Gerry’s luck was turning. It was an ad. A very fateful ad. One that would breathe life into his dormant portfolio. It was an ad for foreclosed properties. Apartment buildings sold cheaper than branded subdivision lots; houses were selling for practically nothing. The stars were finally in place for an epiphany. All the knowledge from Rich Dad Poor Dad and his banking experiences were paying off. He went on and bought the best deals he could find.

Page Contents

Meet Gerry, pre-Rich Dad Poor Dad

This was the story of Gerry before real estate investing became mainstream. Real estate investing has been embraced largely because of Robert Kiyosaki’s Rich Dad Poor Dad, but also because of the speed and ease of dissemination in the Information Age.

Real estate had been touted as a way to financial freedom for the layman. And rightfully so. The basic formula in the book was “passive income > expenses,” and real estate seemed like a reliable way of building anyone’s passive income.

Were foreclosed properties cheaper then? More often than not, they were. People like Gerry bought as much as they could. He would do a mix of flipping (buy-and-sell) and holding. He would even do paid seminars preaching how foreclosed properties helped him achieve financial freedom.

Demand for real estate, and especially cheaper foreclosed properties, was picking up.

How banks see foreclosed properties

Foreclosed properties are cheaper because they’re what’s called non-performing assets.

Every business asset has a purpose. Banks pay specific attention to which assets give them the best returns. And because foreclosed properties do nothing to contribute to a bank’s cash flow, they are a waste. Banks are better off selling these sleeping assets and using the cash proceeds in better-performing assets (e.g., loan out to someone else).

The supply of foreclosed properties also generally increases during recessions, when borrowers are unable to pay their obligations. This is bad for banks and they try to rid themselves of repossessed properties as fast as possible.

The economics of foreclosed properties

Supply and demand 101

Information dissemination has caused an influx of buyers for cheap foreclosed properties. Improving economies saw declining supplies of repossessed properties from banks. The increase in demand coupled with the decrease in supply have contributed to the increasing prices of foreclosed properties as a whole.

But even as subsequent declines such as the sub-prime crisis of 2007-2008 saw spikes in supply, the information had stayed. Investors knew of the benefits of foreclosed properties and were ready to buy the best deals.

That’s the thing. Even if the supply of foreclosed properties increases by 100x, that doesn’t do much if demand increases by as many.

And in a zero-sum economy, every loser will have a winner ready to profit.

Gerry’s success is our undoing

Before they became popular, property foreclosures were diamonds in the rough. These were often neglected properties with much potential.

Think about it. When a borrower takes out a loan, she uses the property as her guarantee to the bank. And if the borrower is unable to pay her obligations, then the bank takes the property. A distressed borrower, who’s already struggling with her finances, is probably not going to spend much on repairs and maintenance.

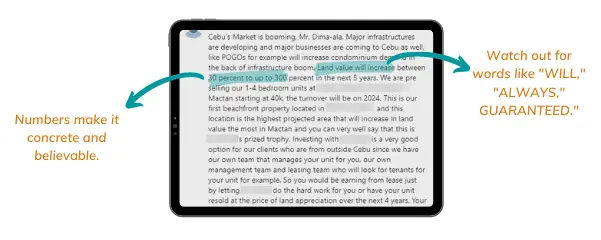

Foreclosed properties have even been used by some institutions to advertise properties. “Get the best deals by buying our foreclosed properties.”

It has become a label that attracts new investors. And it’s a label with strong social proof, including people like Gerry.

The true cost of buying foreclosed properties

Repairs and maintenance

I already mentioned how foreclosed properties are usually from distressed owners. The neglected property may need some repairs and maintenance before it’s sold to a new buyer. As a buyer, you have two options. You could account for the required repairs and plug it in your budget, or you could leave it as-is and flip the property.

Regardless of what you do, buyers will only be willing to pay for what they think the property is worth.

If you saved on repairs, you’re also likely going to end up with a lower selling price. If you decide to spend on repairs, then that will likely increase the property’s value. In fact, “forced appreciation” is a popular technique in real estate investing, where you find improvements to increase the value of a property by more than the cost of the improvement.

(But be careful not to overspend on improvements. Related: 9 Hidden Ways a Good Property Can Be a Bad Investment)

In short, you get what you pay for. Cheap foreclosed properties are cheap for a reason. The pristine foreclosed properties are likely going to sell at a premium.

Other underlying issues

Aside from the low costs to acquire due to the needed repairs, foreclosed properties have other issues. These include illegal tenants and unclear titlings.

All these costs add up and you may end up with a much more expensive property, all things considered. A property with a low price is not necessarily cheap after considering all other costs.

Foreclosed properties today

‘Foreclosed properties’ is a label that’s used to attract a particular set of investors. The success stories of Gerry and people like him have pushed the notoriety of foreclosed properties further.

If COVID puts a lot of properties into foreclosure, the supply of foreclosed properties might again go up. But also remember that this information is not unique to you and other investors will be standing by.

Supply and demand are equalizers.

The information is out and a lot more buyers pry on foreclosed properties, foreclosure proceedings, and lists of repossessed assets.

There are clearly good deals with foreclosed properties. You’ll just have to put in the effort to look for it. But isn’t that the same with on-market listings? If it’s a market with good and bad deals, then it’s just like any other market.

The smart real estate investor assesses a property based on its merits, not its label.

*This post may contain affiliate links. You can read my affiliate disclosure here, Terms & Conditions, #6 Links.

Read more, select a topic: