Some people don’t have to make this choice. Entrepreneurship either comes naturally to them or is totally out of the question. But for others, including myself, there’s this grey decision area between a stable job and starting a business. For people asking “should I quit my job and start a business,” this is for you.

There are obviously many factors that come to play, but my basic message is this: It’s a sensible decision to quit your job and start a business when the commitment seems like an asymmetric bet in your favor.

Quick disclaimer, there are other elements I will fail to consider and the decision is never clear-cut. Our goal is to identify which direction your decision favors. This is also for people who’ve done the business research but are on the fence — Unfortunately, this isn’t for those who simply had a bad day and want to quit now, or have similar fickle reasons.

To really understand asymmetric bets, we’ll first talk about symmetric bets — what they are and how they apply in life. I’ll then bring up asymmetric bets in investments, and then how it matters to you and your decision.

Page Contents

Entrepreneurship isn’t for everyone

I’ve talked about this in detail (see Is Entrepreneurship for Everyone?), but it’s worth mentioning again. Entrepreneurship is not for everyone… and that’s okay.

Not everyone will understand risks, much less be comfortable with risks. Everyone will also have their own priorities. Some priorities lead to entrepreneurship (e.g., valuing time over everything, or the larger income potential), while other priorities lead to employment (e.g., the prestige of belonging to a well-known corporation, or the safety of a job).

I am (blindly) assuming you want to pursue entrepreneurship. You’re willing to put in more work and you understand that failure is very real. And although I firmly believe it’s not for everyone, I also believe the entrepreneurial mindset is a learned trait and a decision anyone can make.

Now that’s out of the way, let’s get into the meat of the matter.

What are symmetric and asymmetric bets?

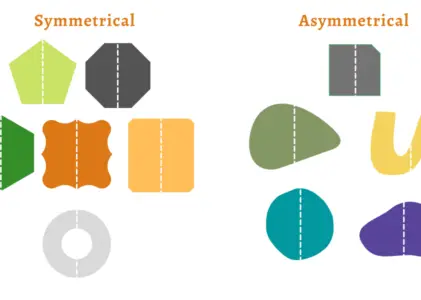

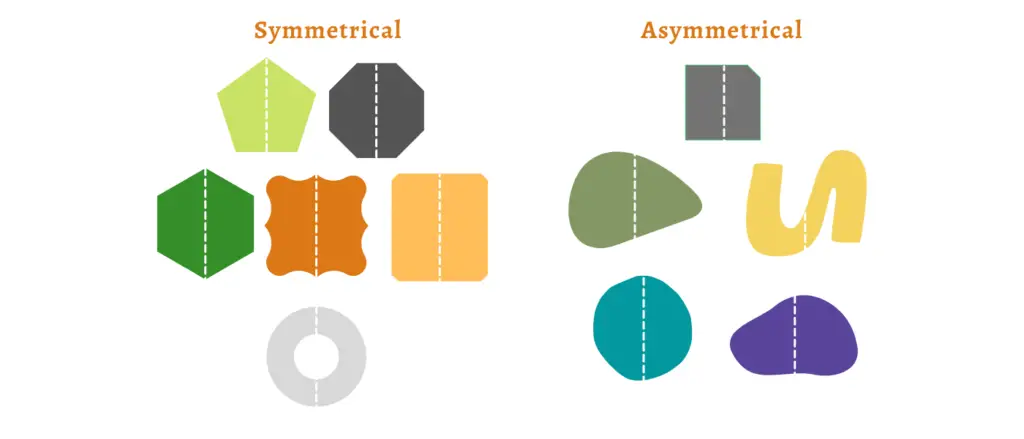

Asymmetric bets are bets that are NOT symmetrical. Genius, right!?

The “a” is Greek for “without,” as in apolitical, atheist, and apathetic.

To understand this, consider a fair coin toss where you bet 100 if it lands on a certain side. There’s a 50% chance you win 100, and a 50% chance you lose 100. There is symmetry (or balance) between your upside and downside.

We also see this in things like the stock market. Large companies tend to be the safer bet, while small-capitalization companies tend to be the riskier choices. The greater risks from small caps are compensated with greater potential returns. (We also see this across industries and asset types.)

In finance, this is common parlance and comes in the form of the risk-return tradeoff. The greater the risks, the greater the potential returns. This is a rule-of-thumb that has some nuance though — such as non-diversifiable risks and the occasional asymmetry between risks and returns.

Asymmetric risks in practice

When banks give out loans, collaterals are used to improve their risks. Consider a bank that gives out a 10% interest loan for 1 million without collateral.

The upside is the borrower fulfills her duty and pays 10% of 1 million, or 100,000. (We’ll keep our computations simple.) The downside is the borrower defaults and the bank loses 1 million. This is a pretty glaring example of asymmetrical risk against the bank.

To alleviate their risks, banks require collateral. For simplicity, we’ll assume the value of the collateral is 1 million. With the collateral, the bank’s upside is still 10% of 1 million but their downside is virtually zero. That is, if the borrower defaults, the bank gets to keep 1 million in collateral. This is an example of asymmetric bets working in the bank’s favor.

Asymmetric risks in general

An asymmetric bet often comes in the form of losing frequency (as in losing more often than winning) at the small chance of winning big.

It’s being wrong most of the time; but when you do get it right, there is a huge payoff!

It’s how startups, in general, are still successful at attracting investors despite the high odds of them closing down. (Most startups lose money.) And it’s the basis for Nassim Taleb’s Barbell Investment Strategy where he bets on both ends of the risk spectrum — and looks like a barbell — hoping the extremely risky bets pay off.

How asymmetric bets matter to your decision

New business owners often wonder if quitting their jobs is necessary. This is particularly an issue for businesses that start out as side hustles. But I would argue that the time/effort/dedication, whatever you want to call it, will be different between a full-time business owner and a side hustler. Worlds apart, even.

For most businesses (I can imagine there are exceptions), growing a full-income business will require your full-time effort. This is a contentious take that some would say is reckless. But not if it’s an asymmetric bet.

Scenario analysis

Scenario analysis is imagining how different scenarios could play out. We can use the technique by considering our two options in detail and visualizing the best and worst-case scenarios.

Option 1

Option 1 is to not quit your job. That’s a relatively easy scenario to forecast because it’s basically the status quo. This probably means stability working the 9 to 5 and retiring when you’re 60.

Option 2

Option 2 is to quit your job and start a business. Let’s pretend you’ve set up your emergency fund to include a safety net for when the business goes south.

It’s all hypotheticals from here. But for the sake of argument, let’s say the worst-case scenario is you lose all of your entrepreneurial money of a few million and in 3 years or so go back to the corporate world. You’d be late for promotions, but in the long run, it’s back to the retire-at-60 case.

But what if your business is a huge success? What if you’re able to focus on a niche, create a business system that runs on autopilot, and allow yourself to expand and invest some more? What if the business truly becomes a step to financial freedom?

If this is what you aspire for, then that right there is an asymmetric bet.

(Related: Financial Freedom While Having a Job: A Paradox)

It will always be a bet

Needless to say, this doesn’t happen overnight. This will mean more work, research, and sacrifice. It also means taking on a bet, a risk.

Jeff Bezos, the founder of Amazon, makes a great point. He believes failure and invention go hand-in-hand. You have to experiment and try new things if you want to invent. If you already know it’s going to work, then that’s not an experiment. So in a way, you have to be willing to take risks and fail.

And he also makes a great point about the baseball analogy and how it falls. Starting a business is like being at-bat — often times you strike out, sometimes it’s a base hit, and sometimes it’s a home run.

But Bezos points out that the home run scenario is where the analogy fails. In business, sometimes you “hit it so hard that you get a thousand runs” — an asymmetric bet. He’s clearly one who’s had success in making asymmetrical bets.

Conclusion: Should you quit your job and start a business?

How do you know if you should quit your job to start a business? We know that it’s not about going in recklessly without an emergency fund nor a plan. But then, no matter how well-thought-out, it’s still about taking risks.

The scenario analysis — if you fail vs. if you succeed — is an extremely helpful exercise. Have you prepared yourself and turned the odds in your favor, or are you jumping in blindly? What happens if you fail? Do you have a safety net and can you carry on? But what happens if your business plans do pan out? Does it mean financial freedom? Or at least a step closer to it?

The truth is, you’ll never really know and it’s always going to be a bet. But we can better our odds and jump in when we see how it’s an asymmetric bet.