfer Accounts | Transfer Accounts |

| Outflow | Transfer Accounts | Outflow Accounts |

Focus on progress, not perfection

One mistake is to try to track every single cent and go nuts when things don’t balance out. I was guilty of this for years and I can tell you, the effort’s not worth it. Instead, you might want to include a “force balance account” if you really want to see the correct balances. (But control the force balance account.)

Automated transfers

It’s also worth checking if your bank has an automated transfer feature. For those really struggling with being disciplined with their money, this is a helpful feature.

(Be careful though not to limit your liquidity. You’ll need cash on hand for emergencies.)

Be disciplined with money tip #2: Know your avoidable expenses and eliminate

Credit Cards

Expenses like credit card fees are completely unnecessary (because you can avoid them by paying in full). And with their extremely high rates, it’s easy for people to fall into the spiral.

In Finance for People Who Hate Math, I’ve talked about how companies quote rates paid to us (i.e., the amount we receive) in annual rates. While the rates we pay to them are quoted in monthly rates. Why is this important? Because it gives the illusion that the annual rates are larger than they are and monthly rates are smaller than they are.

If the monthly rate of a credit card is 1%, and our bank deposits receive 0.5% per year then it doesn’t seem too bad. But when we compare apples-to-apples and annualize the monthly credit card rate, that’s 0.5% vs 12%! Either pay them in full or don’t use them at all.

Subscriptions

Another item that creeps up on us is subscriptions. They’re typically insignificant amounts (e.g., $0.99) and easy to spend on.

But because they’re small amounts, they’re also easy to forget. And these add up. Be wary of subscriptions and always think if they really add value to your life (or if you’re subscribing just because it’s cheap). If you’re struggling right now, then pull out your monthly statements and go line-by-line. Force yourself to classify each item as either “eliminate,” “keep,” or “TBD.“

Rent vs. Own

This isn’t probably what you’re thinking. Most people say renting is throwing away your money. My biased is towards owning, for sure, but renting can be a good choice.

You can save money by renting OR by owning. Circumstances are unique, and sometimes one option is financially better than the other. (See Is Renting a Waste of Money: The Financial Advantages of Renting a Home)

But the point is this. There are avoidable expenses to both renting and owning. See which option makes more financial sense to you.

Cooking vs. eating out (and similar issues)

This falls in the catchall category of just being smart with your choices. In most cases, cheaper (but probably less convenient) options are available:

- Cooking vs. eating out

- Walking/biking vs. commuting

- Generic vs. branded

See which areas you’re willing to sacrifice time for money and vice versa. If you’re not willing to sacrifice, then you shouldn’t be complaining.

The Balance has a list of 100 ways to save money.

Be disciplined with money tip #3: Accountability partners

Studies have shown accountability (partners you report to) increases your chances of success. They may be a spouse, friend, or a coach.

Others have taken the open-to-the-public route. I’ve actually found a lot of pro-budget Instagram accounts detailing how much they’ve saved/spend/made. This can be a powerful motivator. (Because remember, pressure from the community can be hard to ignore). So if you can’t ignore how people think of you, then you might as well use it to your advantage.

Some of the accounts I follow are achievefireph and pinay_racketeer. You might find yourself rooting for their success as they document their journeys.

(Follow me on Instagram.)

Side-note on saving

freedom locker PH is all about financial freedom and I’ve highlighted how being hyper-focused on savings can be detrimental.

(Related: Why Tipid Tips Fall Short)

How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.

Robert G. Allen

Remember that saving money isn’t enough, but still necessary for personal or business finance. Being disciplined with money should be a process goal, not the end goal.

Consumerism is not all bad

I’ve said it ad nauseam: I don’t intend for this to be a fight against consumerism. We will continue to celebrate birthdays, go on travels, and buy the things that make us happy. Consumer spending contributes to economic growth, and I can’t get mad at that. But being aware of its implications (that a lot of our decisions are subconsciously society-based) also leads to smarter and more disciplined consumers.

Understand that it’s okay to buy and splurge as long as you (truthfully) understand why you’re buying. And be candid with yourself.

No one really thinks about you as much as you’d like to believe. Because they’re too busy thinking about themselves. When we understand that buying the next big thing is mostly because of our want to belong and maybe raise our social currency, then it becomes an act of controlling that imagined reality.

Read more, select a topic: