This post tries to simplify the 3 valuation methods but still covers intermediate/advanced topics. If you find them confusing, I recommend starting with the Fundamentals of Personal Finance.

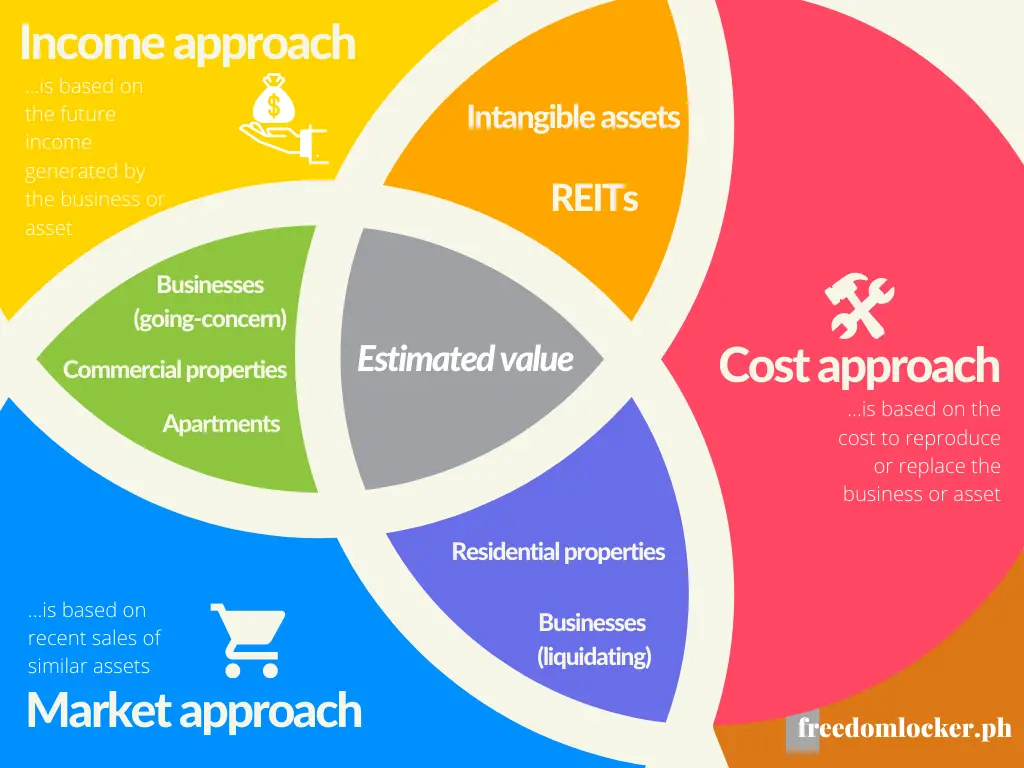

Contrary to what most believe, valuation (or appraisal) is not an exact science. Two valuation specialists may try to value the exact same business or property but come up with different estimates. And because it has an art-component to it, presenting a range of values is normally the smart thing to do. But what causes valuation estimates to differ? To answer that, we will need an understanding of how valuation estimates are made in the first place. Valuation methods, or the procedures by which estimates are made, are categorized into 3 approaches: (1) income approach, (2) market approach, and (3) cost approach.

A basic guide and some insights

This isn’t meant to be a deep-dive of valuation and appraisal principles. By the end, our goal is to have an understanding of what financial analysts or appraisers typically look at when valuing a business or property. There are excellent benefits to this. If you invest in stocks or want to invest in a company, knowing a company’s valuation, or even just an understanding of what drives its value, is beneficial. If you want to sell or buy real estate property, knowing what appraisers look at or what price-point generates a profit, is also beneficial.

Let’s quickly run through the 3 valuation methods.

Page Contents

3 valuation methods

All three methodologies are based on sound principles but certain approaches produce better results, in theory, under particular circumstances. For example, the value of a going-concern business or property is best estimated with the income approach. (A “going-concern” business simply means it’s expected to continue operating in the future, as opposed to closing down.) The reverse is also true. More on this in a bit.

In practice, it is common to first compute for all three approaches, unless it is prohibitive or misleading to use a specific approach, and then a selection process is performed by the specialist — either by ignoring one approach or heavily weighting another. Do you see how all this is very subjective?

Income approach

The income approach considers the income that the business or property generates. The rationale here is that an asset should be worth whatever it is expected to generate.

According to this approach, for example, an apartment’s worth should roughly equal the total net cash that it is able to generate over its life. An important consideration though is that:

today’s cash is not equal to tomorrow’s cash!

Php100 today is not equal to Php100 next year because a rational human being is expected to prefer the Php100 received today over the same amount received one year from now. (But not all decisions are rational. See Thinking, Fast and Slow.)

To account for the differences in value between today’s and tomorrow’s cash, tomorrow’s cash is discounted back into today’s terms. I understand that’s all too vague now (I will probably write a follow-up article here.), but just know that the asset’s value is equal to the total “adjusted” (discounted) cash of tomorrow.

Income approach example

Let’s make it more concrete. In our example below, we’ll assume that a financial instrument is to receive Php40 every year for 3 years.

The Php40 received next year is actually equivalent to Php36.46 today if we assume a 10% discount rate. (Determining the discount rate is another factor deserving its own post.) That is, theoretically, a person with a required return of 10% would be indifferent between receiving Php36.46 today, or Php40 next year — that person would be happy either way.

The same person would be happy to receive Php33.24 today or Php40 in 2 years; Php30.30 today or Php40 in 3 years.

In essence, this person could care less if he received Php100 today or Php40 every year for 3 years — despite the latter totaling Php120. The estimated value of the financial instrument is therefore Php100.

| Year | Cash Out | Cash In | Value Today |

| 0 (now) | -100 | -100 | |

| 1 | 40 | 36.46 | |

| 2 | 40 | 33.24 | |

| 3 | 40 | 30.30 |

Market approach

A market, in economics, describes a means by which exchanges happen between buyers and sellers. Accordingly, the market approach to valuation recognizes assets as exchangeable goods with similarities and differences. The more similar an asset is to another, the closer their values are assumed to be.

When investing in the stock market, these relate to your P/E, P/B, P/CF, and other similar ratios. Or when looking to buy a property, this approach suggests looking for recent sales of similar properties. This approach works best where markets are more efficient, such as in a stock market.

Market approach example

For example, a buyer is looking to purchase a 3-bedroom 2-bathroom house in a subdivision. Recent sales in the area have averaged around Php5 million for a 2-bedroom 2-bathroom house. Using the market approach, it would then be reasonable to assume a purchase price of no less than Php5 million since, in theory, the buyer is looking at a more valuable house having more bedrooms. This of course assumes the other factors are similar, such as vicinity/location, lot area, etc.

We can apply the same approach to stocks. Let’s assume Company A is priced at Php50/share with earnings of Php15/share. Its P/E is Php50/Php15 or 3.33x. Let’s also assume Company A is priced correctly. Finally, we’ll pretend Company B has earnings of Php20/share. Company B’s estimated value is Php20 x 3.33 or Php66.67.

The main intent of this approach is:

to value assets based on comparable companies or properties

but adjusted for advantages or disadvantages unique to the asset being valued. (You’ll frequently see comparable assets referred to as “comps.”) This is unique to the 3 valuation methods because it explicitly includes comparable assets in the analysis — although the income approach indirectly considers comparables through its discount rate.

Cost approach

As you may have guessed, the cost approach estimates an asset’s value based on its assumed cost to reproduce or replace. Because it fails to consider the potential earnings of an asset, this approach isn’t the best to apply when estimating the valuation of businesses or rental properties.

That said, it is assumed to be accurate when measuring new properties; or when estimating the value of a liquidating business. This approach is also frequently observed with specific tradeable assets like REITs. Also worth noting is that this is the preferred method by bank appraisers valuing residential homes.

How to use this information

Valuation methods guide us with the required procedures, but valuation is ultimately both a science and an art. All this is saying that valuation is subjective and implies a few things for us investors.

For one, it means bank appraisals can be influenced.

By adding a room to a house with lots of idle space, for instance, you can sway a bank’s appraisal. Another is that stock valuations are as good as the analysts’ insights. (Even then, it would be difficult to beat the stock market. See this related post on the Buffet Indicator.) It would be wise to take the analysts’ valuations with the understanding that these are all based on subjective forecasts and variable estimates. It also hints that stock market prices usually do not equal a company’s intrinsic valuation. If everyone has their own valuations, then odds are you’ll have a range of values anyway — and this is on top of the emotions that move these markets. (Related: Market cycles)

It is then the valuation specialist’s responsibility to come up with a range of values that is reasonable and defensible. Knowing these approaches may help you sway the valuation estimate or appraisal in your favor.

Shameless plug I hope friends and family don’t see 🙈: I have years of experience in business valuation and placed Top 3 in the 2014 Real Estate Appraiser’s Exam. You can send me an email at dan@freedomlocker.ph, or drop a message through our contact form here.

Read more, select a topic: