Does peso-cost averaging work? Let’s backtrack a bit. How do we even define “work” in this context? Do we say it works because it always gives out better returns? Or are we asking if it works in the way it was intended, to minimize risk?

Peso-cost averaging works if you’re not willing to bet on short-to-medium term market trends. Cost-spreading, and therefore “averaging,” is a risk-minimizing strategy. If you’re bullish or bearish on market cycles, then cost-averaging is not the strategy to use.

Is it a strategy that always gives you better returns?

No, cost-averaging doesn’t always give the best returns. In a sustained uptrend, lump-sum investing (i.e., buying everything upfront) will give better returns. But in a downtrend, investing everything upfront also gives out worse returns.

In other words, peso-cost averaging (or in general, “cost averaging”) usually keeps you in the middle. It’s a strategy for investors who readily admit not knowing the movements of a market’s cycle.

Now, if the stock market has been on a general uptrend, and lump-sum gives better returns in sustained uptrends, then why the prevalence of this advice? Is peso-cost averaging relevant in the Philippines, or are we mistakenly trying to adopt the dollar-cost averaging strategy used in other countries? Is it better to cost average weekly, monthly, or quarterly? Should you practice strategic investing and buy more when the asset is below your target price?

Page Contents

What is peso-cost averaging?

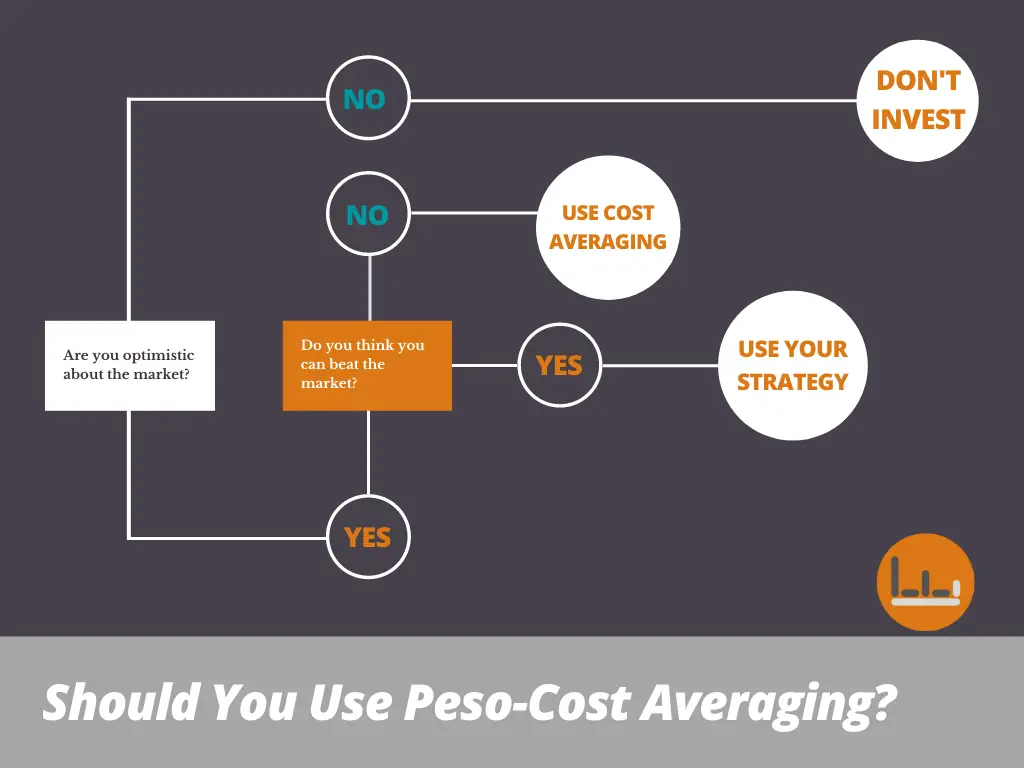

Peso-cost averaging is setting aside a fixed amount to invest in an asset at regular intervals.

Let’s break it down:

- Peso-cost averaging — The cost average strategy applied in the Philippines using the Peso currency.

- Fixed amount to invest — Regardless of what happens in the market, the investor allocates a fixed amount to invest. From as low as Php50.00 (Digital Banks) to as high as you’re comfortable with.

- In an asset — The strategy isn’t limited to individual stocks. Cost averaging can apply to index funds, mutual funds, UITFs, bonds, cryptocurrencies, REITs.

- At regular intervals — The investor sets when she wants to invest. Weekly, monthly, and quarterly intervals are common options. Some also set their investments to time with their payday.

This highlights how cost averaging doesn’t have a specific application. It is a concept with a lot of flexibility — in currency, amount invested, asset type, and intervals.

How does cost averaging work (example)

Suppose you decide to invest a fixed amount of Php10,000 every year in Stock A. We’ll assume the following prices at years 1 to 3:

- Y-1 = Php100.00/share

- Y-2 = Php95.00/share

- Y-3 = Php115/share

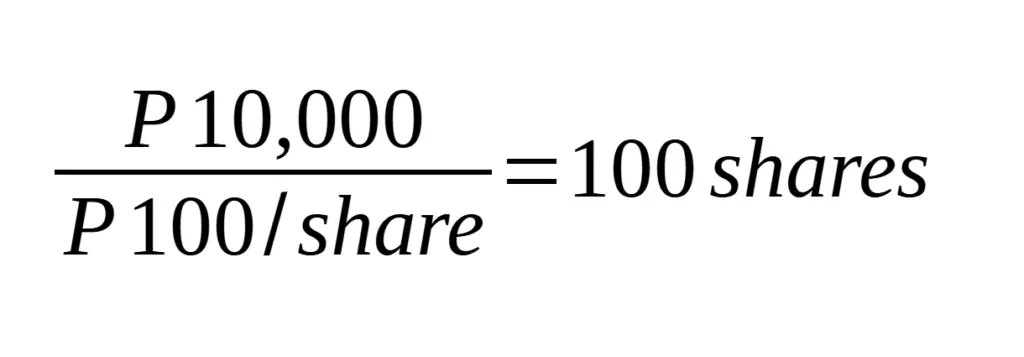

Year 1

Investing Php10,000 in year 1 when Stock A’s price was Php100.00/share meant you received 100 shares:

Year 2

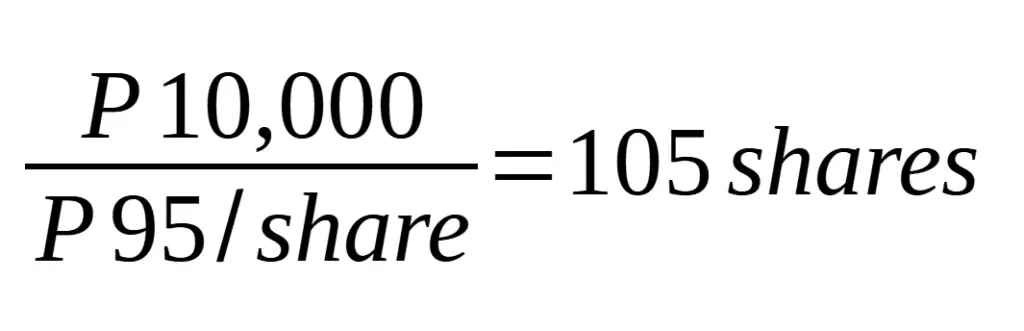

In year 2, you again bought Php10,000 worth of shares. But at Php95.00/share, you got 105 shares:

Year 3

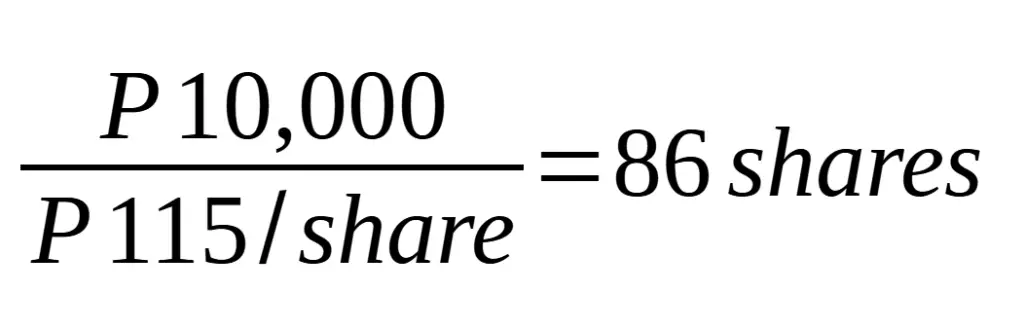

In the 3rd year, you allocated another Php10,000 to invest in Stock A. Php115.00/share gave you just 86 shares.

Better or worse?

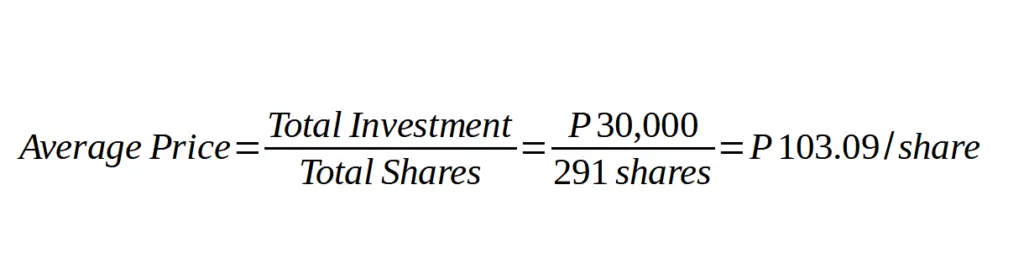

At the end of the third year, your portfolio now has 291 shares of Stock A bought at an average price of Php103.09:

Are you better or worse off? It’s never as clearcut as you may like because the answer depends on what has happened (and will happen) to Stock A’s price.

(This example also emphasizes how cost averaging isn’t limited to weekly or monthly intervals.)

How to know if Peso-cost averaging is better or worse

In this context, we specifically want to know if a cost-averaging strategy gives better or worse returns against lump-sum investing. Lump-sum investing means investing everything at time zero. We’ll also later see how Peso-cost averaging fares against “intelligent averaging” or strategic buying.

The typical pattern of markets

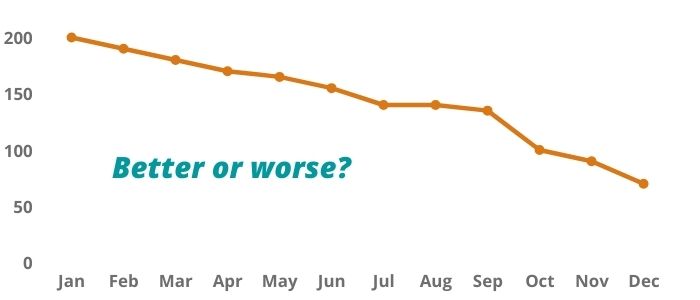

A peso-cost averaging strategy performs better when there are short-term downturns in an overall uptrend market. Consider the following chart.

This chart is typical of markets. There is an overall uptrend splattered with a few down months. In this type of market, peso-cost averaging usually gives better results. Rather than have every unit of an asset bought at Php100 (as with the lump-sum approach), cost averaging means we’re also buying when the asset is priced at Php50 and Php70.

(It’s worth noting how not all markets will be like this. The prevalence of this pattern though might be one explanation for the popularity of the Peso-cost averaging advice. More on the benefits of Peso-cost averaging later.)

Same trend with different results

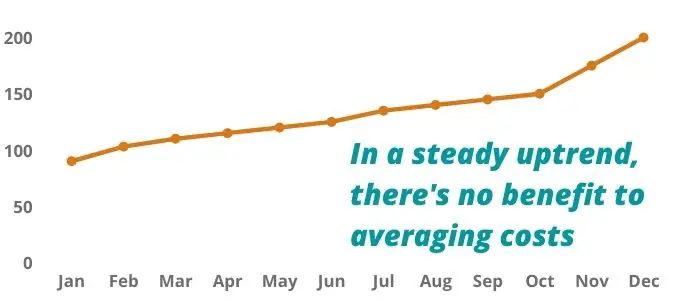

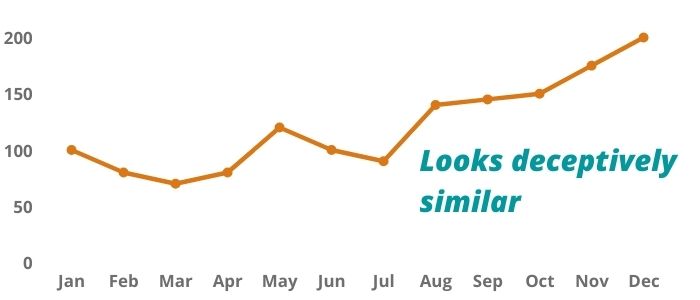

Stock markets, including the PSE, have historically been on a long-term uptrend. But does that mean Peso-cost averaging is the superior strategy to stock market investing? It’s not as simple as that. Consider this next example.

In this market scenario, there is no benefit to averaging and you’re better off investing everything upfront.

This shows how Peso-cost averaging can give either better or worse returns, despite both scenarios assuming an uptrend.

Is averaging down a good idea?

In our last example of a steady uptrend, Peso-cost averaging gave us worse returns. Does this mean a steady downtrend (the opposite) will give us better returns? See this chart.

Compared to lump-sum investing, cost averaging keeps us in the middle. When our hypothetical stock shot up to around Php200 (Graph 2), the Peso-cost averaging strategy didn’t earn as much. But when our stock dropped to 50 (Graph 3 above), the Peso-cost averaging strategy also didn’t lose as much. Cost averaging typically lowers both risks and returns.

But I also mentioned how Peso-cost averaging works for investors who admit to not knowing what direction the market is going. If, for instance, you’re truly bearish and expect the market to decline, then you should be avoiding the market altogether.

And even in that scenario, Peso-cost averaging keeps you in the middle. If being bearish is correct (and you don’t use the Peso-cost averaging strategy; you avoid the market) and the market does tank, then your bet to avoid the market pays off. If you’re wrong and the market rebounds, then your bet to avoid the market is a loser. (Peso-cost averaging keeps you in the middle.)

It’s never clearcut

But even in a general uptrend with occasional downs (similar to Graph 1), the dips can be too small to make an impact in lowering your average costs. In the example below, I gamed the prices to make lump-sum the more attractive option. Without seeing the returns, this chart looks eerily familiar, but with different results.

This is a case where lump-sum gives out better returns and proves how, even with a general uptrend with splattered downs, there’s never a guarantee.

What’s the point of all these charts?

So far I’ve presented a variety of scenarios where peso-cost averaging wins and doesn’t. The point is this: There are many possible permutations and combinations — too many to know if Peso-cost averaging will perform better or not.

If you’re investing in an asset, then that implies you’re betting on the market to go up. Cost averaging is a risk-mitigating strategy for this bet.

If you think, as a whole, that the market is going up, but also know you can’t time the market, then cost-averaging is for you.

This begs questioning Graph 4. If, even in a general uptrend, lump-sum sometimes beats out cost averaging, then why cost average at all? The answer is simple. It’s because there are other benefits to Peso-cost averaging than just ridding yourself of the need to time the market.

Other benefits of Peso-cost averaging

Aside from having no need to time the market, cost averaging offers at least another benefit.

Yes, investing a fixed amount rids us of the stress of timing the market. Market timing is often a moot point anyway, so trying to buy at lows and sell at highs is often a time-waster.

But another advantage of cost averaging talks about how we invest what we can. Rather than investing huge amounts, we set aside a portion of our monthly income for whatever investment. And when we consider how lump-sum investing may or may not achieve better results, then trying to invest huge amounts becomes even less attractive. That’s not even mentioning the emotional impact of losing huge amounts over a short period.

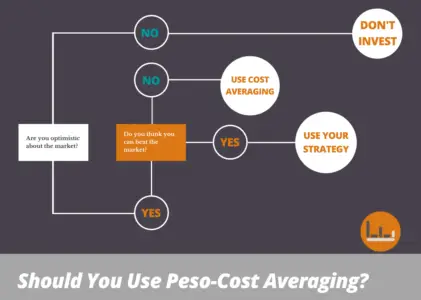

Is Peso-cost averaging for you?

Here’s a process you can use to determine if Peso-cost averaging is right for you.

It’s clear to me how Peso-cost averaging is a strategy that’s appropriate for casual investors without a better alternative. By this, I mean investors who aren’t full-time professionals, including myself, with no alternative that’s been found to give better returns.

(Read my take on timing and trading in the stock market: Make Money Trading Stocks? The Advice You Didn’t Want to Hear)

Alternatives to Peso-cost averaging

Although I am a proponent of Peso-cost averaging for most investors, it is not what I use when investing in the stock market. I use a modified approach, what I’ve called the Modified Buffett Indicator.

This research shows how threshold buying and selling can yield better returns in the PSE, or at least over the 20-year period tested. It explains the rule-of-thumb I use when investing in the PSE. I use buying and selling thresholds to make my quarterly decisions, rather than Peso-cost averaging the FMETF.

(The research link takes you to a study I made on the PSE. Though it is, admittedly, based on past performance and we all know how that isn’t always indicative of future returns.)

Paid subscriptions that time the market

My research is open to the public (through this blog) and any investor who agrees with its findings can use it for free.

But there are paid subscriptions that tell you when to buy or sell based on target prices. Should you join these paid subscriptions that promote “intelligent averaging,” “strategic averaging,” or basically services that try to beat the market?

What follows isn’t advice for you, and please feel free to do as you wish, but I am not a fan. This isn’t discounting how most of them are full-time professionals. But as a former professional myself, I’ve seen how difficult it can be to earn what’s called alpha (or excess returns; see Investopedia’s explanation). So if what you earn is really just explained by beta (what you’d get from, say, an index fund anyway), then you’re wasting money with the subscription fee.

Your subscription’s recommendations must earn enough “excess returns” over what you would’ve earned anyway to compensate for the subscription fee.

Here’s a simplified example. If investing in an index earns you 8%, while joining a subscription service earns you 10%, then you better make sure your fees don’t go over the equivalent of 2% of what you earned.

How you compute this will vary from service to service, the amount invested, etc. If that sounds too complicated, just be aware of two things: (1) Subscription fees put you in a disadvantaged position, and (2) Your earnings should be compared to what you would’ve earned anyway, not compared to zero.

Peso-cost averaging Q&As

In writing this post, I was curious to know how Filipinos saw Peso-cost averaging. Here are a few questions I found that stood out.

Question 1: Am I doing it right?

I’ve tried the Peso-cost averaging method for over 4 years through a UITF that tracks the index. The value of my fund has only grown by 1%, with a CAGR of 0.5%. This makes me feel I’ve done something wrong.

Answer 1.A: This investor fails to understand how stock markets work. There’s never a guarantee when you invest in the stock market.

Answer 1.B: This is a matter of time-period sampling. I wouldn’t be surprised if he got a totally different conclusion over a different 4-year period. Case in point: This week, ending May 28, 2021, the PSE jumped from 6,186.09 to 6,674.51. That is a 7.9% return in absolute terms.

Question 2: Is cost averaging applicable in the Philippines?

The macroeconomics and dynamics are different here. We shouldn’t apply the same principles to the local bourse.

Answer 2: While I do agree how not all studies are directly applicable to our country (I justify this with my Modified Buffett Indicator), cost averaging benefits apply regardless of the economics. As a risk-mitigating tool, it functions the same way. Or how we need less money to start functions the same way. (It is a concept with a lot of flexibility — in currency, amount invested, asset type, and intervals.)

Question 3: Is it better to cost average weekly or monthly?

Answer 3: This comes down to preference. Cost averaging advantages and disadvantages are magnified with granularity. But for the same total amount invested, also consider how the granularity affects your costs. Do you effectively pay your broker more commission with smaller amounts? Other than that, there appears to be no right nor wrong time interval.

Conclusion

Peso-cost averaging is a strategy to mitigate some of the risks that investing large amounts might bring. You do earn less in a sustained uptrend, but you also lose less in a sustained downtrend. If you think you can beat the market, then Peso-cost averaging isn’t for you. For most people with an optimistic view of a market, cost averaging might be useful.

Whether it gives better returns on not, it’ll definitely rid you of anxiety from investing in large amounts and from stock (asset) selection. And the consistency from regular investing strengthens your case with time in the market, rather than timing the market.