You do not need an expert. That’s right, you don’t need a professional to calculate the value of your apartment building. This isn’t being hypocritical of valuation experts. With years of experience in business valuation at one of the largest accounting networks in the world, and by doing well in the real estate appraiser’s board exam, I (hesitantly) consider myself a “valuation expert.” I hope I can help you. These are my tips on how to value an apartment building, in a way that’s easy for most to follow.

(A professional will certainly imbue confidence in your estimate. But also know that valuation is both an art and a science. As an art form, you’d be hard-pressed to find 2 valuation experts with the exact same value for any given property.)

Page Contents

- First, understand the 3 valuation approaches

- Next, know why you want to value an apartment building

- How to Value an apartment building

- Final Tip

First, understand the 3 valuation approaches

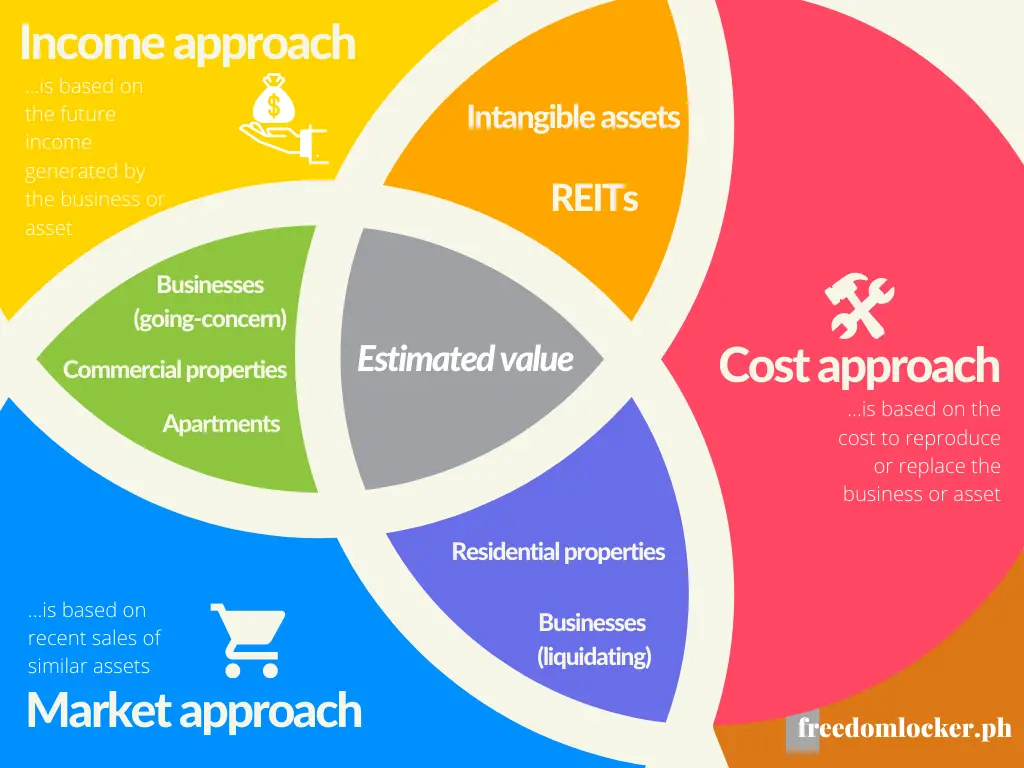

There are 3 broad approaches in estimating the value of anything. Others list more, but those are really just variants of these 3.

And there’s no way around it either. You have to understand these 3 (or at least their differences) because choosing the “correct” approach will require it.

(I emphasized “correct” because there’s really only the “more appropriate” approach.)

The 3 approaches, or methods, in valuing an apartment business, apartment complex, boarding house, or really any other real estate property, are the following.

(Related: 9 Hidden Ways a Good Property Can be a Bad Investment)

Method 1: Cost approach

Rationale: The price to buy or sell an apartment building should be the cost to make it… because you have the choice to make another one.

The value of an apartment building is equal to the cost of constructing another apartment building.

This method can be further broken down into the reproduction cost and the replacement cost. The reproduction cost is the construction cost to reproduce the building with the same materials. While the replacement cost is the construction cost to make another apartment with the same utility, but not necessarily the same materials.

All this is saying that to calculate the value of an apartment, we need the construction cost to reproduce or replace the apartment.

Method 2: Market approach

Rationale: The price to buy or sell an apartment building should be the price of what similar apartments have sold in the past… because you have the choice to choose another one.

The value of an apartment building is equal to the price of what a similar apartment has sold for, adjusted accordingly.

The adjustments can go up or down.

If we’re comparing our apartment complex against one that’s better (in terms of location, amenities, age, etc.), then we can anticipate our selling price to be lower — because it’s worse. And if we’re comparing our apartment complex with worse ones, then we might anticipate our selling price to be higher — because we’re selling a more attractive property than our price comparisons.

Method 3: Income approach

Rationale: The price to buy or sell an apartment building should be the value it adds to you in the form of income it generates… because you have the choice to buy another asset that generates as much.

The value of an apartment building is equal to the future income it’s capable of producing. All of the future income is converted into today’s terms in a process called discounting.

(Related: Discounting is explained more in the basic guide to the 3 valuation methods.)

In real estate, a popular short-form of the full income approach is by using a single year’s net operating income (NOI) divided by a cap rate. We can get our cap rate by computing the implied cap rates of our comparable properties (i.e., annual NOI of comparable divided by selling price of comparable).

Next, know why you want to value an apartment building

There are many reasons why you would want to calculate the value of an apartment building.

You could be trying to sell or buy an apartment complex. What’s your end-goal then? Is it to continue operating the apartment, or convert it to something else? Or you could be trying to add value, and calculating its current value serves to guide your plans for forced appreciation.

Knowing your reasons actually plays a role in the valuation and there are two general directions a transaction ends with: (1) Cease operations of the business or (2) Start/continue operating.

We can determine the correct approach based on what the buyer intends to do with the apartment.

(Note: Price and value are two different concepts. The value to a buyer and a seller are often 2 different things, whereas the transaction price is what the asset has sold for. A transaction’s final price represents the value an independent party might assign to the apartment.)

Cease operations (liquidation)

If the apartment building is in liquidation state, the estimated value shall be based on the cost approach.

(Technically speaking, a valuation estimate is usually a range of values rather than an absolute amount.)

An apartment business that ceases operations is no longer a business and should be valued accordingly. When a transaction to buy an apartment is with the intent of ceasing operations, either by demolition or by converting it to a non-income producing structure, then future income becomes less relevant — but is still an opportunity cost to the new owner.

The market approach may also work. Be careful though not to use sales of comparable properties that continue to operate.

Start/continue operating (going-concern)

On the flip side, the transaction could conclude with an operational apartment business. That is, the buyer intends to make a business out of the apartment building.

The estimated value of the apartment building shall be based on the income approach and market approach.

The income approach is the preferred method because it considers the future capacity of the building. But because there are a lot of unknown variables, it is best to compare your results with the market approach to test its reasonability.

How to Value an apartment building

For our example, we’ll take the case of how to value a 20-unit apartment building for sale. We’ll also assume there have been 3 comparable sales in the past year.

Step 1: Ask yourself what the buyer intends to do with the building

This step helps us determine which approach is more appropriate.

If the buyer intends to demolish and liquidate the property, then the cost approach is arguably the better approach.

(If the demolition is part of a long process to construct another income-generating property, then it might be best to also consider the income potential of the new property in the buyer’s analysis.)

This is also the preferred approach of bank appraisers in valuing residential properties.

But if the buyer intends to start or continue operating the apartment as a business, then the market and income approaches are then arguably better.

The cost approach does not take into account the future state of the apartment building. This means the potential growth isn’t captured, which generally leads to a lower value under growing economies.

Step 2.A: Gather the relevant data for the cost approach

If using the cost approach, you will need an estimate on the value of the land, as well as estimates on construction costs. The common methods include the cost per:

- Sqm (or sq. ft.)

- Bedroom

- Component (e.g., roof, foundation, plumbing, etc.)

Getting in touch with a contractor helps. Keep in mind though that contractors send you quotes with their profit margins, so the actual costs to you are most likely lower.

Step 2.B: Gather the relevant data for the market approach

The market approach will need information on the selling price of comparable properties, as well as the attributes of those sold properties. Real estate brokers or agents might be able to help you with these.

Here are a few guidelines to help you collate your comparable properties:

- Look for recent sales within the neighborhood

- The closer the proximity, the better

- The more recent transactions are preferred

Apartment-specific attributes include the following:

- Number of units

- Floor area per unit

- Amenities

(This isn’t an exhaustive list by any means.)

In the absence of recent sales, you may use older transactions but make sure to adjust for inflation and other economic changes that may have happened since.

You will need the following data:

- Closing price

- The lot and floor areas

- Number of bedrooms

- Other variables you think are relevant to your specific case (e.g., number of bathrooms, garage, intangible factors)

Step 2.C: Gather the relevant data for the income approach

As with the market approach, data on comparable properties will help. You’ll use the data to verify if your assumptions on the following are reasonable:

- Rent per unit/rent per sqm

- Vacancy rate

- Budget for repairs and maintenance

- Property management fees

Really anything that’s deducted from rent to arrive at your net operating income (NOI), which is the income you make before loan amortization and taxes are deducted.

You will also use your comparable companies to get a discount rate. This is, unfortunately, a complex topic that deserves an article of its own. For our purposes, we’ll use our comparable properties’ cap rate (i.e., annual NOI divided by selling price) and focus on 1 year’s worth of NOI.

(The discount rate is the weighted-average cost of capital between debt and equity. Again, knowing how this is derived is excessive for our purposes. Practitioners end up with 8% to 12% most of the time anyway.)

Step 3: Use the appropriate method

3.A: How to calculate the value of an apartment building using the COST APPROACH

Using the information gathered, we can estimate the cost per sqm. or cost per sq. ft, cost per bedroom, or cost per component.

Cost per sqm. or sq. ft.

- Get the total floor area

- Multiply the floor area by the cost per sqm. or sq. ft.

- The product is the estimated value of the apartment building based on the cost approach

Cost per bedroom

- Get the expected number of bedrooms

- Multiply the contractors’ quotes (average) by the number of bedrooms

- The product is the estimated value of the apartment building based on the cost approach

The cost per component method follows the same steps but is a more in-depth (and arguably more accurate) breakdown of our total costs.

There are also many variants to this approach. For example, if you deem the quality of amenities as the biggest contributor to value, you may also use that metric.

(You may also combine several factors, such as bedrooms, bathrooms, garage, view. But this variant will require regression analysis.)

3.B: How to calculate the value of an apartment building using the MARKET APPROACH

With data on recent sales (of properties similar to ours), we can estimate the value of our apartment by focusing on the unique characteristics of each sale. Creating a grid might help.

| Comparable Property | #1 | #2 | #3 |

| Price | 10 million | 15 million | 14 million |

| Sold how many months ago | 0 | 0 | 3 |

| Bedrooms | 10 | 15 | 15 |

Based on the information, we can see the number of bedrooms increases property value by approximately 1 million per bedroom. (See properties 1 and 2 where the additional 10 million in price is explained by the difference in the number of bedrooms.)

Property 1

Price per bedroom = 10 million / 10 bedrooms = 1 million per unit

Property 2

Price per bedroom = 15 million / 15 bedrooms = 1 million per unitWe can also see that recent sales have gone generally gone up (i.e., more recent sales have resulted in higher selling prices per bedroom).

Properties 1 and 2

Price per bedroom = 1 million per unit

Property 3 (sold 3 months ago)

Price per bedroom = 14 million / 15 unit = 933k per unitIf our property has 20 units, then a reasonable value might be somewhere around 20 million (1 million per unit x 20 units).

Apartment Building *Our property has 20 units*

Estimated value of our apartment building = 1 million per unit x 20 units

Estimated value of our apartment building = 20 million3.C: How to calculate the value of an apartment building using the INCOME APPROACH

A full-blown income approach involves plotting our NOI year-on-year, for around 5 to 10 years, and estimating a terminal value (or our value beyond 5 to 10 years). This process is tedious and unnecessarily time-consuming considering the nature of apartment businesses. Compared to other businesses, NOI doesn’t fluctuate as much.

A shorter route is to estimate the annual NOI and use the capitalization rate (or cap rate) that’s derived from the sale of comparable properties. (If you’re familiar with stock valuations, this is similar to the dividend discount model.) Let’s assume our annual NOI is 2 million. For a cap rate range of 8% to 12%, our values are:

Low case: 2 million / 12% = 16.7 million

High case: 2 million / 8% = 25 millionIf a comparable apartment complex sold for 10 million, and its annual NOI was 1 million, then the implied cap rate is 1 million / 10 million, or 10%. Assuming our apartment building has an annual NOI of 2 million, then the value of our apartment building is 2 million / 10%, or 20 million.

| Comparable Property | #1 |

| Price | 10 million |

| Annual NOI | 1 million |

COMPARABLE PROPERTY

NOIComparable = 1 million

Selling PriceComparable = 10 million

Cap RateComparable = 1 million / 10 million

Cap RateComparable = 10%

APARTMENT BUILDING

NOIApartment = 2 million

Estimated ValueApartment = NOIApartment / Cap RateComparable

Estimated ValueApartment = 2 million / 10%

Estimated ValueApartment = 20 millionFinal Tip

As we consider our resulting apartment building values, let’s not forget to view the valuation from our perspective. What I mean is this. If you’re the buyer, a lower price benefits you. So assuming you’re looking to buy an apartment business, you could then negotiate using the cost approach as it generally yields a lower value in a growing economy.

The reverse is true for the sell-side. If a buyer tells you he intends to demolish the apartment, you shouldn’t have any incentive to value the apartment on liquidation conditions. Especially because you can look for buyers that do intend to continue operating the apartment business.

We instinctively know the value of an apartment building. An understanding of valuation principles is therefore a sharpening tool that hones our instincts. Valuation is both a science and an art. As an art form, we have much flexibility and influence on how to value an apartment building. Negotiations are then about how you justify your assumptions and methods.

Read more, select a topic: