You’ve opened a brokerage account and started investing in the stock market. You presumably understand that there are risks involved and that reducing risk is part of the venture. There are many tools and techniques to reduce risk. Here’s one way to lessen your risk in the stock market, PSE, or any market.

This post may cover some intermediate/advanced topics. If you find them confusing, I recommend starting with the Fundamentals of Personal Finance.

Diversification

Long story short, one way to reduce risk is through diversification. Yes, probably a boring plan and we’ve most likely heard it before. But why does it reduce risk? What’s the math behind it?

For us to answer this, we need to define what risk is. This is kind of a tricky topic. Some argue you can’t measure risk. Finance professionals and economists though need a number to represent this risk and a reasonable proxy is by measuring an asset returns’ volatility, or the possible movement in price (and return) of an asset.

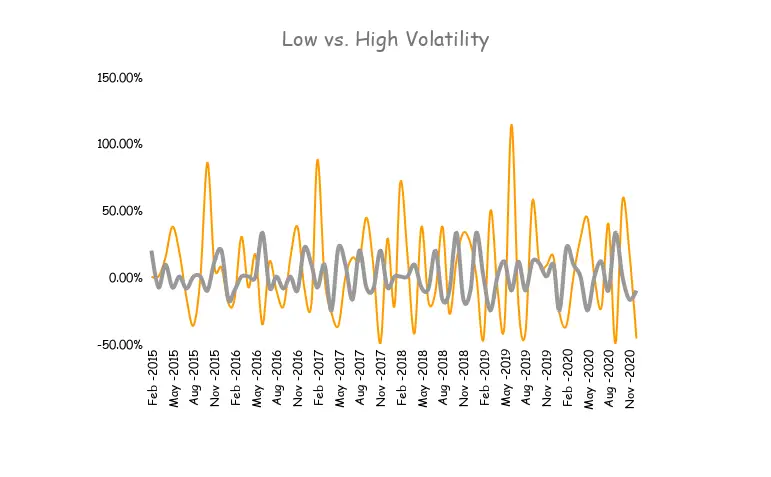

The chart below represents the returns of two hypothetical assets. The orange line represents an asset with higher volatility (and higher risk) while the grey line represents an asset with lower volatility (and lower risk).*

Let’s break it down. On the one hand you have your super safe (less-risky) assets like deposits from digital banks or money market instruments (i.e., prices and returns don’t move much). And on the other hand you have your more-risky assets like stocks or cryptocurrencies. The number used by professionals to measure this volatility is called standard deviation.

A quick way of thinking about standard deviation is that it’s a number that represents the possible movement, up or down, of the asset’s prices or returns.

A higher number means higher volatility and risk. In short, this is the number we want to minimize.

Portfolio Risk is NOT the Average Risks of Your Assets

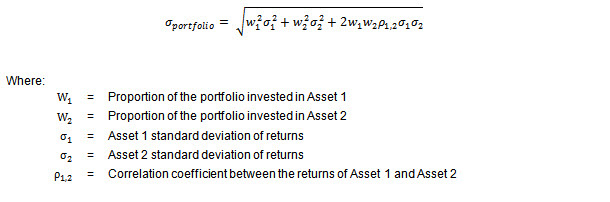

So how do we calculate our risk exposure? Said mathematically, what’s the standard deviation of our portfolio?

[If you don’t like math, all you need to know is that reducing a variable on the right side (in this case, the correlation coefficient of returns between two assets) effectively reduces the number of the left side (our portfolio’s risk). Feel free to skip to the conclusion.]

A portfolio’s risk is calculated as:

Notice the last term “correlation coefficient” in the formula.

Correlation is basically how those 2 stocks move together.

So a correlation of “1” means they move exactly the same, and a correlation of “-1” means they move the exact opposite to each other. In practice, or at least as I have seen in the PSE, the perfect 1 or -1 correlation doesn’t exist. It’s also worth mentioning that I’ve yet to see a negative correlation coefficient but wouldn’t be shocked either.

A prudent strategy would be to aim for something with a low correlation. These would typically be stocks in different industries (but not always). You’ll also see that as you add another asset in your portfolio, the formula becomes more complex, exponentially (i.e., you’ll have to consider the correlation coefficients among each other for three assets). For a 30-stock portfolio, a spreadsheet or programming language like Python is necessary.

And just with adding stocks to your portfolio, you’ve now reduced your portfolio risk. Congratulations! Now I understand I left a few details out. Please remember this explanation was meant for the beginners. If you have questions or comments please leave them down in the comments section or send me a message. Or if you’re super interested in finding out the correlation coefficents of your stock holdings, I’d be happy to help.

Possible strategies to implement

All of this is a long-winded way of saying that increasing your stock portfolio to include a variety of stocks will most likely reduce your portfolio’s risk. In fact, the risks diversified away is what finance professionals call, wait for it…

“diversifiable risk.”

My recommendation for non-professionals is to invest a bulk in an index fund. Warren Buffet famously placed a bet for $1 million that an index fund would outperform a collection of hedge funds over the course of a decade. Hedge funds are highly specialized finance professionals with all the time and technology. Warren Buffet won the bet that concluded in 2017. If Warren Buffet believes index funds are for the everyday investors, that’s good enough for me.**

*Both are high volatility assets, exaggerated for educational purposes.

**Full disclosure, I am a Warren Buffet apologist. 🤷♂️

Read more, select a topic: