Why is a lower break-even point better? Or, why might a business wish to lower its break-even point?

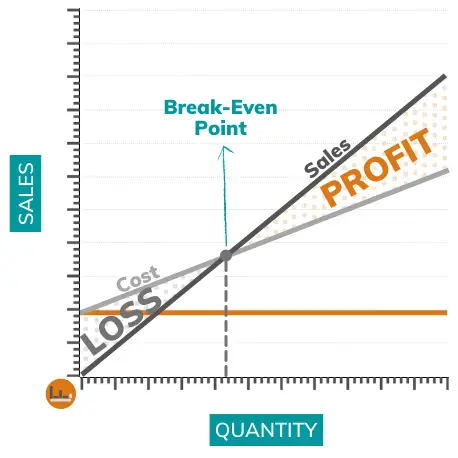

A break-even point is where the business has zero profit and zero losses. It is the sales level where the business isn’t making nor losing money. Consequently, the lower this level is, the faster the company profits — it needs to sell fewer units before it starts to make a profit.

Here’s the break-even point formula. Notice what happens to the break-even point when fixed costs decrease, the average price is increased, or when variable costs decrease:

(Our FREE Starter Kit for Entrepreneurs has a spreadsheet that calculates the break-even point.)

Page Contents

- General ways to lower the break-even point

- 1. Rent

- 2. Optimize staff schedules

- 3. Consult with an attorney on relevant costs

- 4. Hire part-time

- 5. Buy efficient equipment

- 6. Outsource some costs

- 7. Refinance debt and see if you can reduce monthly payments

- 8. Look for alternatives to your insurance

- 9. Revisit marketing and advertising initiatives

- 10. Recheck your bank’s fees

- 11. Increase price

- 12. Decrease price if price elastic

- 13. Change your product mix and promote items with high margins

- 14. Go paperless

- 15. Look for supplier alternatives to your raw materials

- 16. Train staff on cost avoidance spiels

- 17. Train staff to conserve energy

- 18. Keep spoilage down

- 19. Invest in controls to avoid theft

- 20. Save on delivery costs by ordering in bulk

- 21. Save on storage costs with proper inventory management

- 22. Gas vs. electric

- 23. Invest in tools that make the job faster

- 24. Revisit discounts

- 25. Revisit production methods

- Conclusion

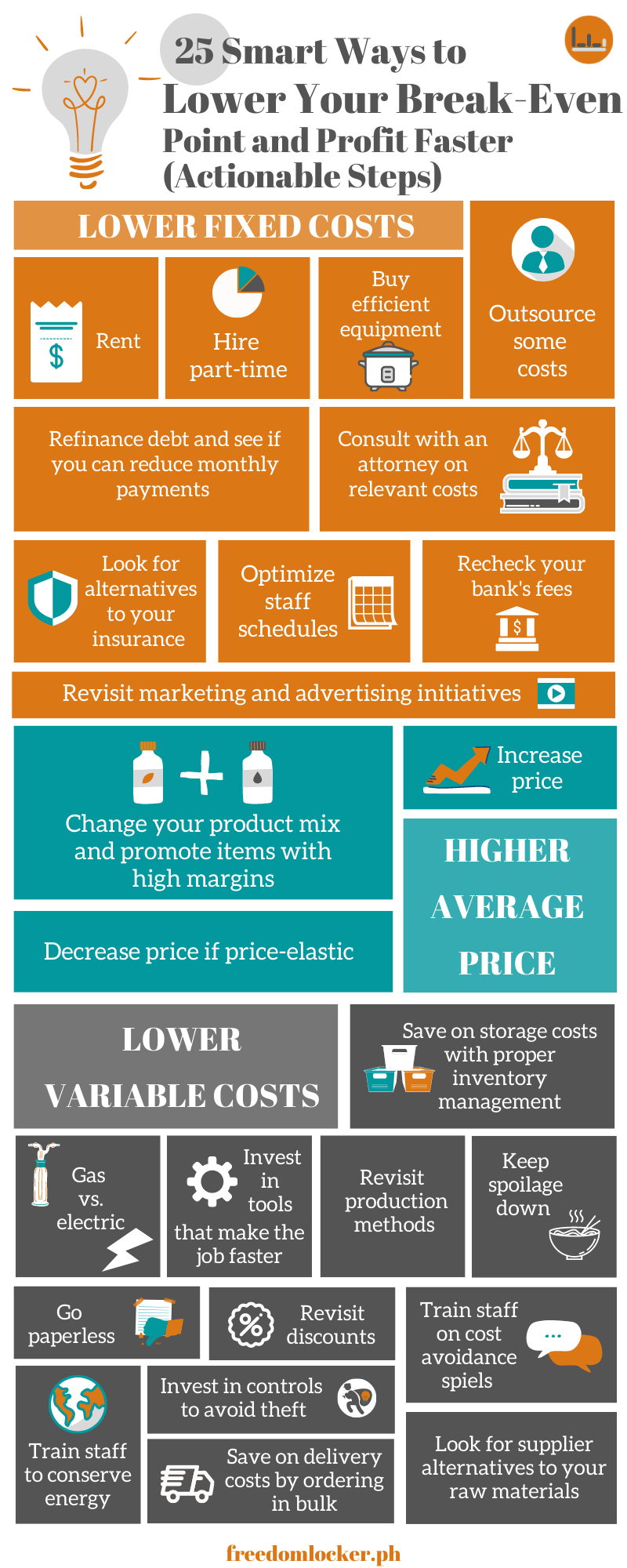

- Infographic on the 25 Ways to Lower Your Break-even Point

General ways to lower the break-even point

At its core, the break-even point is just a function of fixed costs, variable costs, and average price. You can influence these 3 to lower the break-even point. Specifically:

- Lower fixed costs

- Higher average price

- Lower variable costs

Most changes don’t happen in a vacuum so take each course with caution.

This post is a (non-exhaustive) list of actionable items for the entrepreneur. There are certainly a lot more but, hopefully, this leads to active discussions with your team on specific actions you may take to profit faster.

(Related: The break-even point is also a useful tool to know if a business idea is viable and worth pursuing.)

LOWER FIXED COSTS

(Please remember that most cost items have both fixed and variable components.)

1. Rent

One of the most prominent items, lowering rent will reduce your fixed costs. You may choose to relocate or negotiate a lower lease with your landlord. But also consider whether your current location is strategic (and brings in more clients) or not.

2. Optimize staff schedules

Check on redundancies in staffing schedules and ensure you’ve optimized their allotments.

Be slow to hire but quick to fire. Do you need staffing for 24 hours, or are the losses from closed hours lower than the costs of manning the shop? Is it possible to reschedule staff from slack hours to peak hours?

3. Consult with an attorney on relevant costs

In the Philippines, for instance, the daily minimum wage is set per region. Holiday pay is also set per number of employees. If your information is based on national standards but you operate in a lower-cost region, you might see some cost savings with a few statutory optimizations.

4. Hire part-time

Part-time employees are perfect for odd job roles that don’t fit your full-time employees’ schedules but also take less time than what a new hire would cover.

5. Buy efficient equipment

All things the same, efficient equipment lower your base costs. Make sure the low kWh are in fact efficient, and not low-powered machines that ultimately cost more to operate. (Low-powered machines have their place. See variable costs.)

6. Outsource some costs

Global freelancers have lowered the costs of doing business, so this may fall under both fixed costs and variable costs. From virtual assistants to graphic designers, a freelancer is probably available for your needs.

Of the online marketplaces, I use and recommend Fiverr for Business owners. Creating an account is free or search for the freelancers you need here:

7. Refinance debt and see if you can reduce monthly payments

Debt refinancing or restructuring is frowned upon by some, but it’s actually a way to lower your debt payments. Debt payments are a function of your loan amount, tenure, and interest. If you can find a bank that’s willing to take your loan at a lower interest rate, then it’s another way of lowering your monthly payments and fixed costs.

8. Look for alternatives to your insurance

In a competitive landscape, most insurance providers bid and offer the best insurance they can. Make sure to scout for cheaper alternatives to lower your costs.

9. Revisit marketing and advertising initiatives

Of all the cost items, this is probably the most interrelated with revenues. Ensure marketing actions have acceptable ROIs. (Or better yet, NPVs, as better measures over ROIs) Ads and other initiatives with poor returns should be changed or axed.

10. Recheck your bank’s fees

With the booming of digital banks and the modern financial transformation, traditional banks have no choice but to lower traditional fees. Make sure you’re getting the most out of your bank fees.

HIGHER AVERAGE PRICE

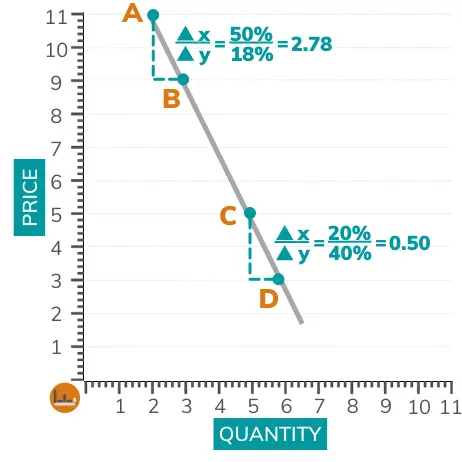

(Please consider the dynamics between your price and the quantity demanded.)

11. Increase price

Increasing price lowers your break-even point. But be careful with price increases and always consider the price elasticity of your product.

(Related: Does Lowering Prices Increase Sales? 2 Ways Math Says Yes and No)

12. Decrease price if price elastic

Related to the previous number, decreasing prices, assuming your product(s) or service(s) are price-sensitive, will hopefully result in more than offsetting increases in quantity sold.

13. Change your product mix and promote items with high margins

Train your team to upsell or promote high-margin items. If having a portfolio of products is the industry standard, then selling more of your high-margin items will result in a higher weighted-average price and a lower break-even point.

LOWER VARIABLE COSTS

(Please remember that most costs have both fixed and variable components.)

14. Go paperless

Eliminate the need for paper copies when allowed. Create digital backups to ensure continuity. Keep your accounting records on a cloud-based platform such as FreshBooks (for non-accountants).

15. Look for supplier alternatives to your raw materials

Depending on the industry, supplier alternatives might operate in competitive markets willing to bid for contracts.

16. Train staff on cost avoidance spiels

Train your staff with customer service spiels to avoid costs. For example, in the food industry, have them ask if disposable utensils are needed when reusable ones are available.

17. Train staff to conserve energy

Remind your team to turn off the lights when not in use, use low-power mode when possible, or other actions that conserve energy.

18. Keep spoilage down

Spoilages add to your effective cost per product. Proper planning and forecasts can limit wastes.

19. Invest in controls to avoid theft

Similar to spoilages, theft incidents add to your effective cost per product. Investing time and/or money in controls should limit theft.

20. Save on delivery costs by ordering in bulk

Most suppliers and couriers offer discounts on bulk orders. When your inventory controls permit, try ordering in bulk to lower your variable costs.

21. Save on storage costs with proper inventory management

Also in line with inventory management, some storage costs may be saved with just-in-time systems or sound forecasting.

22. Gas vs. electric

Consider the operating costs of gas vs. electric. Gas or electric may be cheaper or more expensive to operate for small or large and/or infrequent or frequent orders. The point is, assess which alternative lowers your costs.

23. Invest in tools that make the job faster

Lowers the time it takes to produce an item, but balance this with the potentially high upfront costs. (See fixed costs.)

24. Revisit discounts

Have discounts improved sales? Can you effectively sell without the discounts?

25. Revisit production methods

Can you create your product or service with fewer parts or components? Can you replace the raw materials without compromising quality? Or will the compromised quality lead to more than offsetting demand, and is that in line with the company vision?

Conclusion

A company achieves its break-even point faster when it lowers its fixed and variable costs or when it’s able to determine an optimal pricing structure and product mix.

The BEP concept is straightforward, but an understanding of your pricing and costs takes a little bit more. Hopefully, this introduces you to the possible changes you can work on your business, have conversations with your team on actionable items specific to your business, and realize profits sooner than later.

What industry-specific adjustments can you make to lower your break-even point? Help the community by commenting below.

Infographic on the 25 Ways to Lower Your Break-even Point

*This post may contain affiliate links. You can read my affiliate disclosure here, Terms & Conditions, #6 Links.

Read more, select a topic: