I avoid reading the news. The stock market section, at least. And there are very compelling reasons, in my biased opinion, for you to ignore them, too. If you enjoy trading and use the news for your buy and sell decisions, then this isn’t for you. There’s no convincing a trader with preconceived notions, and that’s okay. But if you’re on the fence, I’d like to share 5 reasons why I don’t read the news for stocks (trading or investing). And maybe then you can decide if trading or investing based on the news is for you.

(To be clear, I occasionally see the headlines and read if it’s interesting. But I don’t read the news looking for trading opportunities.)

Page Contents

Empathizing with hopeful traders

It wasn’t always like this for me. I’d have multiple screens with numerous data — including the news and stock charts. I learned about technical analysis and studied Python-based algorithmic trading. It seemed cool, I guess. And it felt like the right thing to do for a self-proclaimed finance pundit. I even made a few good deals, and I’m pretty confident I netted positive. But was it a productive use of my time? I don’t believe that.

I’m saying this to highlight how I understand the feeling of traders. No doubt, it’s a thrill. Trading is exciting; investing is boring.

But since then I’ve discovered a better use of my time and a more profitable alternative to investing. If you’re looking to make money trading stocks, this is the advice you didn’t want to hear.

Now, I’m not saying you can’t or shouldn’t trade. In the end, it’s still a preference that can be lucrative for some (the minority). This is just me, sharing what I know now. And my 5 reasons for ignoring the news for stocks.

Reason #1: Can you really beat bots?

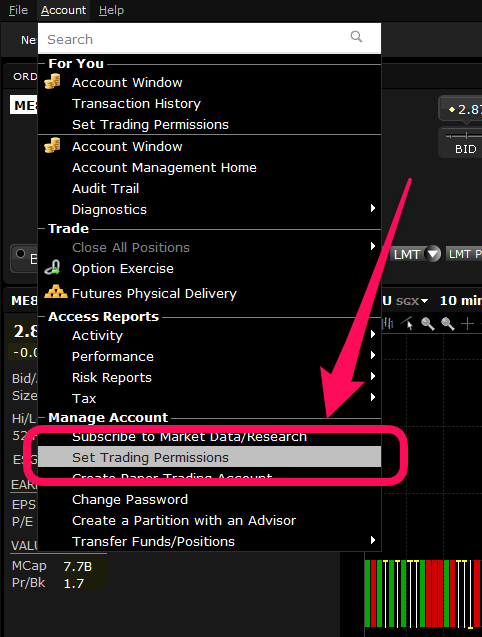

You will be competing with algorithms — programs that trade based on rules, with execution speeds of a fraction of a second. Algorithmic trading has financial exchanges relocating computer systems to shave milliseconds off execution times.

Some trading algorithms are based on news and market sentiment.

Through web scraping, they scan the news for positive and negative keywords, making an assessment based on predetermined rules. They might say something like “trade X when the price is Y and sentiment is Z.” And then the algorithm is backtested with historical data to see if it’s a profitable strategy.

But algorithms can really be anything. Sentiment-based algorithms will focus on positive and negative keywords.

Positive keywords might include:

- Improved

- Upward

- Gains

- Soaring

Negative keywords might include:

- Drop

- Misses

- Revised

- Falls

All this is assessed in milliseconds. And I don’t think I can do better than those guys. Particularly because news-based trading is basically timing the market, which I’ve grown to be against. Ray Dalio said it best.

Timing the market is basically playing poker with the best players in the world who play round the clock with nearly unlimited resources.

Ray Dalio

(Even in nonintegrated markets where bots can’t trade, it’s easy to scrape the web for news and create custom alerts to then manually trade on.)

Reason #2: I don’t trust my emotions

When positive or negative news breaks out, it’s hard to stay unemotional.

Emotions blur judgment. Think about the last time you bought a stock and it dropped based on unfavorable news. You either feel like getting out or hate yourself for buying the stock. It takes extreme discipline to absolutely not care. I mean, who likes staying in a losing position, right?

When the overall market sentiment is high, it feels like every risk is worth the potential return and you’d be a fool to miss the boat — think of the Internet bubble. But when market sentiment is low, it feels like “I don’t care what I make, I just want to get out” — think of the aftermath of the Global Financial Crisis.

So for me, it’s ignoring the news altogether.

Especially because the news is merely reflective of the writer’s sentiments (see Reason #5) and is usually short-term noise anyway (Reason #3).

(Related: Peso-Cost Averaging Advanced Guide: Know if It Works for You)

Reason #3: Short-term, the news is just noise

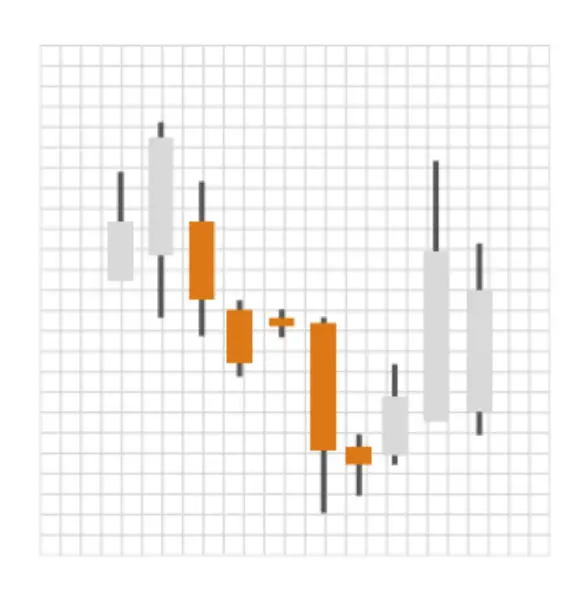

Theoretically, a stock’s price should be based on the business’s performance. And business performance is relatively stable day-to-day. But in reality, markets swing a lot more than actual changes in operations.

So why the exacerbated swings? In the grand scheme of things, most of it is noise caused by emotions (Reason #2). It’s also noise I don’t see myself realistically taking advantage of (Reason #1).

The swings are also intensified by market sentiment. When people see the market going up, they buy more. And vice versa. But all things considered, the actual performance of the business hasn’t exactly changed as much.

(Related: How to Earn 19% pa in the PSE)

Reason #4: Long-term, financial statements are better

When looking at the long-term prospects of a business, financial statements provide direct information about the company as opposed to the mere interpretation by an analyst that’s reported on the news. Warren Buffett reads annual reports more than anything.

This is what a good value investor should probably do. But I do not have the willingness nor capacity to sift through financial statements, hoping to find valuable information. (My unwillingness to read the news for trading and investing stocks also extends to financial statements, unfortunately.) So instead, I invest in index funds.

(Related: Buffett Indicator Philippines: Adjusted for the PSE)

I don’t have unique information to trade on, and I’d rather spend the time on other things. You could argue this: Although I don’t have unique information, my analysis is unique.

But in a world with millions of investors, some full-time professionals backed by limitless resources and top-notch education, that’s highly unlikely.

Reason #5: News is written by inherently biased humans

And it all comes down to this. No human is absolutely free of bias. When we read the news for stock trading or investing, we’re reading a prejudiced report.

What you see on the news is a reflection of the reporters’ sentiments and emotions.

There’s no malicious intent either. It’s plain human nature. Take, for instance, my favorite quote on skewed interpretations at work from Howard Mark’s book, Mastering the Market Cycle. These examples show how stock market rallies (i.e., uptrends) are explained, no matter what the data.

News on economic data:

- Strong data: economy strengthening – stocks rally

- Weak data: fed likely to ease – stocks rally

- Data as expected: low volatility – stocks rally

News on oil:

- Oil spikes: growing global economy contributing to the demand – stocks rally

- Oil drops: more purchasing power for the consumer – stocks rally

News on the dollar:

- Dollar plunges: great for exporters – stocks rally

- Dollar strengthens: great for companies that buy from the abroad – stocks rally

News on inflation:

- Inflation spikes: will cause assets to appreciate – stocks rally

- Inflation drops: improves the quality of earnings – stocks rally

Regardless of actual data, the news will reflect human emotions and biases.

The best we can do is be aware of our biases. Even then, it unknowingly creeps upon us, as underscored in Daniel Kahneman’s Thinking, Fast and Slow. (I highly recommend you get this book!)

Conclusion

Reading the news for stocks, for both trading and investing, is like the chicken-egg puzzle. Is the news reflective of patterns, or do trends follow the news? I don’t know the answer, and I don’t intend on spending time to know the answer. But it also seems superficial for me to say the news is insignificant — I don’t believe that either. What I am saying is there are too many variables to consider when trading on news reports, that it makes sense to simply ignore the noise and invest in an index over long time horizons.

(Related: FMETF: The Smart Way of Investing in the PSE Stock Market)

This is a contentious take that I’m not willing to debate. I absolutely respect anyone who thinks otherwise. This is one man’s point of view. My hope is for the essay to spark curiosity. Please do share what you think about reading the news for stocks, and if you do it for active trading or long-term investing.