Not to bore you with it, but I’ve always been a spreadsheets kind of guy. It’s important I say this off the bat so you’ll know my biases and decide based on that. I am also a business owner who understands the struggles of finding the perfect accounting software for entrepreneurs in the Philippines. (But I imagine business owners in other countries will have similar experiences.)

From in-house bookkeepers to outsourced accounting solutions, here’s a list of your options at every price point.

Page Contents

3 Broad Options

I’ve classified the small business accounting solutions into 3 general (unofficial) categories. These are the (1) spreadsheets or software developed in-house, (2) purchased-based or subscription-based accounting software for internal use, and (3) outsourced local or online retainer.

1) In-house development

Although the most customized to your business needs, this option also takes the longest to implement. As a small business, you’re probably going to use a spreadsheet with pivot tables. Microsoft Excel is a common option but a lesser-known alternative is LibreOffice Calc, an open-source option for businesses on a budget.

(Related: Best Free Software for Small Businesses)

Larger companies sometimes choose to develop their own software, but this is becoming less of an option due to the prevalence of cloud-based accounting software.

2) Subscription-based

Subscription-based software is going to be the most convenient option of the bunch. But they’re also likely going to be the most expensive. But expensive is relative as we’ll get to later.

A similar alternative is the one-time purchase model, but these tend to have poor customer support and the upfront cost can be significant for small businesses. I’d probably stay away from this dying breed.

3) Outsourcing talent

For solopreneurs or micro-businesses, getting someone to do your accounting work might be the best choice. (But also worth noting is a lot of the options here are moving towards better user experiences for non-accountants.) You can choose to hire within your neighborhood or have a freelancer anywhere in the world through online marketplaces.

Let’s discuss these 3 broad categories in more detail.

Developing your own accounting spreadsheet

We’ll focus on making your own spreadsheet and not the software development side. Though if you’re a savvy programmer, the same lessons apply. AppSheet is also gaining ground, which is a platform that lets you create your own apps based on Google Sheets (i.e., no coding required).

Our accounting system

I’ve already mentioned the spreadsheet options but let me preface this part by saying this isn’t the most efficient accounting solution. There are several reasons for us going with this route, but we understand they’re most likely not going to be the best for small business owners.

The reason we use spreadsheets

My wife is an accountant and I am a certified accounting & finance mentor. It’s easy to see why we’d choose this route. We didn’t want to “waste” money. Financial modeling was a core skill and the spreadsheet requirements of small business bookkeeping solutions are pretty basic, to be honest (e.g., pivot tables, table filters).

Hindsight tells a different story

But it took months to perfect the system, and that’s time spent away from activities that could’ve grown the business. It was us going back to the technical aspects of what we knew, rather than being true entrepreneurs.

Now, we have the spreadsheet systems in place. Whether or not it’s a sunk cost fallacy (and it’s really because we prefer to think the effort was worth it), it gets the job done and we don’t see the need to upgrade.

Recommended approach

We have tried a few alternatives (see below) since then, and they have been fantastic. These are cloud-based accounting systems we’d recommend and use if we didn’t have our established spreadsheets and systems.

So if you’re at the onset looking for accounting solutions, learn from our mistakes, accountants and non-accountants alike, and seek the efficient and entrepreneurial route.

Subscription-based accounting software you can use in the Philippines

The two subscription-based and cloud-based accounting software we’ve tried are FreshBooks and QuickBooks. FreshBooks is our preferred choice, but we’d have no apprehensions recommending QuickBooks, too.

A common advantage with cloud-based accounting software is they typically come with apps that you can access on a smartphone. This means easy access to reports and mobile invoicing, among others.

Now on to our preferred accounting software used in the Philippines.

FreshBooks

The easy reason why this is our preferred choice is this: FreshBooks is an accounting software designed specifically for small business owners.

It doesn’t try to be a catchall service. Its purpose is to help small businesses, and that shows in their invoicing, reports, and time-tracking. There are tools for specific trades such as freelancing, self-employed professionals, businesses with employees, and businesses with contractors. And you’re not swamped with jargon.

The list of features include customizable invoices, remembered vendors, and the sending of proposals from anywhere.

(See the full list of FreshBooks Features on their website.)

They allow a free 30-day trial with a cancel-anytime guarantee. Prices may change but as of this writing, their Lite Package is priced at $4.50/month (around Php200/month).

Accounting for Non-Accountants

(Related: FreshBooks vs. QuickBooks)

QuickBooks

Despite being the most well-known option, QuickBooks can be quite daunting to some. They’ve improved their interface a lot though, and that issue seems to be a thing of the past. As with FreshBooks (and really almost all modern accounting solutions), QuickBooks has an app that lets you track income and expenses, send invoices, and so on. Unfortunately, inventory tracking is not part of the basic package. (But read on to see the free alternative from listed company Square.)

Again, prices change but as of this post, QuickBooks starts at $8.00/month (around Php400/month). This is for the subscription-based model, which we recommend over the one-time payment option. For your reference, the QuickBooks Desktop Premier 2021 costs $649.99 at the time of writing.

Their subscription model has a free 30-day trial as well. You may also use this partner link for $180 off of your first year with QuickBooks Online Plus:

Other bookkeeping packages for small businesses

With no actual experiences with them, I went back and forth on including these in the post. Ultimately though I think it’s best you see a list of the other available options to help you in your research.

Here’s what I’ve found to be the popular alternatives to FreshBooks and QuickBooks:

- MYOB – https://www.myob.com/

- Xero – https://www.xero.com/

- Sage – https://www.sage.com/

Payroll tracking is normally an add-on service and you may want to check if your package includes this or not. And if it’s a feature you need or not.

All options have solutions for small businesses, large corporations, accountants, and point-of-sale (POS). This brings us nicely to our next point, POS systems and inventory tracking.

A sidenote on inventory systems for small businesses in the Philippines

If you’re looking for an inventory management system, the best option we’ve found is Square, the financial payments company. It’s free to use and is the inventory tracker we use in our franchised (as franchisees) businesses. (Coming soon — What to Expect When Franchising in the Philippines)

Square provides an app you can deploy to your stores. In fact, this is how we’ve repurposed old iPads, as POS alternatives on a budget. The app allows you to sell online or in-person and has features to email daily reports, set reorder points, and other inventory-specific tools.

(Fun fact, Square, Inc. is a listed company as was co-founded by Twitter founder, Jack Dorsey.)

The Bureau of Internal Revenue (BIR)

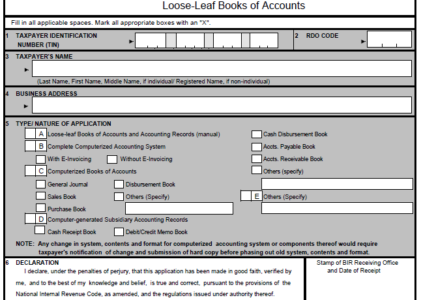

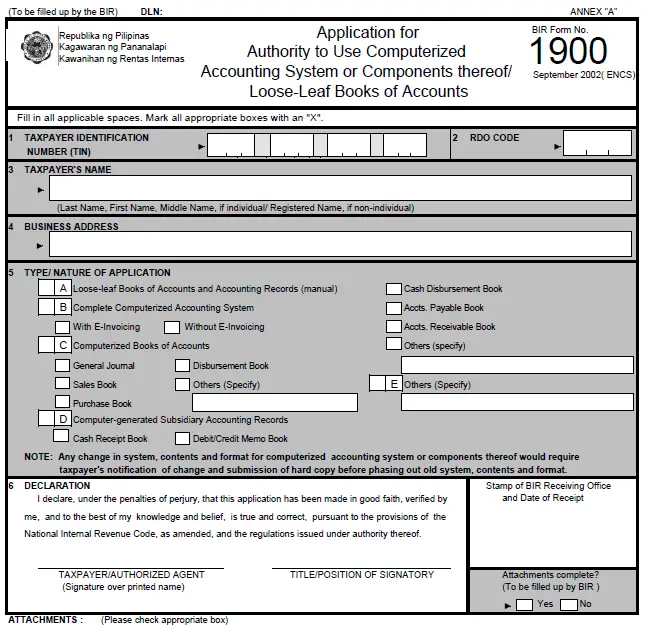

Is an accounting software required by the BIR in the Philippines? The short answer is no. The BIR, or Bureau of Internal Revenue (which is the Philippine version of the IRS in the US), simply requires registration of books of the company’s preference – manual, loose-leaf books or software. Should a business prefer to link their accounting software or use loose-leaf books, they’ll have to apply for a special accreditation. More information is available at BIR Accreditations.

A lot of businesses, even some large businesses, prefer to use Excel files over dedicated accounting software (in the Philippines, at least). That said, the trend with cloud-based accounting systems is towards accreditation with the BIR. We should eventually see full integration, much like the advancements in other countries.

Cheap bookkeeping services and beyond

All of the prior solutions involve you, or someone on your team, doing the accounting work in-house. But with the plethora of freelancers in today’s age, outsourcing has never been as simple.

You could certainly go the traditional route and hire a retainer for your accounting work. The advantage here is the local knowledge a neighborhood accountant or bookkeeper will have. That said, platforms such as UpWork and Fiverr have opened up our options to global freelancers. There are other alternatives, such as OnlineJobs.ph, but I find the lack of escrow service worrying.

(Escrow service is where a 3rd party, such as Fiverr, holds payment until the conditions of the transaction between the small business and freelancer are met.)

Fiverr also has a dedicated Accounting & Bookkeeping section, making it easy to find the right freelancer. Select from a range of solo freelancers to larger companies offering bookkeeping packages for small businesses. (Please refer to our guide on using Fiverr to Boost Productivity for some tips on selecting the right bookkeeper.)

You can create a free account on Fiverr and pay only for services when you need them.

Conclusion

Whether you’re looking for an accounting system for your construction company or a graphic artist hoping to manage your freelance business better, an accounting solution is out there for you. You have the option of doing the accounting work internally (developing or buying software) or externally (outsourcing the work).

Online accounting and bookkeeping services are the way to go, as seen by the growth of cloud-based accounting software and freelancers.

You know how important accounting is to your business. You’re already searching for the best accounting software that’s available in the Philippines. With the free options and free trials out there, I encourage you to try before you buy. The 30-day trials fit nicely in knowing if a solution meets your needs. All of them are very capable and it ultimately comes down to preference.

*This post may contain affiliate links. You can read my affiliate disclosure here, Terms & Conditions, #6 Links.

Read more, select a topic: