I stand by my preference for buy-and-hold strategies — stocks and real estate alike. This site is all about the advantages of the long game, and I’ve written extensively about it. But in a nutshell, my approach to investing just fits my personality and risk tolerance. That’s not at all saying the flipping strategy, particularly the fix-and-flip, isn’t profitable.

In fact, flipping houses are typically more profitable than holding them long-term and collecting rent. But the larger profits from real estate fix-and-flips also mean taking on greater risks. Fortunately, there are ways to mitigate these risks, including understanding your numbers.

One very simplistic way of thinking about the business of house flipping is this: You want to receive more money than you spend. You have to know your numbers. While the concept is simple, its real-world application is typically more challenging. This is where financial models can benefit your business.

An excellent real estate fix-and-flip financial model will show you your capital sources, capital uses, cash flow timing, target purchase price, and model sensitivities.

Page Contents

Flipping real estate defined

Real estate flipping is the buying of properties with the intention to sell in the short term, typically less than a year. Difficult markets can sometimes push timetables, though. Flipping contrasts buy-and-hold strategies where the buyer intends to keep the property indefinitely.

A popular variation of flipping is the fix-and-flip model. It is as it sounds. Specifically, the buyer looks for a property to fix, expecting a discount from the dilapidated property. They then rehab the property to increase its perceived value and sell it. These rehabilitation jobs can be as simple as paintwork to the complex work of fixing foundations.

(Related: How to Increase Home Value for Appraisal: 8 Improvements Before Selling)

Is house flipping profitable?

Flipping houses can be very profitable if you know what you’re doing. Not many opportunities offer double-digit ROIs, but flipping properties can offer just that — sometimes even doubling your initial capital. Unfortunately, many budding flippers underestimate the challenges of this business model.

Common pitfalls to avoid when flipping

Some of the common variables we misjudge with flipping projects include the time it takes to rehab, the difficulties of rehab, costs to renovate the property, cash flow timing, and the time it takes to sell.

House flipping vs. condo flipping vs. others

In general, flipping condo units will be much harder than flipping houses just because there’s less you can do to improve a unit. It’s especially hard to flip a new condo sold by the developer because the condo market is more efficient with fewer opportunities. Of course, that’s not always the case, and there will be great opportunities to fix-and-flip condominiums, too.

With houses, though, it’s easier to add a bedroom, open up the garage, or even add another floor if its structure permits.

Broadly speaking, then, adding value by fixing a property improves your chances of earning a profit. Regardless, you’ll have to know your numbers. The ensuing fix-and-flip model covers all types of flipping projects — houses, condo units, warehouses, and so on.

Financing fix-and-flip projects (Knowing your numbers)

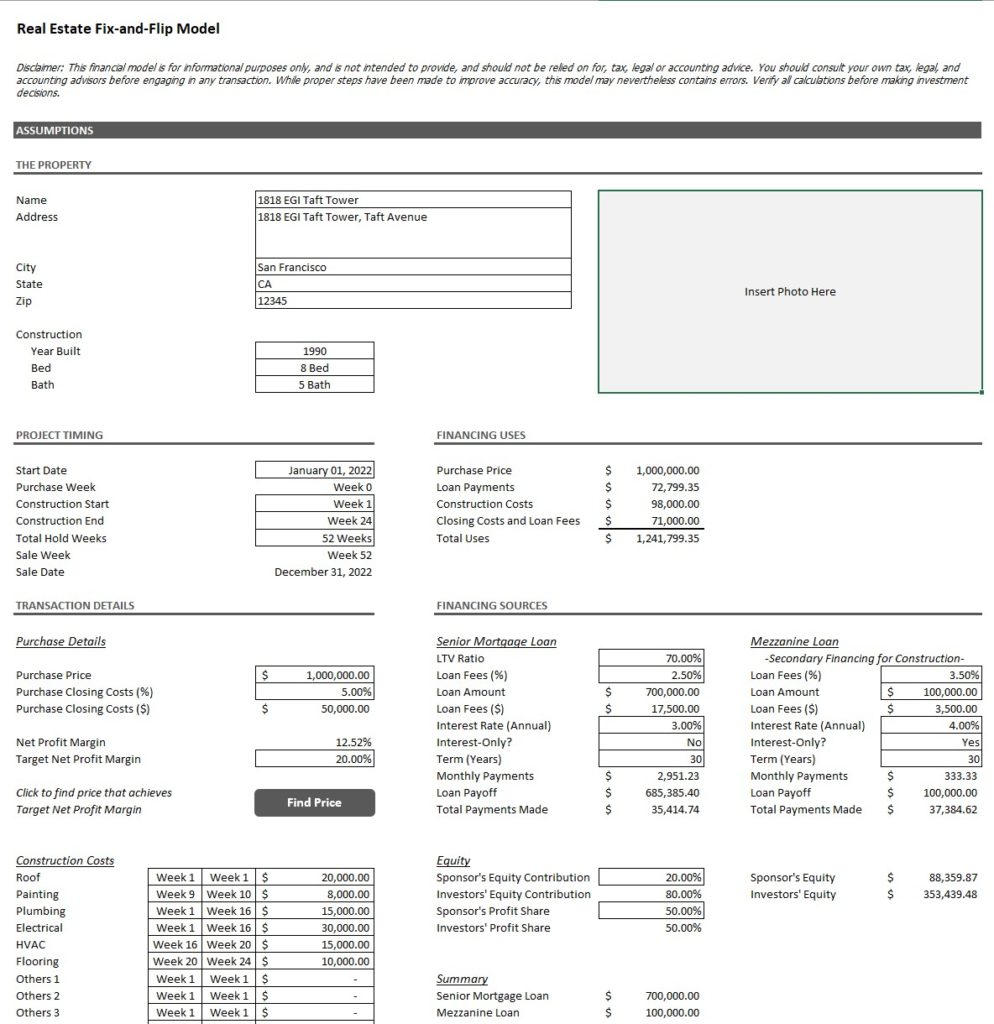

A good way to keep track of your numbers is with a custom-built fix-and-flip financial model. A robust model breaks down your capital sources, capital uses, cash flow timing, expected returns, the purchase price (to achieve a target return), and the sensitivity of your conclusions to changes in assumptions.

That’s a lot to digest, so let’s go through them one by one.

Capital sources vs. capital uses

One crude way of thinking about capital is in calories. (Please forgive my minimal understanding of nutrition.)

When we eat, calories go into our bodies. We then burn these calories doing normal day-to-day activities. We also burn more calories when we exercise. And whether or not we gain or lose weight is a function of caloric surplus or deficit.

Also, not all types of calories are equal. In terms of their effects on health, there’s a noticeable difference between 100 calories of vegetables vs. candies.

We can relate these observations to capital.

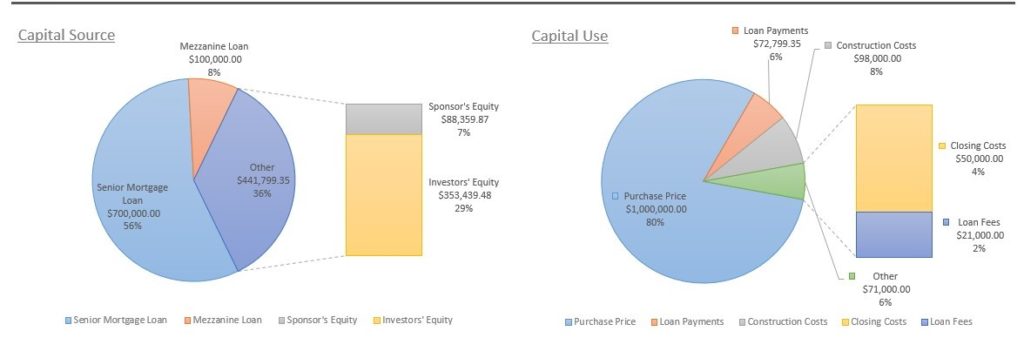

Capital sources include your equity, other investors’ equity, senior loans, and secondary loans. On the other hand, capital uses include the purchase price, loan payments, construction costs, etc. And whether or not we gain or lose money is a function of the capital surplus or deficit.

Similarly, not all types of capital are equal in terms of their effect on the business. For example, subordinated and hard money loans will be more expensive than senior, secured loans.

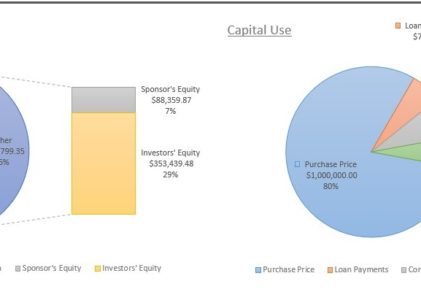

Pie charts of capital sources and uses can look something like this:

Cash flow timing

A good fix-and-flip model also shows your cash flow timing via graphs like a waterfall. Moving from left to right, we can see a significant drop in cash at the start, representing the purchase of the property.

For this example, cash also steadily drops, representing the construction and holding costs before selling. Finally, there is a significant windfall past the 1-year mark, representing the sale of the property.

Waterfall charts like this help set cash flow expectations.

And being able to set cash flow expectations cannot be understated. Even profitable companies can be forced to shut and liquidate with cash flow problems.

Assumptions and expected returns

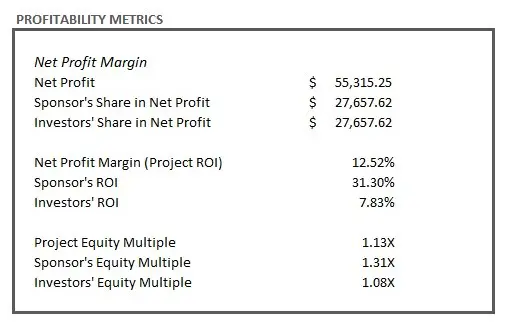

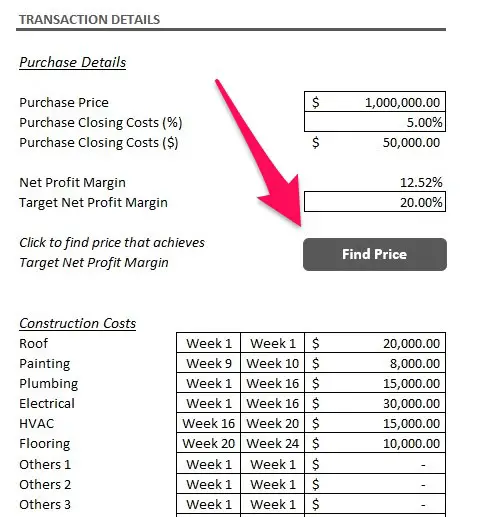

The model should also show your expected returns based on certain assumptions.

As far as I’m concerned, models with single-page assumptions sheets work best.

The “Find Price” button is handy for negotiations.

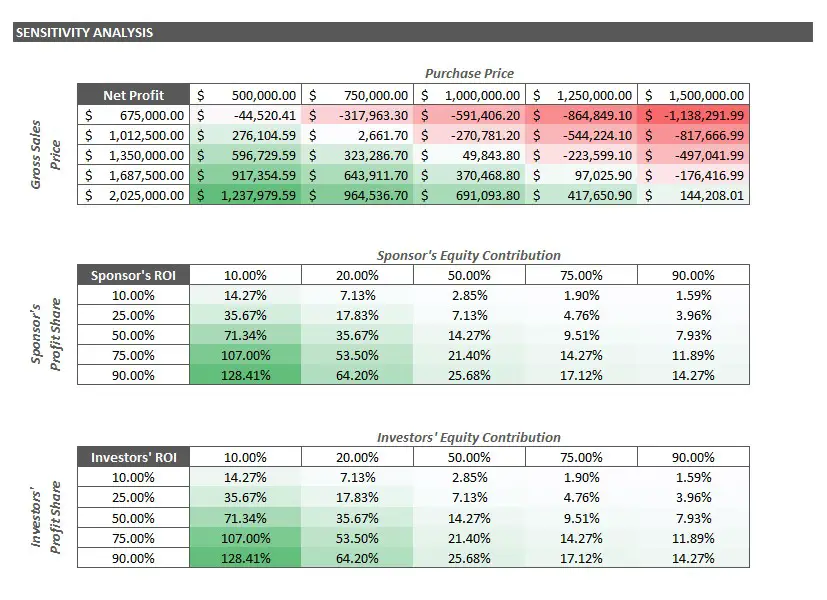

Sensitivity analysis

Everything you’ve done so far relies on assumptions, and it’s critical you see how changing certain assumptions impacts your conclusions.

So my not-so-surprising confession is that this is my fix-and-flip model. You can buy it on Fiverr from $150 to $250: View the Fix-and-Flip Gig

(If you don’t know what Fiverr is, it’s a freelancing platform you can use to boost productivity. You can create a free Fiverr account here.)

Hit me up if you found the gig through this site so I can give you an awesome discount!

What this means to buy-and-hold investors like me

There will always be more opportunities than we can effectively pursue. After much deliberation, I know flipping isn’t the business for me. Nevertheless, buy-and-hold investors should always be open to selling, particularly when your ROE suggests it.

(Related: Should You Sell or Keep an Investment Property: Using ROE as a Signal)

As for aspiring property flippers, you’re certainly a braver bunch. Take heed of the common pitfalls, use a robust flipping model, and have patience. The waiting time can be unnerving, but hopefully, everything pays off when you complete the flip. Good luck!