If you’re anything like me, you’re probably thinking this book’s a scam. “The Book on Investing in Real Estate with No (and Low) Money Down“? How can anyone possibly buy real estate for no money down? This book proves it’s technically possible, but not the way we may have imagined it.

If there’s a phrase to describe the book, it’s “creative funding sources.” We know about bank financing. But there are actually other techniques to buy real estate, with corresponding advantages and disadvantages.

I’ve listed some of the creative funding sources available in a summarized form, and I encourage you to buy the book for more details. Brandon does a fantastic job of explaining these in greater depth. I hope this digest opens your eyes to the world of creative financing.

Home equity loan

When you buy a home with traditional bank financing, your monthly payments are split into principal and interest payments. This means every payment increases your equity in the house since principal payments reduce your debt. (Lower debt on the same house means higher equity.) When the accumulated equity is large enough, you are allowed to get a loan off of it.

You then could buy an investment property with the loan proceeds and, in effect, invest in a new property with very little money accessed from your existing cash savings.

Hard money lenders

These are short-term high-interest loans offered by professionals in the money lending space. In the scheme of real estate investing, hard money loans are meant to be paid back when other, cheaper, funding sources are accessed. Here’s how it goes.

You borrow a 1-year high-interest loan from a hard money lender. They charge higher interest rates to compensate for the unsecured loan and ease of access (i.e., less strict than a bank’s loan application requirements). You then use the hard money loan to buy real estate, while simultaneously processing your application on cheaper loans (e.g., banks). When your bank loan is approved, you use the proceeds to pay off the hard money lender.

Private money

Private money is conceptually similar to hard money. But rather than being offered by professionals, private money is funded by non-professionals (i.e., individuals or entities in the non-lending type of business) and may include family, friends, and other connections.

There are no absolute rules on how you structure private money. It’s up to the creativity of the parties involved. If you’re hesitant, you should definitely consult with an attorney to ensure your agreement is valid in your jurisdiction.

Lease option

Lease options are more popularly known as “rent-to-own.” This is a creative financing source because the routinely high down payment and stringent requirements of a bank loan are done away with.

Seller financing

Seller financing is when you get your financing directly from the owner, rather than using an intermediary such as a bank. There are several reasons why a seller would agree to this.

One reason is they prefer the monthly income over one lump sum amount. Some sellers want the recurring income over a one-time payment, for one reason or another.

Another potential advantage is the higher ROI when compared to a time deposit or some other alternative investment. Other reasons include the spreading out of taxes, or even simply because the large lump sum on their property is prohibitive for buyers.

Conclusion

The creative financing possibilities help you do away with a few of your excuses for not investing in real estate.

This isn’t an exhaustive list. Far from it. The creative investor can even combine elements of each (e.g., partial seller financing plus a hard money lender).

The biggest takeaway is that there are more ways to invest in real estate than you might have initially thought.

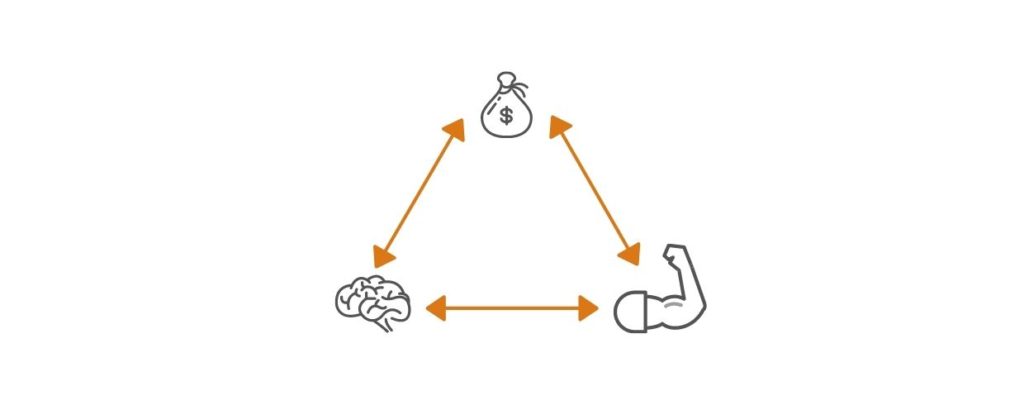

Even if you have zero money right now, remember that a real estate deal will require 3 elements: Funding, knowledge, and legwork. Bring in at least one of these three, partner with others for the rest, and you’ll have your real estate investment. You’ll have a lesser slice of the pie, but 30% of something is still more than 100% of nothing.

*This post may contain affiliate links. You can read my affiliate disclosure here, Terms & Conditions, #6 Links.

Read more, select a topic: