I am a strong advocate of real estate as the investment of choice for true financial freedom — financial freedom that goes beyond just being debt-free or living on a limited budget. True financial freedom is having the choice to do whatever you want, whenever, wherever, and implies a great deal of wealth. And wealth accumulation is made by, among other things, having a successful business and accumulating rental properties. This begs the question, “is a condo a good investment?”

Not all real estate properties are good investments. In fact, there are at least 9 ways a good property can be a bad investment. Unfortunately, we’ve all been accustomed to this “always buy real estate” mindset that it sometimes borders a poor marketing gimmick. I surely was before I knew any better. That said, real estate is still one of my preferred investment classes. But it’s no longer with a buy-anything-real-estate approach.

So then, is a condo a good investment?

Page Contents

3 important conditions to bear in mind

Before the analysis, I’d like to set the stage for my take.

The analysis is from the perspective of an outsider and an independent critic. I do not gain or lose from your action or inaction.

The contents here are based on the assumption that a buyer wants wealth for financial freedom. They’re not buying a condo for personal use, and they avoid buying assets that unnecessarily prolong the wealth-building process.

And finally, this will not be a listing of real estate pros and cons, nor a catalog of real estate characteristics to look for (location, developer reputation, economic prospects, etc.) — those are the usual contents of articles on “Is a condo a good investment?”

1. Objective analysis vs commission-based review

I have no incentive to promote a developer, nor will I benefit or suffer from your decision. (And this is probably where I say goodbye to potential tie-ups with real estate developers.) My analysis tries to be based on a completely objective point-of-view.

I used to spend countless hours on the Internet researching topics, including questions along the lines of “is X a good investment.”

What I didn’t know was this: A lot of reviews are written to ultimately make a commission.

I’m not saying they don’t believe their recommendations, but it does skew their take even by just a bit. I don’t blame them, it’s human nature. (Related: I talk about biases in Thinking, Fast and Slow.)

2. Investment option vs personal use

There’s an important distinction between buying a property for investment vs. personal use.

Buying for personal use is as it sounds, but it also covers renting out the condo when not in use — because that’s an auxiliary activity, not the primary. When we’re buying for personal use, it’s okay for emotions to come into play. Buying a condo unit just because you like the color or location is NOT a bad decision if it’s for your personal use. It’s a decision, period.

If you’re buying a condo for personal use, these don’t apply.

This is markedly different from buying a property for investment purposes. The analysis here also defines “investing” as an activity to grow wealth, rather than a generalized word for buying assets.

(Note: “Investing” is loosely defined as the purchase of any asset. But for our purposes, we “invest” with the intent of growing wealth. So investing in suboptimal assets can be classified as bad investments.)

When we buy a condo as an investment, the correct (and objective) approach is to compare the condo across alternatives. We’re following the economic concept of opportunity cost.

–Opportunity cost explained

Opportunity cost is the cost you take when you choose one activity over the other. The cost is equivalent to the foregone benefit of the foregone activity. Let me explain.

If you choose to invest in a condo, your opportunity costs include the returns you could’ve gotten from investing in another type of real estate, or from investing in stocks, or somewhere else. This is a real economic cost that we all should consider.

For example, say option A yields 3% and option B yields 10%. If you choose to invest in option A, you are not gaining 3% in the economic sense. You are losing 7% (10% gain on B, less 3% gain on A) in the economic sense and it’s best to invest in option B.

There are many more intricacies to the concept of opportunity cost, but just know that positive yielding investments can still be poor choices.

In the example, accounting profit is positive (3%), but the negative economic profit (-7%) is a sign you made a less than optimal choice for wealth creation.

A less than optimal choice, to me, is therefore a bad investment decision.

3. This is not a listing of pros and cons

A lot of analyses on whether a condo is a good investment stick to a listing of pros and cons. A quick Google search will return a good list. I will not be listing them here since most of them do a great job.

We will also not go into the details of what makes a property a good property. But in summary, these include location, developer reputation, expected economic growth, and so on.

Although these are certainly important considerations, most of them also apply to non-condo real estate. Location, developer reputation, and economic growth prospects are all considerations in apartments, vacant lots, residential properties, etc.

Case study: Condo investment against an alternative

Let’s use a budget of Php2.5 million. At this price, I’ve seen both mid-level condos in urban areas as well as low-cost apartments in rural areas. We will be comparing these two options.

In our sample case, the apartment ends up being the better choice but this doesn’t mean all apartments are better, or even that they’re the best type of real estate or investment alternative.

Option A: Mid-market condo in Manila

The condo unit is 40sqm large and rents for Php20,000 per month. I’ve noticed in the Philippines that the 1% rule rarely applies, and good deals hover around 0.8%. The condo is located in an excellent location around the city.

Option B: Low-cost apartment in Palawan

The low-cost apartment has a lot area of 100sqm. At 10-12sqm per unit, it can house a total of 20 units on 3 floors. The cost of living in Puerto Princesa (Palawan island) is significantly lower and a unit rents for just Php2,000 per month. The apartment is also located in an excellent location.

(The 1% rule of thumb in real estate tells how, for a property to be shortlisted as a good investment, monthly rent must at least be 1% of the property’s purchase price. In practice, I use 0.8% to shortlist. But we’ll use 1% to inflate the condo’s results.)

Other assumptions

We will be using the following assumptions under both options.

- The buyer will be financing the purchase through a bank

- Required downpayment is 10%

- The bank requires an 8% interest on the loan

- A 10% annual vacancy rate

- A property management fee of 5% is charged

- Maintenance expense is 7% of rent

- A 2% catchall expense is added

- Capital and rental appreciation is 3%

Analysis: Is a condo a good investment?

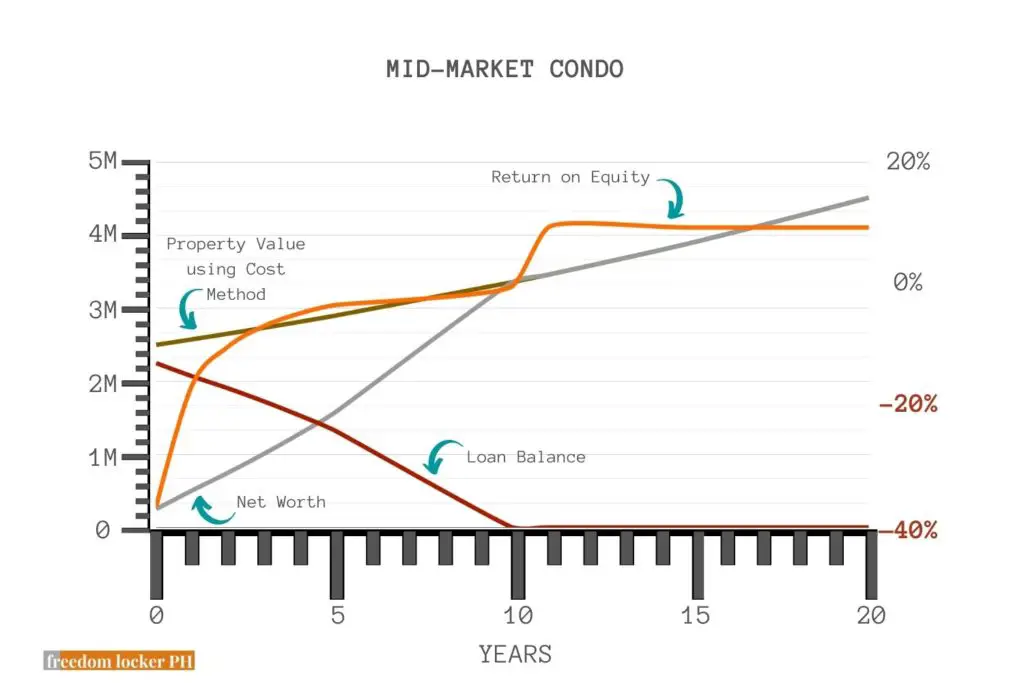

Over time, the condo unit appears to be a good investment with a return on equity (ROE) of 7% in Year 11 despite low (negative) ROEs in the early years.

But the low-cost apartment still appears to be a better investment with a Year 1 ROE of 16%. Positive cash flow generated from years 1 to 10 may also be reinvested elsewhere.

Vacancy rate

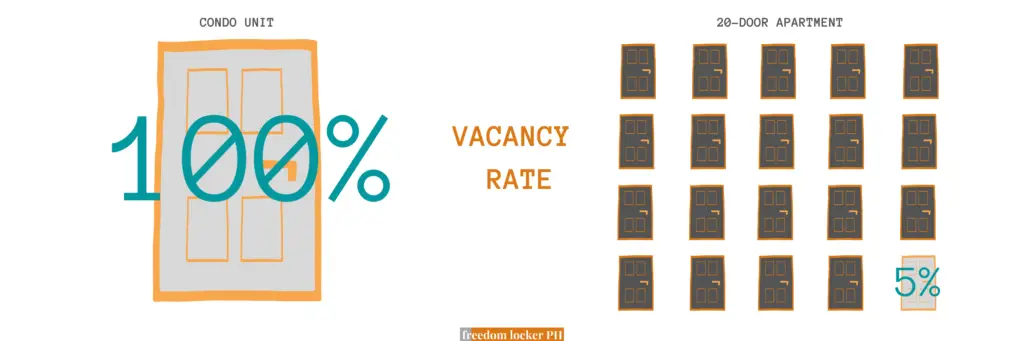

Owning multi-units is a risk-mitigating strategy as it softens the impact of move-outs or vacancies. Yes, our comparison is between a 20-unit apartment and a condo, but even if we compare the condo to a duplex, the point remains.

One tenant moving out of a duplex translates to a 50% vacancy rate. A tenant moving out of a condo unit is a 100% vacancy rate.

In our low-cost apartment sample of 20 units, one vacant unit translates to a vacancy rate of just 5%.

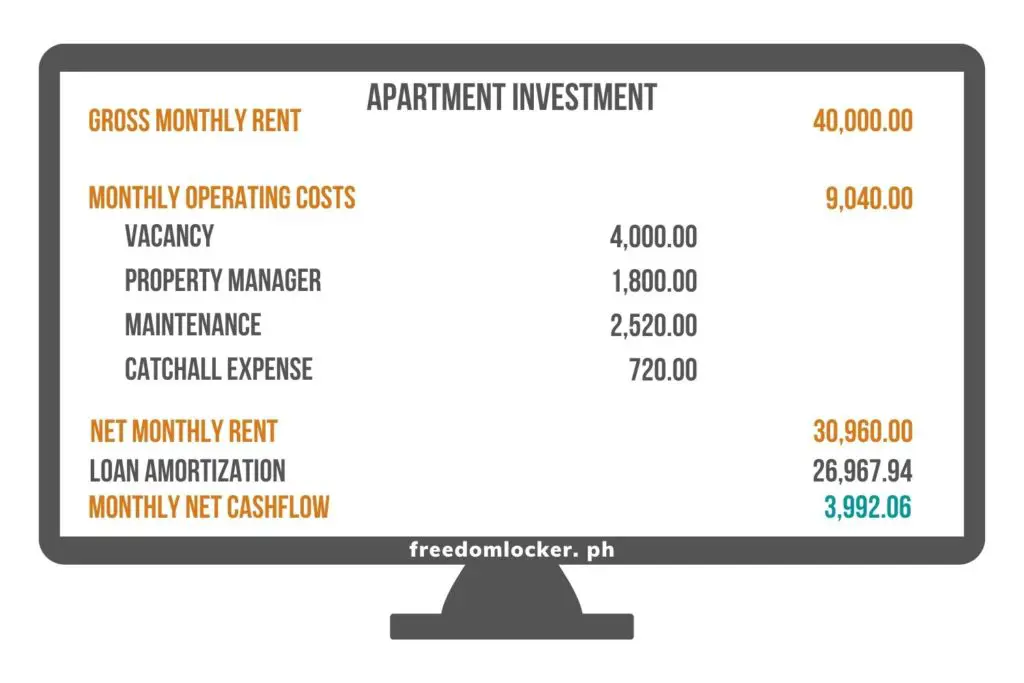

Monthly cash flow

At a Php2.5million purchase price on the condo, we might be able to charge around Php25,000 per month (1% of Php2.5 million). This is effectively Php625 per sqm.

(But again, in practice I would use 0.8% as it seems to be more realistic. Send me a message if you know of a property that passes the 1% shortlist!)

On the other hand, a low-cost apartment may charge Php2,000 per unit or around Php166 to Php200 per sqm.

At 20 units, that’s Php40,000 a month in gross rent. This isn’t surprising since prices generally have a floor the lower we go. What I mean is, have you noticed how prices drop at decreasing rates?

–Prices floor explanation

Buying at the grocery store might be a good analogy. For example, a 100ml bottle of juice might cost Php100. But a 50ml bottle of the same drink might be Php60 (rather than Php50).

(There’s a lot more going on here than just a price floor. It’s also cheaper for manufacturers to sell in bulk. But we’re going off-topic.)

The more granular, the higher the potential profit we can squeeze per unit. If our 12sqm unit was divided into two 6sqm units, we might be able to sell each at Php1,200. The gross rent for the two subdivided units then becomes Php2,400 (Php1,200 x 2), rather than Php2,000 for 1 unit of the same 12sqm floor area.

–Net cash flow comparison

The monthly rent, net of property management, maintenance, vacancies, and the catchall expense, is Php19,350 for the condo and Php30,960 for the low-cost apartment. The monthly amortization on the loan is Php26,967.94.

Net of loan amortization, the monthly net cash flow for year 1 is negative Php7,617.94 for the condo and positive Php3,992.06 for the apartment. (Refer back to the assumptions table.)

Market efficiency and financing costs

At a 10% downpayment and an 8% interest on the loan, our monthly amortization is more or less Php26,967.94 per month.

The market for easy real estate purchases such as condo units sold by large developers is relatively more efficient than the market for unbranded apartments or houses. What does this mean?

Imagine if a condo project sold units that passed the 1% rule. Investors would flock to buy, the increase in demand will increase the price, monthly amortization increases.

This ultimately makes it hard to find condo units that yield monthly rents higher than the bank’s monthly amortization.

In contrast, the inefficient markets of unbranded apartments or multi-room houses mean deals exist more often. Your neighborhood apartment probably won’t cause as much commotion as a large developer might.

Arguments and rebuttals

Here are some arguments defending condo units as alternative investments, and a few rebuttals.

Number 1

Argument

“I am buying with a long-term time horizon, and the value will increase over time. I can rent at a much higher rate. Condos are easy to sell. I can ‘subdivide’ the condo and rent to several tenants. I don’t need a property manager. The condo has a higher growth rate than the apartment. I don’t need financing, I can pay in cash.”

Rebuttal

My answer to all of these relates back to the opportunity cost principle. If you can do these with the condo, who’s to say they’re not available options with, not just apartments, but also other real estate assets?

Assuming you can save on financing costs as a cash-buyer of a condo, then you can most likely save on financing costs regardless. If you’re buying long-term, then the same advantages apply to other real estate assets.

Investing in suboptimal choices is a waste, and our money is best invested where returns are optimized.

Number 2

Argument

“I must have this particular condo because I see my kids using it when they go to college.”

Or similar arguments that highlight the uniqueness of the condo.

“This real estate developer is trusted and all of their properties perform well.”

Rebuttal

As mentioned in condition number 2, the recommendations here do not apply to buyers with personal agendas other than wealth accumulation. And buying a condo purely on developer reputation IS an emotional purchase.

There’s nothing wrong with buying a condo for personal reasons though. What’s wrong is saying the purchase is the optimal alternative. This again goes back to opportunity cost. An investment can make you money but still be considered a poor choice.

Number 3

Argument

“I can’t find anything that cheap in Manila. Managing multi-units is hard. This comparison is unrealistic.”

Rebuttal

Finding good deals is hard. There’s no denying that. If it was an easy process, everybody would be doing it. If everybody does it, it inflates prices, and then it isn’t a good deal anyway. Good deals are usually listed off-market, as in, direct from sellers or by approaching potential sellers.

This isn’t an unrealistic comparison because they’re actually based on personal experiences. In fact, the condo that it’s based on sells closer to Php5 million (not Php2.5 million), making the condo unit’s case worse. I don’t think my case is unique. Far from it. You’ll just have to put in the effort.

Conclusion

Defining what “investing” is

I understand this might be a contentious post, especially with my broker friends. We hear it all the time. “Buy this condo. It’s a good investment.” They’re not wrong in calling them investments, but again that’s “investing” as the generalized term for buying assets.

In my mind though, when we ask the question, “Is a condo a good investment?”, my immediate interpretation is something like “Is putting my money there a good choice?“. Specifically, is it a good choice for wealth accumulation?

A condo unit may give you some attractive returns in rent, plus real estate growth has historically been positive. But, forgive me for repeating this important point:

An investment can make you money but still be considered a poor choice.

Condo units aren’t bad but…

It’s not that condo units are intrinsically bad investment choices. It’s just because other investment alternatives offer superior gains, extra benefits, and risk-mitigating measures, and opportunity cost is a real cost that should be considered when investing. For a fixed amount of money, we’re foregoing the option to invest in superior alternatives when we choose to invest in inferior ones.

I’d rather take the time and effort to look for those superior alternatives. It does take a little more work, and deals are hard to find, but if it doesn’t require hard work, something’s amiss anyway.

What are your thoughts on condo units as investment alternatives? Let me know in the comments or send me a DM on Instagram.

Read more, select a topic:

How about flipping condo real estate, is it a good investment? Thank you

Hi, Monina! Thanks for the comment here and on Instagram. 🙂 I might repeat a few of my points here so bear with me.

Flipping and buy-and-hold strategies are different and hard to compare. I personally like a buy-and-hold strategy, because it aligns with my goals, but that doesn’t mean flipping is bad.

Now in the realm of flipping, a deal can be good or bad based on the return you’re getting. That applies whether or not it’s a condo. You also have to consider the following:

–Flipping is similar to a job. You stop earning when you stop flipping.

–You usually pay taxes per flip. Taxes reduce your net returns.

–If it’s purely flipping (i.e., no rental income), you’re stuck with an illiquid asset with no cash inflow.

Those are my top-of-mind insights. Feel free to send me an email. I’m always happy to help! 🙂