There are many ways to building wealth with real estate. There’s the buy-and-hold strategy contrasting the buy-and-sell (flipping) strategy. Some focus on residential properties, while others on commercial or industrial. There are investors who pool together (syndicate) for larger deals, and others prefer solitude. And then there are questions about leverage, geographic location, target class, and so on.

I can’t stress this enough. This is one of many paths. It isn’t superior to yours. It’s my roadmap, period.

Gary Keller has found some key similarities among real estate millionaires, and it is his principles that I’ve adopted and modified as my own. This post highlights that path. And of the possible paths to financial freedom, real estate is the one that’s truly accessible to anyone.

(My favorite book on building wealth through property is Gary Keller’s “The Millionaire Real Estate Investor.” Buy the book on Amazon.)

Page Contents

4 Ways real estate builds wealth

There are four ways we generate and build wealth from real estate property investments. There’s capital appreciation, recurring cash flow, equity build-up, and tax savings. The first two ways are the primary sources and are usually contrasted against each other. But let’s also talk about the 2 ancillary ways to earn with real estate.

I should emphasize though that equity build-up and tax savings are supplementary ways. You shouldn’t buy real estate solely because of the equity build-up nor tax savings.

Capital appreciation

This is completely anecdotal, but I’d say the most common reason people buy into real estate as an investment is that they expect future prices to go up.

This can be a valid reason and is an easy metric to follow, but also take caution because prices are unpredictable. The overall prices of real estate have gone up but that isn’t a guarantee of future performance.

That said, I’d seriously be remiss if I didn’t mention forced appreciation. Prices may increase due to economic factors, which is what most people think when we talk about capital appreciation. But a more important type of appreciation, at least for the real estate investor, is forced appreciation.

Forced appreciation is the increase in value of your investment through property improvements. For example, a 2-bedroom house is typically more valuable than a 1-bedroom house assuming all other things are the same. It is wealth creation at its core.

Cash flow

A real estate investment’s value is based on its capacity to generate cash flow. Cash flow is what’s left of your rent and ancillary services (e.g., utilities or laundry services) after deducting the necessary expenses and financing costs. Net cash flow is what you take home every month.

A lot of people buy real estate for capital appreciation but I prefer cash-flowing properties. Positive cash flow properties are safer to invest in, but more on this later.

Equity build-up

Assuming a property is bought with a bank loan (and there are pros and cons to doing so), your monthly payments are split into two: Principal and Interest payments.

The principal payments mean you decrease your loan balance, and effectively increase your equity, per payment. The gradual increase in equity is known as equity build-up.

Over time, your equity rises just by paying the monthly amortizations due to the bank.

Tax savings

Real estate operations involve deductible expenses such as maintenance, repairs, and depreciation. What this means is you save on tax payments just by operating and maintaining your real estate investment.

For the same amount of income, the take-home pay is vastly larger for rental properties than it is with a job.

My wealth creation (property) process

Before I detail my preference, I’d like to point out again that this isn’t saying my way is the superior route. It’s a matter of preference, and I prefer investing for the long term. It aligns with my goal of retiring early and being truly financially free.

(Related: You can see my entire roadmap here.)

In a nutshell, my wealth creation process calls for the buying of properties that yield positive cash flow. As a new investor, there is the temptation to buy anything real estate, even if it doesn’t produce positive cash flow. I certainly was in the same boat. But buying positive cash flow properties reduces risks.

Market declines

When prices decrease, you take the losses only when you sell. This also means you’re either stuck with properties you can’t sell, or you sell at distressed prices significantly lower than planned.

With a cash-flowing property, this matters less because you earn while holding the property.

Prices and rental rates have an inverse relationship. When one goes up, the other goes down (but they’ve been found to grow at about the same rate over the long run). So in theory then, rental rates should remain strong during market declines.

And when prices do bounce back, you can either hold the property and still get the cash flow, or you can sell the property if the resulting returns (from the sale) more than offset the hassle of losing the cash flow.

Leveraged purchases

Most real estate purchases are done so with bank financing. Although with more risk, leveraged purchases also open the door to more options. Leverage is a double-edged sword that can be a catalyst if used properly.

The risk lies in our inability to pay the mortgage. So the implication here is simple:

Buy properties that generate enough cash flow to pay the mortgage.

Unknown and unexpected downturns, such as COVID, happen and it’s best to save at least 6 months worth of mortgage in cash or cash equivalents. Kind of like an emergency fund per property.

Combine with forced appreciation

My priority is to look for positive cash flow properties. This is the shortlisting mechanism I use to filter properties — without it, they don’t make the shortlist.

But the potential for forced appreciation makes a deal even better. And that’s the appeal of dilapidated properties. They usually sell for less and a few touch-ups, like a new paint job, will increase market value.

Again, forced appreciation is the sweetener to a deal and isn’t my main consideration.

(But it does make sense when you’re into buying and selling, or flipping. I’m not.)

Buying your first property

The first property is the hardest to buy. You’re unsure of how to analyze a property, there’s constant doubt and a looming feeling of things going wrong, and it’s usually the investor’s biggest purchase yet!

If it’s any consolation, I’ve never heard of anyone say otherwise. And that means it just gets easier as you buy more and more properties.

There are two ways to approach buying your first property. One is to save enough cash for the down payment. The alternative is to apply one of the creative financing techniques.

Option 1: Save cash

This approach is pretty simple. Have a target property in mind, determine what your bank (or some other financial institution like a cooperative) will require as a down payment, and save until you reach the amount.

This will take a little longer but is also arguably the safer route. (Arguable because you could say partnering with experienced investors reduces risk. Read on option 2, creative financing options.)

Option 2: Creative financing

Most people don’t know about buying properties with no, or low, money down, (The Book on Investing in Real Estate with No (and Low) Money Down: Buy on Amazon), or the concept of creative financing.

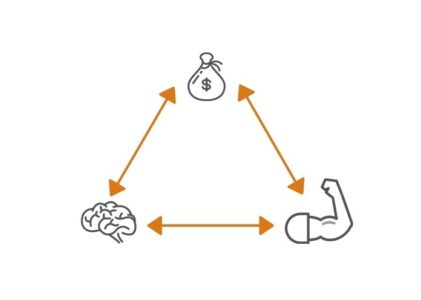

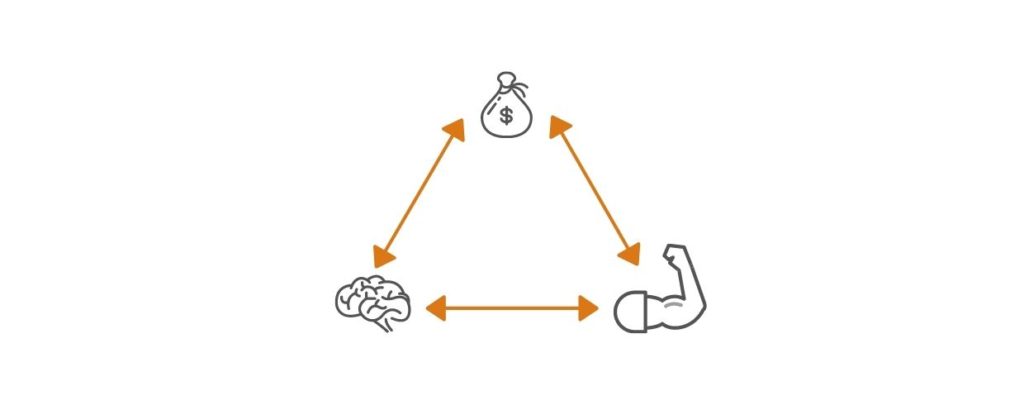

Creative financing is about coming up with ways to finance a project outside of a bank loan. Here’s what you need to keep in mind.

A deal will require three things: Money, Expertise, and Legwork. Bring in at least one, partner with others for the rest, and you have yourself a deal.

How no (or low) money down works

Let’s say you have zero money to spend on real estate. But to compensate for your lack of cash, you spend time researching deals and educating yourself. You’re also willing to hustle and do the legwork.

If you come across a deal that’ll make your friend tons of money, and you’ve shown your expertise and she trusts you, wouldn’t it be beneficial for her to partner with you? And if not her, don’t you think other investors would be willing to jump on that deal, assuming it’s a REALLY GOOD deal?

The challenge is showing credibility, expertise, and trustworthiness. Once you have those, you’re actually doing your partner(s) a favor by having them join the deal.

Estimating the value of an apartment building

The first real estate deal is critical to the wealth creation process because of opportunity cost. Opportunity cost is basically what you lose out on by investing in another property. The limited funds we have are best invested in an asset with the best returns. You prolong your timetable if you invest in a property with poor returns.

One of the surest ways to get poor returns is to overpay for a property. It doesn’t matter if the property is in a good location or has the most appealing architectural designs or whatever else. If you overpay, you reduce your returns.

To avoid overpaying, you may refer to this guide on estimating the value of an apartment building for beginners. But also beware of analysis paralysis. Action is still better than perfection.

(If you’re still struggling to decide, check out our Apartment Deal Analyzer [Should You Buy] service.)

Managing the property

I subscribe to the idea of first managing the property yourself before outsourcing any help. By doing so, you see loopholes you may not have known by not doing it yourself.

For example, should you collect rent every first week of the month? (Tip: You should) Why? How do you avoid bad tenants?

There are best practices to managing properties, and Heather & Brandon Turner lay them out in their book, The Book on Managing Rental Properties. But in the end, you’ll have to tweak these suggestions to fit your own.

Creating wealth through property accumulation

I’ve said this in a lot of my real estate posts, and this is certainly not new information in the industry, but no one gets rich with one property. It takes several real estate investments amassed over years and years of hard work.

The process of accumulating more properties is similar to buying your first real estate deal, but the experience is vastly different. And the same applies for the 3rd compared to the 2nd, or the 4th compared to the 3rd, and so on. It gets easier.

Because it follows the same process, you also have the same options: save up on the down payment or find a creative financing solution.

This includes partnering with investors who have the cash but not the time and/or expertise, using private money, or the BRRRR investing strategy.

Exponential growth

The nice thing about accumulating properties is the rapid growth when you get the ball rolling. There is a snowball effect.

Take, for instance, buying real estate with a bank loan. Let’s assume you save all the net monthly cash flow in a money-market fund or savings account. Let’s also assume it takes 5 years of saving for you to completely pay off the loan, inclusive of prepayment fees.

Now let’s say you pre-terminate the first loan and get another loan for the same type of property. You again save all of the net cash flow. But this time, you have 2 properties working for you. It should take less time to save to completely pay off the loan.

Do the same process again, but with 3 properties, and you see how it snowballs quickly.

Stick to the plan and ignore the hype

Long-term investing is boring. That applies to real estate, index funds, and other long time horizon plans. It’s not about jumping in on the hottest IPOs, cryptocurrencies, or even flipping condos.

When you’re building wealth with real estate, you’re in it for the long haul.

Creating wealth through property accumulation is a process that has been documented to work, time and again. No process is guaranteed success, but if you learn to endure and avoid the temptations of earning a quick buck, you increase your chances of success. The long process weeds out the impatient. Are you determined to stick through it to the end, or will you be another victim of society and media’s pressures? Time will tell.

*This post may contain affiliate links. You can read my affiliate disclosure here, Terms & Conditions, #6 Links.

Read more, select a topic: