Using other people’s money, often referred to as “OPM,” can be a great way to scale. Whether it’s in the form of a loan or ownership in the business, OPM allows you to expand beyond what you could’ve done by yourself. One fairly controversial yet equally valid source of OPM is private money from friends and family. Should you partner with friends and family in the first place? There are strong arguments against partnering with friends and family, but an in-depth discussion is for another day. Assuming it’s a good idea, then what’s a fair split?

There are no hard-and-fast rules to profit sharing, and it ultimately boils down to negotiations. And like all things you negotiate, the end result depends on your negotiation skills and leverage. When you abandon the deal, who loses more?

As someone who has been on both sides, I hope my thoughts are impartial enough to help. Although, spoiler alert, I think the benefits of raising funds from private money outweigh the drawbacks, and I will be speaking from the perspective of a business owner looking to raise capital.

Page Contents

Is it a good idea to invest with friends?

Let’s start with the gigantic elephant in the room: Is it a good idea to invest with friends? Like many things, the answer isn’t a simple yes or no. There are pros and cons to partnering with friends and family, and the results can either be amazingly fulfilling or terribly disastrous.

In an attempt to be as unbiased as possible, I’ll talk about three states — the best, worst, and base case scenarios, if you will.

Because I like real estate, and it’s part of my roadmap to financial freedom, we’ll focus on real estate syndications or the pooling of funds to invest in real estate. (Hoping I can create a complete guide on real estate syndications soon!) But the takeaways here apply to any business that accepts private money from friends and family.

The advantages of financing from friends and family

Under the best-case scenario, everybody wins. The pitch is successful, and raising capital is easy; the business expands purely from cheap external money; profits increase; your friends earn a lot more than investing in the stock market.

Achieving this takes a lot of planning and legwork. You may want to have a written Operating Agreement that details who makes decisions, how voting works, the percentage of ownership, and so on.

- Transparent roles and leadership (best practice is to have one leader)

- Legal and work responsibilities (are your investors purely passive)

- Costs and fees responsibilities

- Business model (niche, exit strategy)

- The level of returns investors can expect

Question 1: Why would a business owner want to give out shares of a truly profitable business?

Answer 1: 50% of a bigger pie can be better than 100% of a smaller pie. Instead of thinking about what it costs to give up part of the business, think about what you’re missing by not raising capital and partnering with others.

Question 2: Why would people invest in the business?

Answer 2: Because they can earn more. Historical stock market returns have been around 7%.

Now, I completely understand the apprehension. Asking for money can be awkward, particularly when you can’t explain the value you’re giving in return. Two real estate books changed my beliefs on asking for money: Brandon Turner and Brian Murray’s The Multifamily Millionaire Volumes I and II, and the Best Ever Apartment Syndication Book by Joe Fairless — pay special attention to the last part of Chapter 2.

Assuming you have the opportunity to impact people positively, then you’re being selfish if you don’t.

These authors emphasize how sharing helps both parties. When I think about how I’m actually helping friends and family, then it becomes an obligation I’m happy to take.

The big risk

On the other hand, you could lose your investor’s money. There’s no explaining your way out of this. If you lose their money, then you risk severing ties. And this is the main reason people advise against doing business with friends.

While you could mitigate the risks by clearly defining leadership roles and profit expectations, businesses still have unavoidable risks.

Is it worth it? Are your financial aspirations more important than your relationships? In my humble opinion, they are not. (Some people would disagree.) With the huge gamble, I know things look grim. But there is a third scenario that’s probably more realistic and achievable.

What we can hope

There is a tradeoff between risks and returns. One major issue with raising capital from purely passive partners (i.e., investors with no say in the business’s daily operations) is how interests aren’t aligned. The business owner wants to take on more risks, but that isn’t necessarily in the investor’s best interests.

(Related: The Risk and Return Tradeoff Applied in Real Life with Uncommon Examples)

One way to align interests is to invest your own money, too. When you have some skin in the game, there’s less doubt about your actions to improve the business. Interests probably won’t completely align, but risking your own money is a good start.

In our base-case scenario, interests are aligned, roles are clearly defined, and we hope the business benefits both parties. But how do you decide on the profit split?

Who loses more?

Sharing profits can be anywhere from 10-90, 50-50, 90-10, or some other combination. When thinking about the fair split, one useful question to ask is, “Who loses more when you abandon the deal?” Or equivalently, who gains the most from the partnership?

A 50-50 split assumes both parties benefit equally. 10-90 in favor of the investor assumes the business owner doesn’t have the track record, while 90-10 favoring the syndicator sounds like participation in a popular and well-established fund.

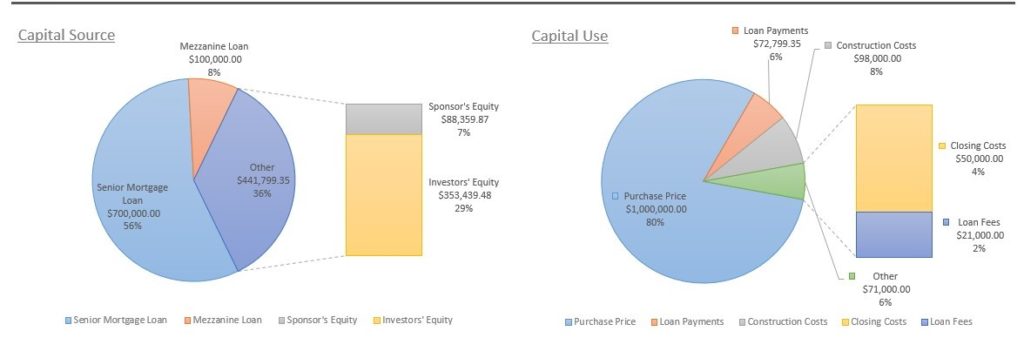

Brandon Turner talks about needing three things to close a real estate deal: capital, knowledge, and legwork. When you bring both knowledge and legwork, does that justify taking ⅔ of the deal? Maybe? It still comes down to what you and your partners agree on.

Assuming you can’t find a middle ground, does your track record show you can look for other partners? If yes, then maybe you have more leverage than you think. Do your investors have other opportunities capable of 12% to 25% returns?

Other FAQs on partnering with friends and family

For complete transparency, I do plan on raising capital from friends and family. I also understand how many of them may not understand the terms of my pitch. And I would imagine these are the same questions many readers may have. So while this section is dedicated to our prospective partners, I hope it adds some value to you as well.

Do investors get paid monthly? When can I expect to receive dividends?

Profit distribution depends on many circumstances, so the frequency of distributions is best discussed among partners. Even in real estate with monthly collections, the syndicator may need to ramp up operations and hold off distributions initially.

Besides, a business that distributes profits only means they lack better uses for the capital (i.e., they’ve hit their business expansion capacity limits). In other words, a business that holds off distributing profits could be showing growth and more significant distributions down the line.

Don’t the investors bear all risks since the money comes from them?

This is false. Syndicators contribute both knowledge and legwork. Assuming things go south, then that’s time wasted for the business owner — time they could’ve spent doing other things like working a regular job or profiting from another business.

To be blunt, if you absolutely feel the risk is solely on investors, then you shouldn’t be investing in private companies. Stick to banks or maybe even REITs.

(Related: REITs vs. Rental Properties: Which is Better?)

Nevertheless, it is good practice to invest your own money in the business anyway. It aligns interests, plus you get a larger share of the profits.

How about a borrower-lender arrangement? Is giving out a loan a better option?

An alternative to investing in exchange for ownership is giving out a loan. Choosing between debt and equity comes down to preference, as there’s no inherently superior choice.

Lenders get paid regardless of performance, but they don’t participate in the upside either. Still, the terms of the loan are subject to negotiations.

Conclusion

There is no objective way to determine what’s fair. Some of the factors that play into this decision include who you are as a person (personal and business track record), how your business has been (do you have the proper controls, do you have a concrete plan, and can you execute it), are there better alternatives for the investor, and how your negotiations play out.

If it isn’t a bad idea (again, there are strong arguments against it), partnering with friends can benefit both parties. It’s a tough choice, no doubt. But then, nothing worth doing comes easy, and this just means it’s an opportunity worth considering.