A good mentor is nothing short of a blessing. But in a world of gurus, who do you trust? And although mentoring is traditionally thought of as taking someone under your wing, I think it’s possible to mentor from afar, without knowing — when a mentor’s teachings, through books or some other medium, shape who you are. This is my list of financial freedom mentors, the people who’ve made the most impact on my principles, strategies, and mindset, and why I think they’re awesome!

This list is certainly not an exhaustive source of ideas that have influenced me. Books like Sapiens (by Yuval Noah Harari; see my biggest takeaways here) and Rich Dad, Poor Dad (by Robert Kiyosaki) are fantastic and have shaped the way I think.

But when it comes to books, context is more important than content. The same message, from different books, read at different times, would’ve influenced me differently. I could’ve read Guns, Germs, and Steel (by Jared Diamond) before Sapiens, or Think and Grow Rich (by Napoleon Hill) before Rich Dad, Poor Dad, and it would’ve influenced me more. So we’ll stick to a list of personalities that I think you, too, should be following.

In no particular order…

Page Contents

Warren Buffett

No surprises here. Warren Buffett is clearly one of the most successful investors of our time. But his net worth is but a result of my reasons for looking up to him.

Instead, his value-centric approach is the one thing I take from him.

Rather than trying to time the market, Buffett advocates investing when the intrinsic value is less than the current price. And there’s an important distinction. To quote Buffett, “Price is what you pay. Value is what you get.”

(Related: Make Money Trading Stocks? The Advice You Didn’t Want to Hear)

My personal portfolio also relies heavily on the Buffett Indicator (Investopedia). I use my own modified Buffett Indicator, adjusted for the PSE, which I regularly send to my subscribers. (Subscribe below!)

Ray Dalio

Although my PSE exposure relies crucially on Buffett’s principles, my overall portfolio is heavily influenced by Ray Dalio’s. As founder of the World’s largest hedge fund, Bridgewater Associates, I’d say he knows a thing or two about asset allocation.

(Related: Asset Allocation for Filipinos: A Global Portfolio Overview)

His emphasis on risk-parity portfolios, discussions plus explanations on market cycles, and insistence on the importance of life principles are all major lessons I take from him.

All-weather portfolio

Dalio’s all-weather portfolio shows how including bonds is important for risk-averse investors. While most amateurs see them as unnecessary, bonds are a risk-mitigating investment that payoff in down markets. Not every investment has to be sexy.

Read more about the all-weather strategy at Bridgewater Associates’ website: https://www.bridgewater.com/research-and-insights/the-all-weather-story

Market and debt cycles

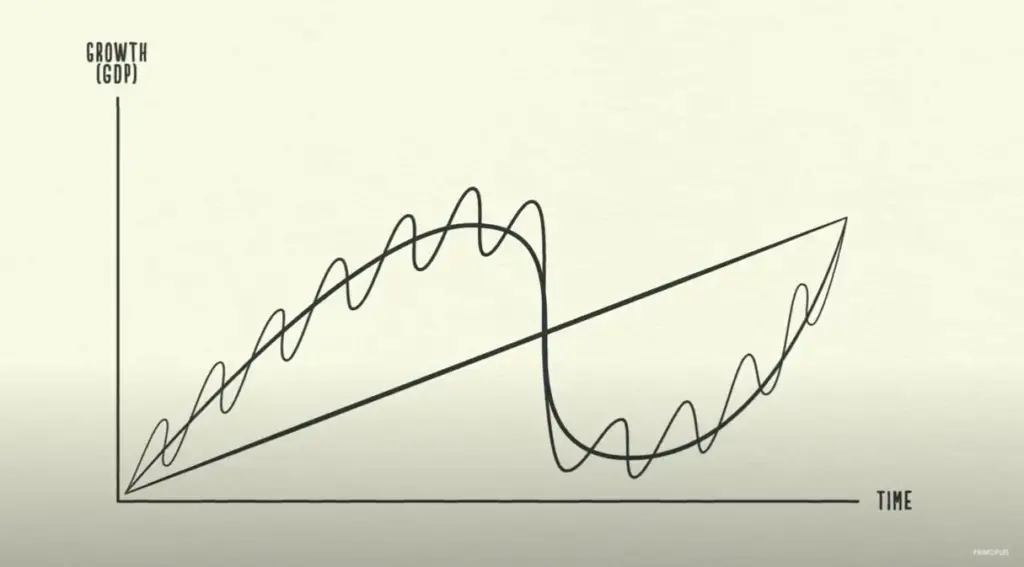

Markets also come and go in cycles. We’ll never know what the future has in store, but it’s still important to understand where we stand in the cycle. Because when we do, we get an idea of where we’re headed.

Seeing this chart for the first time was extremely consequential in how I now view the markets, short-term debt cycle, long-term debt cycle, and economic growth:

This image is a screengrab from Ray Dalio’s video, How the Economic Machine Works.

You can also watch Dalio’s complete explanation in this YouTube video. (And yes, he has his own YouTube channel! Subscribe now.)

(Mastering the Market Cycle by Howard Marks is another remarkable resource on market cycles.)

Life principles

Speaking of YouTube videos, Ray Dalio has another one that’s worth mentioning. It’s another 30-minute video that merits watching several times — new lessons pop up every time — and is based on his book, Principles: Life and Work.

The idea is to have principles that guide your decisions. It’s essentially having life algorithms. An “if this, then that” sort of disposition. Dalio shares his life and work principles, but the overarching message is to develop your own — principles that align with your values.

I’ve since developed mine, written in a journal that I update often. This is one of those habits that feel corny but are actually extremely impactful.

Try it. Set some alone time and reflect on your principles.

Gary Keller

I’m making an exception to my personality over books rule-of-thumb (mentioned in the intro) not just because two of his books form part of my core principles, but because my approach to real estate is heavily based on lessons learned from The Millionaire Real Estate Investor.

And because it’s an entire book, I’d rather refer you to my site’s real estate contents than mention one specific truth from the book.

As for his other book, The One Thing (link to the audiobook because I feel it’s best consumed in its audio format while doing other things like driving, washing the dishes, exercising), the major takeaway is to NOT pursue every opportunity that comes your way. Brandon Turner (mentioned in a bit) talks about this a lot — about not building multiple bridges to reach your goal.

We should instead focus on one bridge until completion. A bridge that’s 99% complete doesn’t do much. It’s the same with any other incomplete project.

The One Thing asks this seemingly simple yet exceptionally profound question:

What’s the one thing you can do, such that by doing it, everything else will be easier or unnecessary?

Avoid the trap of mistaking being “busy” as being “productive.”

True productive work aligns with your One Thing. Everything else is probably unnecessary, nonessential.

Brandon Turner

Brandon Turner is the host of the BiggerPockets podcast. They talk about real estate, mindset, and he’s an entrepreneur himself. He is also the co-author (along with his wife, Heather), of The Book on Managing Rental Properties — the book our rental management policies are based on.

But while his real estate influence has been important to me, the family-oriented approach that he embraces is why I look up to him.

He shows me how big goals and a family-first mindset are not necessarily mutually exclusive. You can have both.

Not everyone aspires for billions of dollars and the inherent challenges that go with it. Some are happy to provide for their families and achieve true financial freedom. Turner’s “Why” is his family, and I am very much the same way.

Daniel Kahneman

If there was a word to describe Daniel Kahneman’s impact on me, it’s “humility” by understanding we’ll never know everything, and how our minds are easily tricked.

When you think you have it all figured out by your superior knee-jerk reactions, you’re probably getting it wrong. Kahneman’s research and influence on behavioral economics is a complete mindset shift from what I’ve known to be true. Whenever I mention “biases” on this site (and apparently I say it a lot), it’s because of this man.

Trained in psychology, he’s also been awarded the Nobel Memorial Prize in Economics and his teachings have far-reaching implications — from investing to marketing.

(Good to Great by Jim Collins and Factfulness by Hans Rosling are two other resources that highlight the importance of humility. Both links direct you to Amazon. Consider reading Good to Great if you want the business context emphasis on humility, and Factfulness for a world-view against condescension.)

Filipino mentors?

As a Philippine-based site, I understand the lack of Filipino mentors on this list is a bit disconcerting. But that isn’t to say they don’t provide value. Not at all! In fact, the Philippine-centric approach is probably better tailored to fit our needs.

Have a look at PesoLab’s list of Philippine personal finance websites and blogs. You’re sure to find a host of characters and maybe one that fits your tastes.

Who’s had the most impact on your financial freedom journey? Please share them in the comments section below.

*This post may contain affiliate links. You can read my affiliate disclosure here, Terms & Conditions, #6 Links.

So far, Freedom Locker is having a huge impact to my journey to financial freedom. Aside from getting insights from the blog itself, I appreciate all the citations made to other works. Makes it really easy to discern who to follow and which books to read.

This message is truly rewarding; certainly made my day! I’m rooting for you, too. As Gary Keller would say, “Big plans powered by persistent effort…” so keep at it! 🙂