I’ve tailored this guide to my experiences of BRRRR investing in the Philippines. This post is a primer on the BRRRR investing strategy. It’s one of those nuggets of information that, to me, was life-changing despite the simplicity. Its personal impact undoubtedly along the lines of “get out of the rat race,” “employment is the new form of slavery,” and “give every (dollar) peso a job.” Whether it’s that impactful to you or not, this tool should be in your arsenal regardless.

BRRRR investing isn’t a new strategy by any means. It’s been around for a long time but wasn’t given an acronym until now. I came across the concept on a forum at BiggerPockets. In a sentence, it is the process of getting equity out of your investment property and using that money to buy more properties.

(If you’re familiar with the strategy, consider this list of frequently asked questions: Is BRRRR Possible in the Philippines (Plus Other FAQ))

The “BRRRR” stands for:

Buy | Rehab | Rent | Refinance | Repeat

This illustration is just one of many variations to BRRRR investing in the Philippines – or the BRRRR strategy in general. For instance, I talk about not selling an existing property and applying the BRRRR concept here. The implications and results vary, even occasionally prompting infinite ROE (we’ll talk about this next time). The objective of this guide is to nudge you into taking action by showing the steps and their possibilities. Let’s assume a hypothetical transaction for a Php2.5 million apartment complex.

Page Contents

Buy

The first step is to buy the property. Your purchase doesn’t have to be in cash but doing so has advantages. It allows you to negotiate a lower price and therefore get a return on your money right away. For example, assuming a property’s valuation is Php3 million and you got in at Php2.5 million, then that’s an instant Php500,000 return (in theory). You could subsequently look for a buyer at fair value (i.e., Php3 million), and realize the gain right away.

For practical reasons though, we’ll assume your cash out for the Php2.5 million purchase price is a 20% down payment (Php500,000). This is your initial investment.

Rehab (“Renovate” as it’s more commonly called in the Philippines)

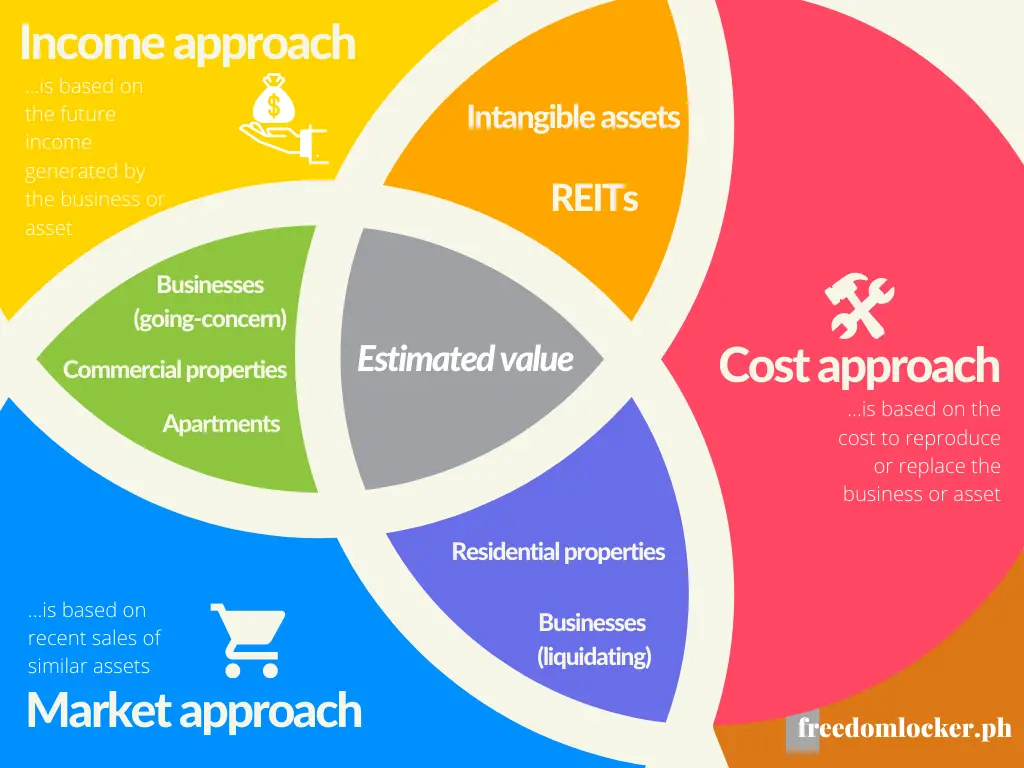

This strategy works best for properties that allow for forced appreciation. Forced appreciation is basically appreciation in value due to actions you directly control. Applying fresh paint that costs X amount and increases the value by 1.2X is an example of forced appreciation. Assuming the renovation costs of your deteriorating apartment is Php300,000, and also assuming the renovation increases the property’s value by 20%, your new valuation is estimated to be around Php3.36 million (i.e., original valuation of Php3 million plus estimated value contributed by your rehab).

Rent

Once you’ve renovated the property, you are ready to rent it out. You may choose to manage the property yourself or outsource this step. Just remember that if you do choose to hire a property manager, your monthly payments to the property manager must be accounted prior to buying the property. I typically assume a 10% commission despite managing our properties ourselves. This acts as a margin of safety and is part of your upside potential.

We will also assume that, because you did your due diligence, your property rents for more than what you pay in monthly amortization. (Although simplified for our purposes, make sure you look into this carefully. It’s easy to miss but has a huge impact on your investment.)

Refinance

Now that you’ve rented out the property, it’s time to get your cash out. I recommend approaching banks or cooperatives early on. This is the 4th step in our process but really should be one of the firsts just because it takes a long time to process.

You approach the financial institution for a loan and present the property (your new apartment complex) as collateral. Also worth noting is that banks and Pag-IBIG only accept titled properties as collateral. Rights and tax declarations are unaccepted collaterals as of this writing.

Financial institutions typically have a 60% to 80% loan-to-value (LTV) ratio. Assuming the appraiser values your property at Php3.36 million (our estimated value) and assuming you are allowed an LTV of 60%, the bank should give you cash of around Php2 million (i.e., 60% of the appraised Php3.36 million).

Repeat

Your net investment in the property is now: Php500,000 (down payment) plus Php300,000 (renovation) less P2 million (cash received from refinancing), or negative Php1.2 million. That’s right, you now have Php1.2 million which you can use to buy another property! You can use this as your down payment for a larger property or as cash for the full payment of a smaller property. Also, keep in mind that the LTV can go as high as 80%. We assumed an LTV of 60%, but a higher LTV also means more cash to spend on another property.

Risks of BRRRR Investing

This strategy is not without risks. These include (1) overestimating the valuation of a property, (2) overestimating the LTV, (3) failure to secure a loan, (4) inability to rent the property out, and many more. To avoid making this post longer than necessary, we’ll tackle these in greater detail at another time. Always ensure you’ve done your due diligence and allow a margin of safety.

Conclusion

BRRRR investing in the Philippines or any other country is a strategy that allows you to accumulate more properties in a shorter time period. But it isn’t without risks. To mitigate these risks, you could (1) increase your initial cash outlay and equity, (2) lengthen the period between renting and refinancing to accumulate more equity and cash, (3) allow a greater margin of safety in your forecasts, and so on. At the end of the day, this is a strategy worth having in your arsenal. Its impact is crucial as most investors stop at renting the property. Be warned though that there’s always a tradeoff and suffering the consequences of these risks could be a step back. If you’ve weighed the risks and see that it’s prudent to act accordingly, this is a strategy that could accelerate financial freedom.

(Related: Is BRRRR Possible in the Philippines (Plus Other FAQ))

I first came across the BRRRR concept on BiggerPockets but learned the details from David Greene’s book:

*This post may contain affiliate links. You can read my affiliate disclosure here, Terms & Conditions, #6 Links.

Read more, select a topic:

Hi Dan, great article. Question, would you know if there’s a maximum number of loans one person can apply say to an institution? When you apply for a loan, one has to declare all their outstanding loans and banks may find it difficult to lend you if you have too many loans already therefor making BRRRR somewhat of a challenge. What do you think?

Hi Michael, thanks for the comment.

You are correct, banks do limit the number of loans (or total amount) you can take. One of the components they check is your Debt-to-Income (DTI) ratio. So applying BRRRR can be a challenge with this constraint.

I’ve found though that different banks have different risk tolerances. In general, smaller banks have more leeway. Consider talking to the less popular banks, cooperatives, and credit unions. Not sure why most Filipinos (at least in my circle) frown upon these institutions, but they’re actually great funding sources.

Speaking of funding sources, try not to limit your options with just financial institutions. Check out this review post on investing with no (or low) money down: https://freedomlocker.ph/books/the-book-on-investing-in-real-estate-with-no-and-low-money-down/

These include hard money lenders and private lenders (family/friends/others). They are great alternatives assuming you have the appropriate risk tolerance. But be careful not to take on too much risk and always understand the implications. After all, banks have a set DTI ratio for a reason.

And finally, keep in mind the “snowball effect” and don’t worry if your initial investments seem slow. Over time, you’ll build enough passive income to again decrease your DTI ratio and allowable loans.

Good luck, Michael! I hope this works for you. Let me know if you need more information, I’m always happy to help. 🙂

Hi michael,

I have an 10 unit apartment in cebu philippines

I want to do the brrrr strategy.

What banks in philippines offer cash out refinance for commercial properties?

I got stuck in the refinancing stage

Please help

Hi Dan,

What banks in philippines do offer cash out refinance ?

I got stuck in refinancing

I want to do the brrrr strategy.

Please help

Thanks

Hi Christian!

See my answer to your comment at: https://freedomlocker.ph/real-estate/is-brrrr-possible-in-the-philippines-faq/#comment-241