In the accumulation phase of the steps to financial freedom, one inevitable question is this: Should you sell or keep an investment property? When is it better to keep holding on to a rental property versus selling it, or versus other ways of getting equity out? Keeping a property is typically the safer route, but selling or refinancing an unproductive property can fast-track building wealth with real estate.

ROE, or return-on-equity, is a metric you can use to determine whether to sell an investment property or keep it. Since most properties are financed, equity typically increases over time through loan payments. The increase in equity may lead to lower ROEs, and a property with a low ROE suggests you’re better off using the trapped equity elsewhere.

Now, there are certainly other reasons for selling/keeping an investment property — quantitative and qualitative reasons. You might be nearing retirement and prefer the lower-but-more-convenient returns of REITs; you might doubt the potential growth of the property’s location; you’d rather deal with other property-specific problems. The list goes on. This article though is strictly about the ROE metric and how it can be used as a signal.

What is ROE? How can you use it as a signal to sell or refinance? How is it different from ROI, and which one do you use? Is there a good ROE to aim for?

Page Contents

What is ROE?

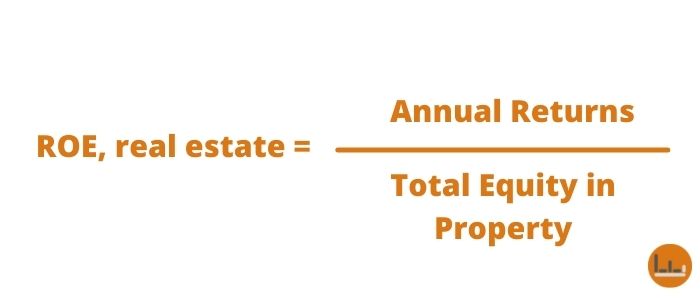

ROE, or return-on-equity, is a profitability metric that tests whether or not your equity works hard. It is typically your annual returns as a percentage of total equity.

In real estate, annual returns are the total of your net cash flow, property appreciation, principal payments on your debt, and tax savings. Return on equity is then computed as your annual returns divided by your total equity in the property.

ROE over time

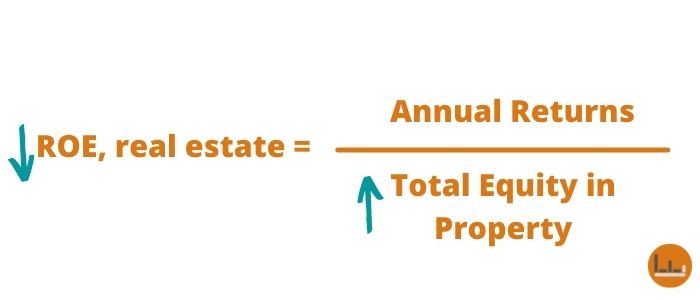

ROE usually (but not always) drops over time due to changes in the variables at play. The direction your ROE takes, up or down, ultimately depends on which variables have the larger net impact.

Historically, rental rates and property prices have appreciated, causing ROE to go up. But paying down your loan on a property increases equity and reduces ROE (because equity is in the denominator).

(Monthly payments are typically divided into two parts — principal payments and interest payments. Principal payments increase your equity.)

The resulting change in ROE is decided by a combination of these changes. In this illustration, ROE goes down when equity increases while annual returns remain the same.

ROE vs. ROI

ROI, or the return-on-investment, is similar to ROE as a profitability metric. It, too, uses your annual returns on the property as a percentage of funding — funding is your total investment, in the case of ROI.

The ROI metric is favored by many investors for its simplicity. It is used in assessing whether or not a prospective investment property is worth buying.

Difference between ROE and ROI

Although both are profitability metrics that use your property’s annual returns, ROE measures success relative to your current equity while ROI uses your initial investment. For new properties, this can, in fact, be the same thing. But for most, they are different metrics. You will want to know both.

Assuming you bought a property at market value, using a standard loan, then equity and investment might be the same thing. But for properties bought at a discount (which is what good investors strive for), equity starts higher.

| Bought at Market Value | Bought at a 20% Discount | |

|---|---|---|

| Market value | 100 | 100 |

| Purchase price | 100 | 80 |

| Loan (80% of the price) | 80 | 64 |

| Equity, based on market value | 20 | 36 |

Notice how, for the same property, an investor’s equity starts higher by buying at a discount.

What is a good ROE

As with all financial ratios and multiples, the proper approach is to compare a property’s ROE over time and across comparable properties. There is no way to say if an ROE is good without the right comparisons.

That said, investors are free to specify a minimum target ROE that they think suits their circumstances. And this is only possible when we track ROE through time.

Sample computation: ROE and ROI

Let’s continue with the previous example — an investment property bought at a 20% discount. We’ll also assume a loan amortization of 11.92 (interest rate of 8%) and an appreciation rate (for both price and rental rates) of 3%.

Table 1 is the Loan Amortization Schedule for our hypothetical property. In the early years, a bulk of your monthly payments go to paying interest. But over the life of the loan, more is allocated to paying your principal. (See column 5.)

Each principal payment adds to your equity.

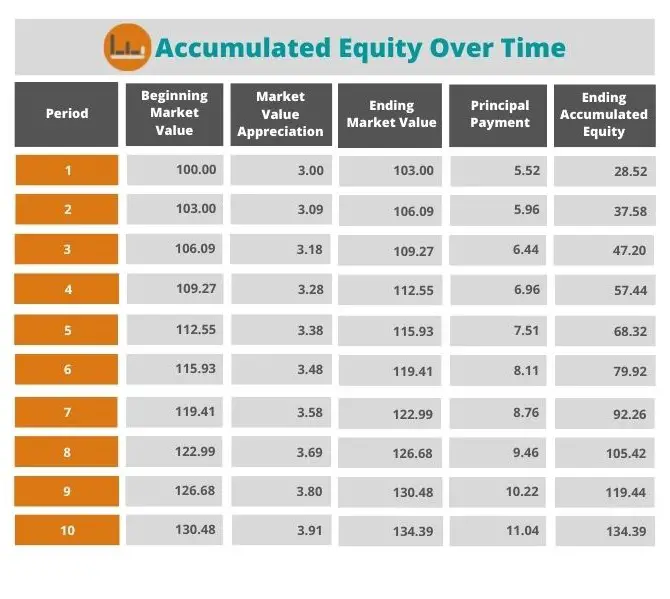

Table 2 shows our accumulated equity over the same time period. We see that, when the loan is fully paid in period 10, our equity equals the market value of the property.

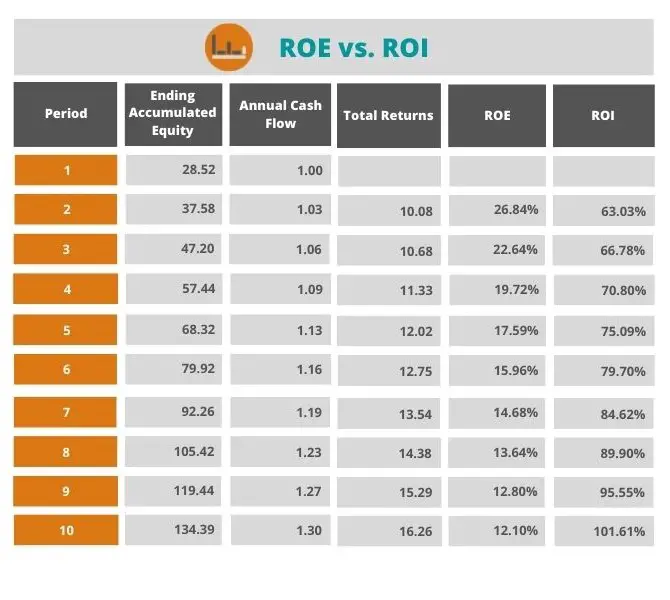

Table 3 is a comparison of ROE and ROI. ROE drops over time largely because equity increases. (The increase in equity offsets the increase in returns.) We also see how ROI increases over time because the initial investment doesn’t change.

In this example, ROE drops below 15% in period 6. (For simplicity, I used the ending equity value. But other acceptable methods include using the beginning equity as well as the average equity.)

Whether or not this is a good number will depend on a lot of variables. For example, investing in alternatives that generate more returns can be a strong case to sell or refinance the property. Even investing in alternatives that yield the same returns for less work can be a sensible decision.

(In fact, always know the Options to Consider Before Selling Your Property.)

Consider your opportunity cost

An investment property that yields 15%, looks good. And it arguably is. A reason that it may not be a good position to be in is when you have the opportunity to invest in another property that yields 20%. Keeping your money in the same property means you’re losing out on 5% returns.

A profitable venture isn’t always the best venture. And in business models that take full advantage of the snowball effect, these seemingly marginal differences matter a lot.

Conclusion: To Sell or Keep an Investment Property

The biggest takeaway is to track your return on equity. The status quo is always the easy route. But then you’ll never know if your money still works hard. ROE can be a signal to pull out lazy equity and put them to good use.

(Related: Step 3 of my Roadmap to Financial Freedom, Park Your Money Where It Works Hard)

Having said all of this, ROE is just one of the many factors. There will be other reasons, financial and non-financial, to sell or keep an investment property. I wouldn’t overthink the ROE factor. After all, ROE is still based on an assumption about the property’s value. But it’s still a metric I consistently keep track of. It’s my pledge to pursuing the best possible opportunities available to me and my family.