Here’s the “TL;DR” version: You’re probably not going to consistently make enough money trading stocks, and investing in an index fund is a better alternative. The big words here are “consistent” and “enough.”

You can definitely make money trading stocks. I’ve seen it. In fact, I’ve talked about how stocks make your money work hard and how they can help you achieve financial freedom. But remember that any investment can make you money and still be a poor choice.

(Opportunity cost: If an investment makes you 3% but prevents you from investing in another investment that would’ve made 10%, then your 3% investment was a poor choice.)

Page Contents

Make money trading stocks vs. investing

The hype on trading has been so widespread, everyone and their moms trade stocks like it’s an errand! This is unfortunate because most simply confuse investing with trading.

Both investing and trading attempt to profit in the stock market.

Trading is more short-term and takes advantage of quick market movements. Investing is more long-term and focuses on looking for undervalued stocks. They occasionally intertwine.

So which is better? I prefer investing but the truth is, there’s no universally correct answer.

The optimal approach will depend on your goals, risk-tolerance, how much you currently have, where you’re currently invested, and so on. I prefer investing but it is NOT necessarily the best approach. This is my preferred approach for 3 reasons:

- Trading is a full-time job: Anyone who says they’re trading part-time making a full-time income is either lying or extremely lucky.

- I tried and failed at it: I understand the appeal of trading but also admit it’s not a source of income I can count on.

- Index funds have done better: Index funds have beaten actively managed funds on many (but not all) occasions. This, to me, is the tipping point.

(Related: How to earn 19% p.a. in the stock market, Philippines)

This, therefore, applies to you if

- You can’t commit yourself to trading stocks full-time; you are not a full-time professional in the business of trading stocks

- You’ve been unable to consistently make money trading stocks

- You make money trading stocks, but not enough to replace a full-time income

- You don’t mind the slow-but-steady (as opposed to the fast-but-unlikely) route to financial freedom

Understanding why the advice to trade is prevalent

If trading the stock market to make money is a poor strategy for non-complex individuals such as ourselves, then why is the advice so prevalent? Here are a few reasons.

Stock brokerages make more money when you trade

Stock brokerages earn a commission for every trade that’s made through them. The more you trade, the more they earn.

These businesses are typically large companies with generous marketing budgets. They recommend investing in the stock market, which is really a small and non-intrusive way of hoping you’ll eventually trade with frequency.

I’m not saying they have bad intentions. They’re certainly not going to recommend buying and selling at the risk of losing credibility. Just know though that it’s in their best interests you trade more.

Financial advisors make more money trading stocks

Ambassadors to stock brokerages also make money from trading advice. These come in the form of referral fees or even paid subscriptions for stock recommendations.

They’re not going to have a secret sauce of some sort. They will not have a revolutionary technique that’ll make you rich. If they did, then they’re wasting time marketing their service rather than just doubling down on their trading strategies.

Please consider this carefully before subscribing. You’re already at a disadvantage with the high transaction costs of active trading. Add the subscription costs and you’re at an even steeper climb to recover costs and make money.

The appeal of getting rich (quick)

Of course, large marketing budgets and influential ambassadors are weak motivators if they don’t have a strong call. And that call is the opportunity to grow your wealth in an instant.

This is a very strong hook! Imagine yourself making money trading stocks and earning a few percentages just by riding a wave. Now imagine doing this every day. Why wouldn’t you go for it, right? How hard could it be?

Just writing that makes me want to trade again. It’s definitely a strong hook and I’ve fallen for it many times.

The testimonies are from survivors

And finally, the cases that support active trading come from those who’ve done well.

This is the classic survivorship bias where our information is based on samples that have survived. The losers likely stay quiet.

In other words, you’re rarely going to hear a testimonial from someone who lost money trading the stock market. Most gossip will be about how they made a quick buck trading stocks. And all advertisements are unquestionably going to be about how a strategy makes them money.

4 Reasons to stop trying to make money trading stocks

1. You’ll likely end up worse than investing

When we take into consideration the fluctuations in earnings from trading as well as the costs to trade, investing usually turns out to be the better option.

Let’s assume a portfolio of stocks with a market capitalization of 100.00.

Tom, the trader, actively times the market. He buys and sells according to signals recommended by a fellow trader. Ian, the investor, buys and holds an index fund that tracks the same basket.

By the end of the year, the market capitalization has gone up to 110.00. Who did better?

For Tom to do better, he’d have to have exceptional forecasting abilities, time the market impeccably, and analyze the data flawlessly. All of which are discussed in the next sections.

But for an oversimplified example, let’s just say Tom always bought lower than he sold.

| Time | Buy | Sell | Profit |

|---|---|---|---|

| 1 | 100 | 105 | 5 |

| 2 | 107 | 109 | 2 |

| 3 | 107 | 110 | 3 |

Although Tom also made a 10.00 profit, Ian’s position was better because (1) he did not incur transactional costs on 3 separate occasions, and (2) he saved time by not actively trading and was able to do other stuff.

Yes, it could also go the other way where trading would’ve been the better choice. But even in this very profitable trading scenario, investing trumps trading.

Remember that traders:

- Incur transaction costs (commission, clearing, etc.) for every transaction, profitable or not, and

- Must time the market in both directions; losses add to costs

2. We overestimate our forecasting skills

We, as humans, tend to highlight our success and put the blame on others for our failures. More often than not, it’s someone else’s fault.

We also tend to overestimate our forecasting abilities.

We believe predicting the future is easy because explaining the past isn’t hard.

When we explain what has happened, it often feels like the explained event was bound to happen and was easy to predict.

When trading stocks, these manifest in the following scenarios:

- You would’ve earned more if you waited longer

- We should’ve secured that IPO

- I could’ve cut my losses if I stick to my strategy

Shoulda woulda coulda…

3. Problems with timing the market

Business valuations are based on a company’s financials. These financials naturally fluctuate, based on a myriad of factors, and the resulting valuations should theoretically fluctuate by as much.

For example, if the net earnings of a company unexpectedly improved this year (and is anticipated to be sustainable), then we may expect an increase in the company’s valuation.

Production capacity is relatively stable. Emotions are not.

But a company’s production capacity and margins are relatively predictable and stable over time. They certainly don’t change as frequently as stock market fluctuations. So how do we explain the day-to-day movements in the stock market or even the unsupported prolonged uptrends or downtrends?

In a word: Emotions.

Traders have different sets of buy-and-sell rules and, regardless of a company’s performance, they close transactions based on their (subjective) criteria.

We also know from number 2 that we, at the very least, have differing forecasts. This means for the same set of buy-and-sell rules, we have differing entry and exit points.

When we add the fact that we don’t have the same sets of buy-and-sell rules, market movements are further exacerbated.

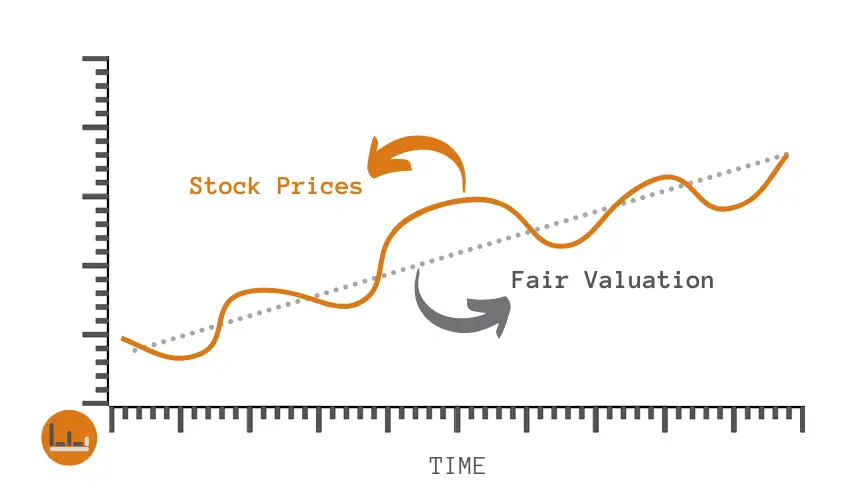

A swinging pendulum

If we call a company’s fair valuation its so-called equilibrium, then its real-time stock price is rarely at this equilibrium. Here’s why.

If the stock price is too low, investors buy more and the increase in demand pushes the price up. Other traders see the rising price and try to ride the wave. It’s likely to go past the equilibrium point as every trader tries to get in on the act. If they don’t, they’re missing out and a buy-hold strategy would’ve been better.

The continued trend eventually reaches an unsustainable high point. Does anyone know where this point is? No one actually knows.

And then some event happens that causes a massive selling. Is this selling a minor correction or is it an absolute sign of a downtrend?

Assuming it’s a new downtrend, traders cut losses and sell excessively. It’s again likely to go past the equilibrium point as traders rush to avoid being the last one out. The selling continues irrationally because no one knows where the actual bottom is.

Not quite a pendulum

Like a pendulum, momentum builds up the farther it is from equilibrium. When the swing reverses, the stored energy is released like spring at an equally forceful push.

But unlike a pendulum, the extreme ends (top and bottom) aren’t necessarily at equal distances. Rather than potential energy that converts to kinetic, it’s tantamount to randomness more than anything.

Sometimes they’re exaggerated swings. Other times they revert around a midpoint. And no one knows when they’re bound to switch, or by how much.

The unemotional and rational investors are a minority, so the market is rarely at an equilibrium. And if it were, then it’s probably because it’s on its way to the other end of the pendulum again.

4. The same data can be interpreted in many ways

We know that data is important to business valuations. They form the inputs to our analyses.

But how we interpret data is another unpredictable variable that we should consider. How we interpret data ties back to investor sentiment and emotions.

This point is best illustrated with a direct quote from Howard Mark’s book, Mastering the Market Cycle. These are skewed interpretations at work for stock rallies. (Sustained uptrends in the stock market.)

- Strong data: Economy strengthening — stocks rally

- Weak data: FED likely to ease — stocks rally

- Data as expected: Low volatility — stocks rally

- Oil spikes: Growing global economy contributing to demand — stocks rally

- Oil drops: More purchasing power for the consumer — stocks rally

Make money investing, not trading

Long-term investing and low-cost index funds are a great way of expanding your equity exposure. I would not be willing to bet that an index fund will make more money than trading stocks, just because I don’t like betting. But Warren Buffett would.

In fact, he made a bet in 2007 that an index fund would outperform an actively managed fund. A hedge fund took the bet. After 10 years the results were out and the hedge fund lost.

I don’t know about you, but I don’t believe I’m any better than full-time professionals with sophisticated equipment in the business of earning excess returns for their high net-worth clients.

A low-cost index fund that tracks the market costs less and is likely to do much better. And is accessible to us all!

(Related: FMETF: The Smart Way of Investing in the PSE Stock Market)

The freed-up time is a step closer to achieving financial freedom

Trading stocks to make money part-time can be a viable option. But not when you consider how index funds have performed and that the freed-up time allows you to do more things.

I’m an advocate of entrepreneurship and real estate for complete financial freedom. Stock market growth rates are just not enough for true financial freedom. Investing may be enough for financial security when you’re 60, but not true freedom — freedom where you have the choice to do whatever, whenever, wherever, with whomever.

True freedom means not being tied to a job until you’re 60. And it’s not being forced to live a frugal life with restricted use of your money.

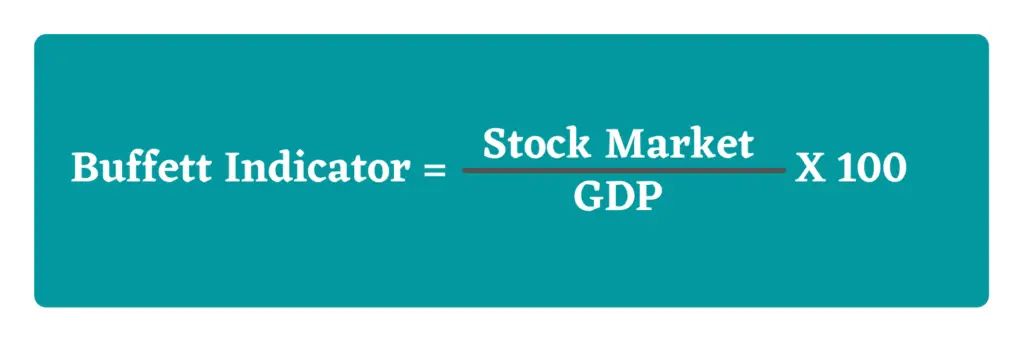

Rather than giving away time trying to trade stocks that may or may not earn you money, you can invest in an index fund that’s rebalanced quarterly using the Buffett Indicator.

The released time from trading allows you to do the following. Boring or not, these have been proven to work.

Read more books

Learn what you need to learn to run a successful business or buy real estate at a fair price.

Books develop your mind and maturity. They’re a sure-fire way of speeding up the learning process.

People would pay a fortune to be mentored by the great investors of our time. The irony is, their experiences are actually found in the books they’ve authored. And all for the price of a book.

Here’s what Warren Buffett has to say:

“Read 500 pages…every day. That’s how knowledge works. It builds up, like compound interest.

All of you can do it, but I guarantee not many of you will do it.”

Network with others

“Your network is your net worth.”

“You are the average of the 5 people you spend the most time with.”

“It’s not ‘What’ you know. It’s ‘Who’ you know.”

There are scores of quotes about how connecting with people is an important key to wealth. It’s certainly another productive alternative to trading in the stock market.

Run an actual business

Instead of trading stocks to make money, why not run a side hustle? The more time you allot to it, the greater the chance for it to reach its full potential.

It’s no secret that starting and running a business takes tremendous amounts of time. Your excess funds are therefore best invested in a passively managed portfolio so you can focus on growing the business.

Conclusion: Should you try to make money trading stocks?

Trading is exciting! It’s the closest thing to gambling that has a semblance of instruction to it. I get that the chance to earn a quick buck is not easy to pass up.

I’m not one to say you shouldn’t gamble. I’ve been on the same boat and it is admittedly enjoyable. But we should call it as it is. Trading is not investing.

If you’re in the stock market to maximize wealth through investing, the best strategy for non-sophisticated investors has often been found to be through low-cost index funds.

It’s not sexy and you probably didn’t want to hear that. But when you consider that it’s an alternative that’s consistently done well, and frees up your time for real productive activities, how can you not choose this simpler route?

*This post may contain affiliate links. You can read my affiliate disclosure here, Terms & Conditions, #6 Links.

Read more, select a topic: