Let me make one thing clear off the bat. REITs are not perfect replacements for owning rental properties — they weren’t meant to be. As supplemental products or even close substitutes, sure. But, aside from both having exposure to real estate, their goals and ramifications are different. They’re different. So between REITs vs. rental properties, which is better? Well…

Different doesn’t mean advantage and it’s not about being principally better than the other. REITs are safer and convenient while rental properties are the riskier yet more profitable option.

It comes down to a few questions then: Are you willing to bear the risks of rental properties or would you rather have a professional manage them? Do you value diversification over upside potential? Can you afford to use other people’s money in buying properties or would you rather just buy what you have in cash? Are you willing and capable of investing time and money into managing properties? How does owning both REITs and rental properties affect your portfolio?

Let’s begin with the typical reasons for buying REITs.

(A lot of the information here is also covered in the primer post REITs in the Philippines: Are They a Smart Investment)

Page Contents

A tale of two plots

Kevin is a 25-year old IT professional who fears, more than anything, losing a condo rental unit to foreclosure. He remains determined to invest in real estate and figures he can cost-average REITs over the long run by getting a chunk from his salary. The REITs he selects are a mix of residential, office, and industrial sectors.

Marvin is also determined to invest in real estate. But he prefers tangible assets and doesn’t mind the grind. In fact, he feeds off of it. Because of the higher costs to acquire, Marvin knows he must select his properties well. He follows a strategy: screens 100 properties, analyzes 20, makes an offer on 3, and closes 1. He also focuses on one real estate niche — apartments — and understands how valuation can impact the deal.

(Related: How to Value an Apartment Building: Expert Tips by a Pro for Beginners)

Consider these two extremely simplified scenarios and their impact on both Kevin and Marvin.

| Scenario | Marvin | Kevin |

|---|---|---|

| Apartment boom | Wins big | Wins slightly |

| Apartment bust | Loses big | Loses slightly |

I understand this example is far from perfect and we’ll get into the specifics in a bit. My point here is to highlight that this is a classic example of the risk-return tradeoff. There isn’t a right nor wrong answer and it comes down to your preference as an investor.

(Related: The Risk and Return Trade-off Applied in Real Life (Uncommon Examples))

Advantages of REITs over rental properties

REITs are an inclusive way of gaining from rental properties. I love rental properties but that doesn’t preclude me from buying REITs in the Philippines and elsewhere. They’re easy to buy and diversify my portfolio. Here are some reasons why REITs are nice.

Liquidity

Rental properties are notoriously illiquid. You’re forced to sell at depressed prices when things go south. Now, that doesn’t sound too bad… until you actually feel it first-hand. (It’s the worst!)

With REITs being listed companies, liquidating your position isn’t a problem. (Philippine laws currently mandate all REITs to be publicly listed companies. Private REITs exist outside the Country.)

This is a huge advantage of REITs that you shouldn’t understate.

Ease of entry

Unlike tangible rental properties that require huge upfront costs, REITs are a lot easier to get into. It really is just trading stocks in the stock market. So know the minimum opening balance of your preferred broker and you’re set.

(But the ease of entry can be a disadvantage as you’ll see.)

Diversification

Buying REIT stocks mean you’re getting a portion of the entire company’s equity. This means you share in everything that it owns. In other words, your one stock inherently means exposure to multiple real estate properties. That is a diversification benefit that isn’t present when buying a rental property.

Why do you need diversification? Because it reduces your overall risks.

(Related: Reduce Risk in the Stock Market: Diversification Primer)

Professionally managed

REITs are managed by full-time professionals held to high standards. To me, this is the decisive factor for investors who are incapable or unwilling to dedicate time and effort to rental properties.

Rental properties are riskier ventures and it doesn’t help to be uneducated nor lazy.

If you don’t need the added liquidity of REITs; have large cash positions to spare for rental properties; and are well-diversified (in other words, you don’t need the other benefits of REITs), then should you opt for rental properties over REITs? Not if you’re unwilling to commit the time and effort to buy and maintain rental properties.

Just because you have the money and time doesn’t mean you should go for rental properties. Willingness is a key element.

Managing the REITs you buy

But REITs don’t abdicate you from responsibilities. You’ll still have to select REITs that fit your investment portfolio.

Factors include the fund from operations (FFO) and the weighted-average lease expiry of the company (WALE). You may refer to REITs in the Philippines: Are They a Smart Investment for more information.

Advantages of rental properties over REITs

The profitability upside for rental properties is higher and that’s just a compromise for the added risks.

I’ve seen a few analysts point to how REITs are more profitable vs rental properties though. They even back this up with statistics. But is this a case of biased or incomplete data? Can numbers lie?

Profitability

Let’s start with the biggest reason (in my opinion) for buying rental properties over REITs — the upside potential. The other reasons only support this (again, my opinion). For example, having complete control over things like rent is an advantage of rental properties, but it still tethers to profitability.

Small-scale real estate investors can take advantage of small and off-market offerings, which oftentimes give the highest returns. These opportunities simply aren’t afforded to large-scale REITs.

Typical yield and returns

Most REITs yield around 5% more or less. With capital appreciation, that’s typically around 10% of total returns. (There are various studies comparing REITs vs. stock market indices because they yield similar returns.)

But for rental properties, it’s not uncommon to earn substantially more. For example, the cash-on-cash return of a 100% leveraged property is infinite (i.e., returns divided by zero). Granted the risks are way higher, again highlighting the risk-return tradeoff.

Even if we, say, use a typical rule-of-thumb such as the 1% Rule, rental properties are able to take advantage of forced appreciation. Let’s assume you buy both REITs and rental properties at the same rent-to-purchase price ratio (i.e., both have a monthly cash flow of 1% of purchase price). If we assume our cash flows remain a fixed percentage of market value, then we’re essentially at the mercy of market movements for REITs.

On the other hand, improvements to rental properties, such as fresh paint or adding a bedroom, drastically improve its market value.

We’re forcing appreciation when the cost to improve is less than the resulting increase in market value.

(I’m certainly not talking about buying condo units from large developers or other easy ways of buying rental properties. See Is a Condo a Good Investment? Rarely… Here’s Why.)

Factors that support improved profitability

There are many things going for rental properties’ greater upside potential. They include:

- Greater tax deductions: The costs to run your business are deductible. This means more tax savings.

- Leverage: Using other people’s money (banks, private lenders, etc.) allows for exponential growth. But it is worth noting how brokerages also allow leverage. Ironically, debt in real estate is safer than margin trading stocks.

The REITs-earn-more argument

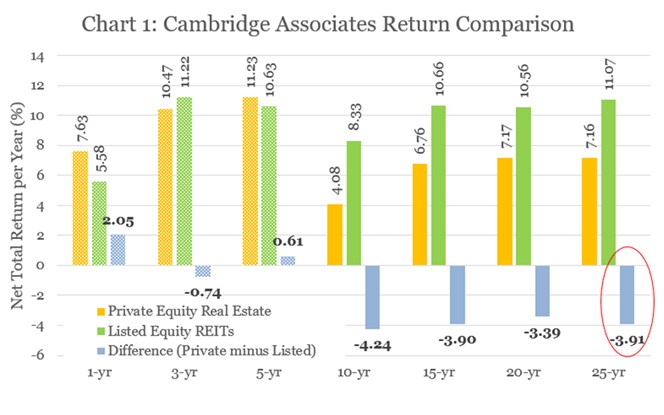

A few analysts argue otherwise and point to the data found by Cambridge Associates.

I’ve found this to be contrary to my experiences. The following points might (or not) explain why the numbers don’t anecdotally match. Each point may or may not support the case for rental properties.

- The data from REITs are from surviving REITs. It can never fairly measure returns because the worst-performing REITs are excluded. (But yes, it also excludes the worst-performing private equity real estate. Which means we’ll never know.)

- The numbers on private equity real estate undoubtedly exclude a significant portion of the total population of investors. It typically excludes small-scale (highly risky yet profitable) opportunities.

- Assuming the private equity real estate numbers do consider a material portion of investors, it also means the subpar investors are included.

- We don’t know the risk-adjusted returns. (But again, if we assume rental properties are indeed riskier, then this argument supports REITs over rental properties.)

Frankly, I don’t know. But I do know how it’s possible to misinterpret numbers and that it’s erroneous to have absolute conclusions based on incomplete data. (See Darrell Huff’s piece on How to Lie with Statistics.)

I may be wrong but because the numbers are inconclusive, I’ll stick to what’s rationale (in terms of risks and returns) and what I’ve found to be true — above 10% returns for properties I’ve invested in; forced appreciation; bargain buys are easier to spot due to inefficiencies in smaller markets.

(I also have no incentive to promote one product over another.)

Complete control

Real estate investors, at least the successful ones, pursue specific niches and criteria. This means only pursuing properties that match your requirements: location, sector, condition, price range, and metrics.

Read more about niches and criteria at Why You Need to Find Your Real Estate Niche for Massive Growth.

It also means flexibility in rent and improvements. There are no bureaucratic rules to bend and quick price tactics are easier. And as previously mentioned, complete control means having the ability to take advantage of forced appreciation and generate higher returns.

Cash flow frequency

This advantage specifically applies to the Philippine market where REITs don’t pay monthly dividends. (At least not at the time of this post.) Rental properties almost always produce monthly cash flow.

Greater inflation hedge

REITs are a good inflation hedge. But they’re not better than physical rental real estate. Rental properties and REITs earn through rent, which typically flows with inflation. Also, the finite supply of real estate, similar to gold, is a hedge against inflation — more money in circulation for the same supply of real estate.

High barriers to entry

As mentioned previously, ease of entry is an advantage that goes to REITs. What’s funny is the high barriers to entry for rental properties are actually an advantage for those willing and capable.

The high costs and challenges of buying and maintaining rental properties weed out competitors, and that means more profit for those who persist.

This ultimately goes back to profitability. In fact, I’d like to add another rule-of-thumb that seems to be incredibly applicable to real estate and beyond. And that is:

The more difficult it is (and more barriers to entry), the greater the potential returns.

Conclusion: Choosing between REITs vs. rental properties

There are two interrelated principles to bear in mind when deciding between REITs vs. rental properties.

Number 1 is the risk-return tradeoff. Rental properties are the riskier but potentially more lucrative option. REITs are safer and more convenient — and they provide improved diversification. Both options increase your exposure to real estate. It’s also about how more challenging opportunities usually yield higher returns. Rental properties can be as easy as buying from large developers, but there’s no real opportunity there.

Number 2 is the willingness and capacity to invest in rental properties. Money, time, and knowledge aren’t enough. If you’re unwilling to grind it out with problematic tenants, contractors, and the other issues inherent to real estate, then REITs are it.

I guess it’s no different from choosing other investments then. Picking an option is about introspection and knowing what works for you.