Warren Buffett and Ray Dalio, two of the most successful investors of our time, believe investing in broad markets is the way to go for many investors. As a matter of fact, Buffett’s advice is laid out in his will, page 20: “Put… 90% in a very low-cost S&P 500 index fund.” I’ve also talked about the importance of having a global portfolio for Filipinos. But for the best possible portfolio, we need to consider a third important factor, taxes. When it comes to optimizing taxes for international investments, Ireland-Domiciled ETFs (also popularly called “Irish-Domiciled ETFs”) are the holy grail.

Ireland-Domiciled ETFs have two important advantages for Filipino investors: (1) Lower tax rates and (2) the availability of Accumulating ETFs.

Firstly, the lower tax rate is due to a tax treaty between the United States and Ireland. But how about taxes between Ireland and the Philippines? And isn’t there a tax treaty between the United States and the Philippines, too? Secondly, all US-Domiciled are Distributing ETFs. How are these different from Accumulating ETFs? Are Distributing ETFs inherently bad?

And finally, I’ll cap this article with my favorite Ireland-Domiciled ETFs, as a Filipino residing in the Philippines.

(Ireland-Domiciled ETFs and Irish-Domiciled ETFs will be used interchangeably.)

Page Contents

- What are Ireland-Domiciled ETFs?

- Lower taxes on Ireland-Domiciled ETFs

- Accumulating vs. Distributing Ireland-Domiciled ETFs

- Performance and Costs of Irish-Domiciled ETFs vs. US-Domiciled ETFs

- The best Irish-Domiciled ETFs as a Filipino residing in the Philippines

- Buying Ireland-Domiciled ETFs through Interactive Brokers

- Complete your global portfolio with Irish-Domiciled ETFs

What are Ireland-Domiciled ETFs?

Ireland-Domiciled ETFs are ETFs (exchange-traded funds) domiciled, or based, in Ireland. ETFs are pooled funds that track a benchmark (e.g., a stock market index) and trade similar to other stocks in an exchange. These Ireland-Domiciled ETFs trade on the London Stock Exchange (LSE).

In a nutshell, they are ETFs that trade on the LSE.

Why do Ireland-Domiciled ETFs matter?

Several Ireland-Domiciled ETFs track US-based indices such as the S&P 500, which is widely accepted as the best gauge for large-cap US equities. But unlike US-Domiciled ETFs, Ireland-Domiciled ETFs impose lower taxes. There’s also the option of Accumulating ETFs for the same tracked index.

Say we were to track the S&P 500, our options as investors in the Philippines (but really for any non-resident alien of the US) include:

- VOO: Vanguard S&P 500 ETF — US-Domiciled ETF (distributing)

- VUAA: Vanguard S&P 500 UCITS ETF — Irish-Domiciled ETF (accumulating)

- VUSD: Vanguard S&P 500 UCITS ETF — Irish-Domiciled ETF (distributing)

There are many more ETF variants that track the S&P 500. For example, VUSA is basically number 3 (Distributing Irish-Domiciled ETF) but denominated in GBP rather than US Dollars. Or VUAG, the Accumulating ETF version of VUSA.

Before we talk about Distributing ETFs vs. Accumulating ETFs, let’s cover the lower taxes on Ireland-Domiciled ETFs.

Lower taxes on Ireland-Domiciled ETFs

By default, the United States’ withholding tax rate for non-US persons (non-resident aliens) is 30%. Tax treaties are agreements made between two countries. The US has tax treaties with a few countries, including the Philippines and Ireland, resulting in preferential tax rates.

See the complete list of United States Income Tax Treaties.

According to the tax treaties, the applicable tax rates are 25% for the Philippines and 15% for Ireland, rather than the default 30% for non-resident aliens.

25% is certainly an improvement from 30%. But needless to say, investors should get the 15% whenever possible. It is effectively the rate you’ll pay on dividends because Ireland does not levy any taxes on non-Irish residents who hold Ireland-Domiciled ETFs.

Ireland-Domiciled ETFs also protect Filipino investors in the Philippines from US estate taxes for accounts over $60,000.

(An Overview of the Taxation of Irish Regulated Funds)

Accumulating vs. Distributing Ireland-Domiciled ETFs

US law also requires ETFs to be Distributing ETFs rather than Accumulating ETFs. Basically, a Distributing ETF pays out all dividends (or ‘interest,’ in the case of bond ETFs) while an Accumulating ETF reinvests all dividends back to the fund.

While there’s nothing inherently wrong with Distributing ETFs, having options is always good for investors. Whether you choose Distributing ETFs or Accumulating ETFs will be a matter of preference.

But as we revisit the objective of our portfolio, a goal that’s consistent with Warren Buffett’s message, we see that Accumulating ETFs are a better fit. Reinvesting in Accumulating ETFs is automated, and that affords us passivity and mitigates the influence of emotions in decision-making. Not to mention the trading costs saved from reinvesting your dividends.

Accumulating ETFs are the set-and-forget options that fit investors in the accumulation phase (i.e., pre-retirement).

For retirement accounts, I am indifferent between the two. Although it’s probably mentally and emotionally easier to have Distributing ETFs in retirement, Accumulating and Distributing ETFs are expected to have approximately the same returns, pre-tax and pre-trading costs.

Performance and Costs of Irish-Domiciled ETFs vs. US-Domiciled ETFs

When choosing between US-Domiciled ETFs and Irish-Domiciled ETFs, especially when you’re buying the latter specifically because they track the US market, there are at least two important factors to consider: (1) Performance relative to the benchmark and (2) the resulting costs as a combination of the expense ratio and the applicable tax rate.

Performance compared

There’s no reason why one option would consistently perform better than the other because both track the same benchmark — the operative word being “consistent.” There will be differences in performance between periods, but the correlation between the two will be extremely high and the returns from either option should be similar.

Let’s consider VOO and VUSD. Both are Vanguard funds that track the same index, the S&P 500. Both funds attempt to have the same exposures through the same companies.

Before buying an ETF, consider checking out its tracking error, or the divergence between the fund and its benchmark. But for the most part, and maybe virtually all, the tracking errors of US-Domiciled ETFs and Ireland-Domiciled ETFs, relative to their benchmarks, should be similar.

Costs compared

Because differences in performance are arguably irrelevant, a global investor will be more concerned with the applicable costs. Two opposing factors come into play: Taxes are in favor of Ireland-Domiciled ETFs but expense ratios generally favor the US-Domiciled ETFs.

For example, the expense ratios for VOO (US) and VUSD (Ireland) are 0.03% and 0.07%, respectively. Does this justify holding one over the other? The answer may vary based on the dividend yield and the differences in expense ratios between your two choices. See Boglehead’s dividend tax withholding ratio calculator here.

For the following choices though, Ireland-Domiciled ETFs make sense.

The best Irish-Domiciled ETFs as a Filipino residing in the Philippines

Due to their competitive expense ratios and large asset bases, the following Ireland-Domiciled ETFs are sensible replacements to US-Domiciled ETFs for Filipino investors residing in the Philippines.

Total World Market

- US-Domiciled ETF: VT, Vanguard Total World Stock ETF (Expense ratio 0.08%)

- Ireland-Domiciled ETF: VWRA, Vanguard FTSE All-World UCITS ETF (Expense ratio 0.22%)

All-World ETFs are popular due to their exposure in both developed and emerging markets. Rebalancing isn’t necessary as your weights are dictated by the market. This is a set-and-forget type of investment and is consistent with our portfolio objective.

Personally, the relatively high expense ratio of 0.22% is a turnoff and I prefer buying the developed markets plus emerging markets combination separately. Granted that’s a more involved option.

Despite the lack of VWRA in my personal portfolio, it’s still prudent to have a total world market ETF in a list of best ETFs.

US S&P 500

- US-Domiciled ETF: VOO, Vanguard S&P 500 (Expense ratio 0.03%)

- Ireland-Domiciled ETF: VUAA, Vanguard S&P 500 UCITS USD (Expense ratio 0.07%)

An equally good alternative is CSPX, or the iShares Core S&P 500 UCITS ETF by BlackRock. CSPX also has an expense ratio of 0.07%, with tighter spreads and better liquidity. CSPX is probably better for higher trade values and VUAA for lower trade values. Ultimately, both are equally excellent ETFs that track the S&P 500.

Rounding up the portfolio

Among many other things, Ray Dalio is famous for his all-weather portfolio and its emphasis on gold, commodities, and emerging markets in combination with the US market. For a truly diversified portfolio, strategic exposures to other developed markets, and emerging markets are probably justified.

Developed Markets

- Ireland-Domiciled ETF: SWDA, iShares Core MSCI World UCITS ETF (Expense ratio 0.20%)

Emerging Markets

- Ireland-Domiciled ETF: EIMI, iShares Core MSCI EM IMI UCITS ETF (Expense ratio 0.18%)

Buying Ireland-Domiciled ETFs through Interactive Brokers

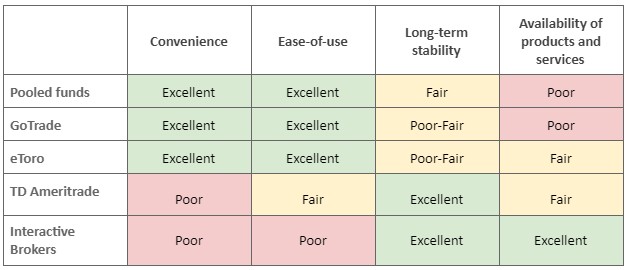

Now, to the fun part, buying your Ireland-Domiciled ETFs! There’s a big catch though. Ireland-Domiciled ETFs are not available on popular international platforms like GoTrade, eToro, and even TD Ameritrade.

These brokers allow Filipinos access to the US stock market only. If you recall, Ireland-Domiciled ETFs are listed on the London Stock Exchange. Fortunately, Interactive Brokers (IBKR) gives us access to markets outside of the US.

I’ve read about TradeStation as an alternative. But with a large listed company like IBKR waiving inactivity fees, offering the lowest commissions, and forex near spot rates, I see no reason not to choose Interactive Brokers. Read more about Interactive Brokers’ waived fees and funding instructions here.

If you’re ready to open an IBKR account, the following link is part of their refer-a-friend program that benefits both referring clients (me) and referred clients (you).

Should you choose to support this site by using the link, you will receive $1 worth of Class A common stock of Interactive Brokers Group, Inc. for each $100 deposited to your account. I may also receive a commission when you maintain at least $10,000 in your account for one year following the opening of your account.

I recommend using someone’s link, whether it’s mine or not, just for the added benefit of getting IBKR stocks from deposits you would’ve made anyway.

The terms and conditions of IBKR’s refer-a-friend program is here: https://ndcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4051

Complete your global portfolio with Irish-Domiciled ETFs

Ireland-Domiciled ETFs, Irish-Domiciled ETFs, whatever you want to call them, are a vital part of your global portfolio. Whether you’re in the accumulation phase or in the dividend-heavy retirement portfolio, the tax advantages are a huge benefit that you shouldn’t pass on.

I’m sure I missed some of your favorite ETFs. Let me know in the comments below.