Am I naive? Today I found out about fake gurus promising financial freedom. As an advocate of true financial freedom with specific actionable steps, the scams gutted me. They start with a rosy vision and then a promise that it’ll take hard work. And here I am writing about the same things.

I haven’t been active on social media for years and found out about them through separate topic researches for this blog. It’s affected me so much that I’ve postponed some posts to make way for this.

Some old-school scams still exist. But a lot of them have evolved and are no longer the pyramid schemes of old.

Let’s go through the fake gurus’ evolution and some tips on how to spot empty financial freedom promises.

Page Contents

Oldest tricks in the book

It starts with a promise

Fake gurus and financial advisors start with a promise or a vision of what could be. The specifics don’t matter, as long as it resonates with their audience.

Travel anywhere; quit your job; buy anything you like; spend time with your family — writing this makes me cringe because they’re exactly what I advocate!

Packaged in a believable story

Then they go into their story. It’s usually a sob story we can relate to.

Maybe they were picked on as kids, or they came from a broken or poor family. Again, as long as it resonates with their audience.

By sharing their stories, it makes us feel like what they’ve achieved is possible. Some are legitimately rich. Others rent expensive stuff to appear rich. What’s consistent is how they package their stories to make them appear accessible to everyone.

Why scams catch on

Both of these are marketing methods that try to touch on our humanity. Jonah Berger highlights this best in his book, “Contagious: Why Things Catch On.” (Made to Stick by Chip and Dan Heath cover the same things.)

(Both books are highly recommended.)

Information is retained in our minds and spreads to the community if they have social currency; have triggers; are emotional; can be seen by the public; are practically valuable; packaged in a story.

Social currency -- People share things that make them look good. Being linked to financial freedom is a strong hook. Triggers -- How frequently do we see triggers or stimuli of the promise? We're reminded of our debt every month. We're reminded of our prison when our bosses annoy us. Emotion -- When people are physiologically aroused, they act. Positive (awe; excitement) or negative (anger) emotions make us act. Public -- Can other people see it? When you have the latest gadgets/clothes/accessories, do you secretly hope people notice? Value -- Is it helpful? Does it make life easier? Stories -- Information travels faster under the guide of idle chatter. It's usually easier to remember stories than random facts.

Fake gurus cover all of these and make their messages easy to share. They’ve also focused their strategies to fit the information age.

Fake gurus with new methods

But the fake gurus and biased advisors of financial freedom know we’ve caught on. So they’ve evolved their strategies.

Instead of get-rich-quick schemes, they paint a picture of realism by highlighting the get-rich-slow strategy. Rather than saying it’s easy, they emphasize what it takes (hard work) to succeed. You’ll have no one else to blame for your failure but yourself. Not them and especially not their course.

| Old Scams | New Scams |

|---|---|

| Get-rich-quick | Get-rich-slow |

| Easy work | Hard work |

| Very secretive | Shares teasers or shallow information |

| Pay to get in | Free giveaways |

Here I am again, cringing because these are also done by legitimate advisors/coaches/gurus. Let’s just say then the new scam techniques are red flags (warning signs) rather than sufficient evidence.

The line between real and fake financial gurus continues to blur.

How to spot fake gurus (and biased advisors) of financial freedom

Fair or not, I’ve included advisors with ulterior motives.

If someone’s getting paid based on specific advice, rather than independent of it, then their advice is probably going to be biased and isn’t the best action for you. They’re likely to promote a product they’re getting paid for, even if it’s not the optimal choice for you.

The simple fact is they have an incentive to promote a product, regardless of its impact on you. Their goals can occasionally align with yours, but having an independent advisor is still best all things the same.

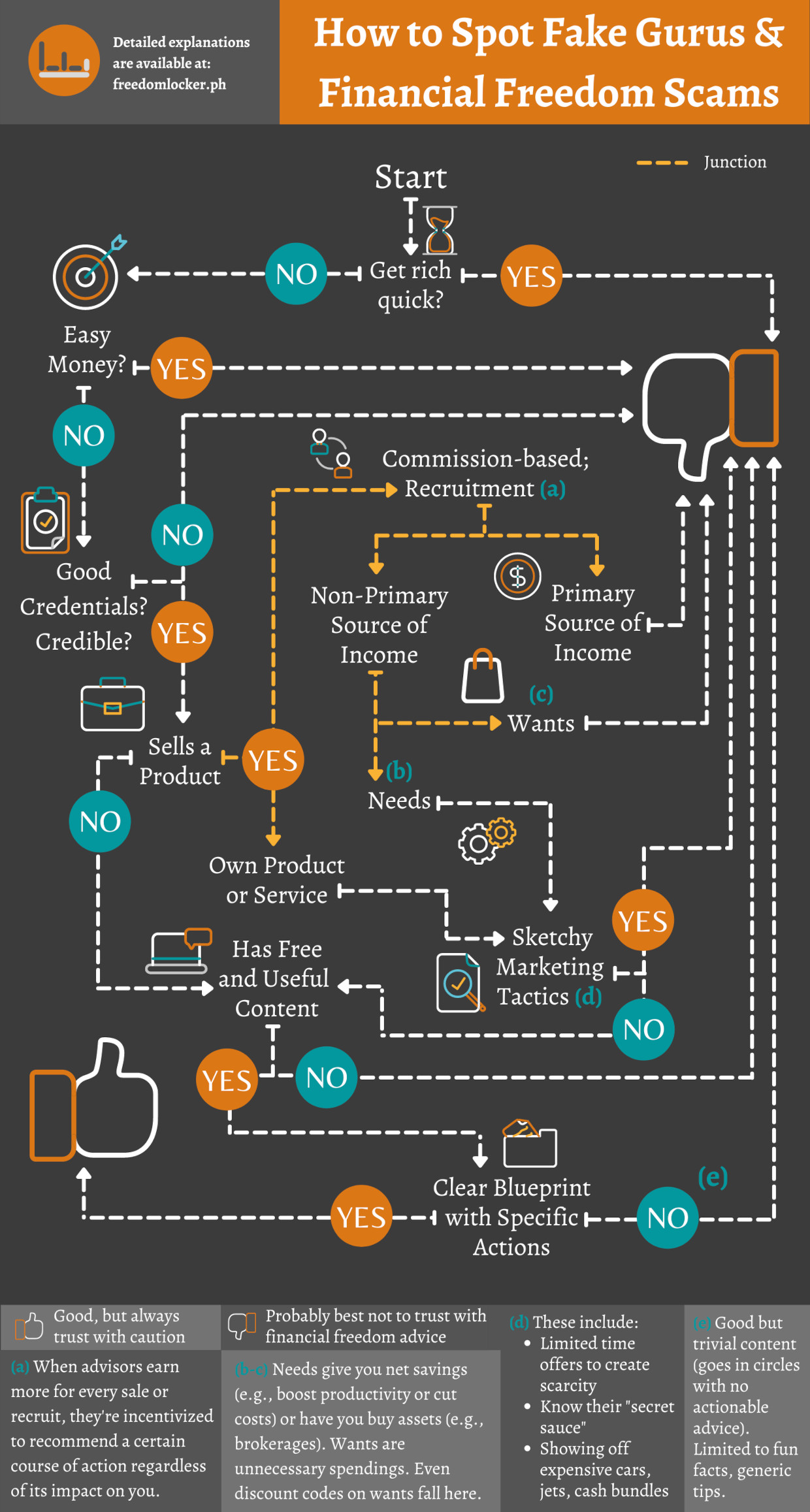

Flowchart: Choose your advisors wisely

You may use this flowchart to help you decide if you should trust your advisor/mentor/coach with unbiased recommendations on how to achieve financial freedom.

Each situation will be different. The guide will help you shortlist your candidates, and isn’t meant to be the definitive factor in selecting the best advisor for you.

(Specifically, the best guru/advisor/mentor/coach for you to achieve financial freedom.)

If, for some reason, this flowchart doesn’t show, please DM me on Instagram. I’ll have it saved on my phone.

Some notes on the flowchart

Good credentials: What have they done? How's their technical knowledge? Have they had success? Sketchy marketing tactics: These are certainly just warning signs and not deal breakers. Examples include: • Limited time offers to create artificial scarcity, pressuring you to buy the product/service. If it's genuinely helpful, they don't need to hide behind a countdown timer. • Flashy possessions and activities such as showing off expensive cars/gadgets/accessories/cash bundles. They also overhype working and earning remotely (e.g., trading stocks while hiking). • They have a secret sauce/formula/strategy that's unique and brings them a lot of money. Commission-based investments or networks that require aggressive recruitment: When this is the advisor's primary source of income, it compels them to sell/recruit more regardless of the buyer's goals. Free and useful content online: Content marketing has blown up and there's no reason not to have free content. It's also important for the content to be meaningful. Is it purely motivational talk or does it actually have actionable advice?

My conclusion and about freedom locker PH

Maybe I am naive. I’ve been hoping to share my roadmap to true financial freedom through this blog. That’s financial freedom in its truest and best sense. The type of freedom where we have the choice to do whatever, whenever, wherever, with whomever.

Except I stand by my view. We are in an industry marred by fake gurus, but that shouldn’t be an excuse to stop. If anything, it’s a call to make our voices heard.

The flowchart is ultimately about what benefits YOU, not your advisor or coach, mentor, or guru.

Most decent and legitimate advisors will have free content online. Read their blogs, watch their videos on YouTube, listen to their podcasts. They won’t be pushing for sketchy marketing tactics. And they will not be pushing for products just because it benefits them.

For full transparency

I live a comfortable life, but not true financial freedom as I’ve been describing it. I’m convinced I’ll get there, and I’ve been transparent about it with my roadmap. These are actionable steps you can replicate, and you don’t have to buy anything from me to apply them.

It’s a simple roadmap, but one that took me a decade of discernment. Anyone can benefit from it today.

So what are my goals with the blog? They are to earn from web traffic and digital products (monetary goal) and the fulfillment of knowing I helped a few (non-monetary goal) through a medium I enjoy (writing).

Please share this post with your friends and family if you think it helps. Let’s protect our loved ones from wasting money on fake gurus and empty promises.

*This post may contain affiliate links. You can read my affiliate disclosure here, Terms & Conditions, #6 Links.

Read more, select a topic: