The rule does hold but is often misinterpreted. Many newcomers hold off investing because of the popularized 8k Rule when investing in the PSE stock market. For a lot of beginners, allocating 8,000 pesos isn’t possible. So instead, they set aside 1,000 pesos a month for 8 months to save on trading fees — or some other iteration like 2,000 pesos a month for 4 months. But is this a wise decision? Does the 8k Rule apply to long-term investments in the PSE stock market?

In my analysis, Filipino investors may profitably invest less than 8,000 pesos if they believe the stock market’s annualized returns are around 7%, which is equivalent to monthly compounded returns of 0.56%*. This is a fairly reasonable assumption if historical data is our basis**.

Now, fees certainly increase (in percentage terms) when investing less than 8,000 pesos. Over long time horizons, these fees add up and are an instant negation to profits. But what isn’t accounted for are the returns you would’ve missed by not participating in the stock market.

It, therefore, helps to know the returns that make the added fees worth it.

*This is original research prepared by the author in June 2021. Please credit this site accordingly.

**Historical returns have been 7.88% from 1987 to 2021, and 8.6% from 1987 to 2019. Data on the Philippine Stock Exchange Index, PSEi, from Yahoo Finance.

Page Contents

What is the 8k Rule in PSE stock market investing?

The 8k Rule says that to optimize fees (i.e., to make the most fees paid), invest at least 8,000 pesos. Online brokers charge commissions of “0.25% of the amount invested or 20 pesos, whichever is higher.”

We get the equivalence by 20 pesos divided by 0.25%, which is 8,000 pesos.

In other words, if the amount invested is 8,000 pesos, then the total commission paid is 20 pesos. Invest anything less and you still pay 20 pesos — you’re basically paying more in percentage terms. For example, if you invest 1,000 pesos and pay 20 pesos in commission, then that’s 2% of commissions paid (20 pesos divided by 1,000 pesos) — significantly more than 0.25%.

The point is to not waste money by still paying 20 pesos in commissions despite investing a lower amount.

Total commissions when investing monthly

Let’s carry on assuming you invest 1,000 pesos per month for 8 straight months. Total commissions would’ve been 160 pesos (vs. 20 pesos by investing 8,000 once).

And we haven’t even mentioned the other fees when investing.

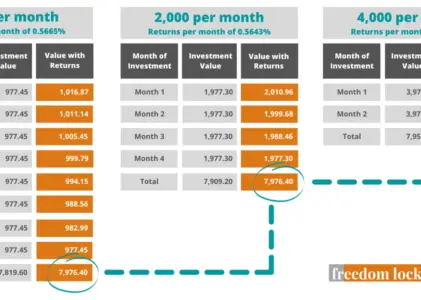

Total fees per investment

For every investment you make in the PSE stock market, the following fees apply:

| Online brokerage commission | 0.25% of the amount invested or 20 pesos, whichever is higher |

| VAT | 12% of broker’s commission |

| PSE Transaction Fee | 0.005% of Gross Trade Amount |

| SCCP Charges | 0.01% of Gross Trade Amount |

No doubt increasing the frequency of trades increases your costs. These costs mean you start in a disadvantaged position. So whenever reasonable, invest 8,000 and make full use of your fees.

But this comparison is lacking, incomplete, imperfect.

Where the 8k Rule breaks down

Investors invest in the stock market expecting a return. When new investors hesitate to invest because of the 8k Rule (because they haven’t accumulated as much), it’s clear that their focus is on added costs.

What they fail to consider are the returns compounded over missed periods.

Consider an extreme hypothetical scenario to drive the point: If returns are a million percent a month for investing 1,000 today, wouldn’t the returns more than offset the added costs?

Obviously, a million percent is unlikely. But it’s clear that a certain level of returns exists where you wouldn’t care between 1,000 pesos over 8 months and 8,000 pesos after 8 months — a point of indifference.

I loosely call this point of indifference our breakeven returns.

Breakeven returns when investing in the PSE

The breakeven point is the level of returns that offset the added costs of investing less than 8,000 pesos.

Said in another way, if you get this level of return per month, then it wouldn’t matter if you invested now or waited to accumulate 8,000 pesos. And that means if you earn more than this level, then investing as soon as possible is profitable.

I understand all this is a bit abstract, so let’s consider an example.

(Read this somewhat related primer if you’re unfamiliar with the breakeven point concept: 3 Easy Steps to Know if Your Business Idea is Worth Pursuing: Breakeven Point)

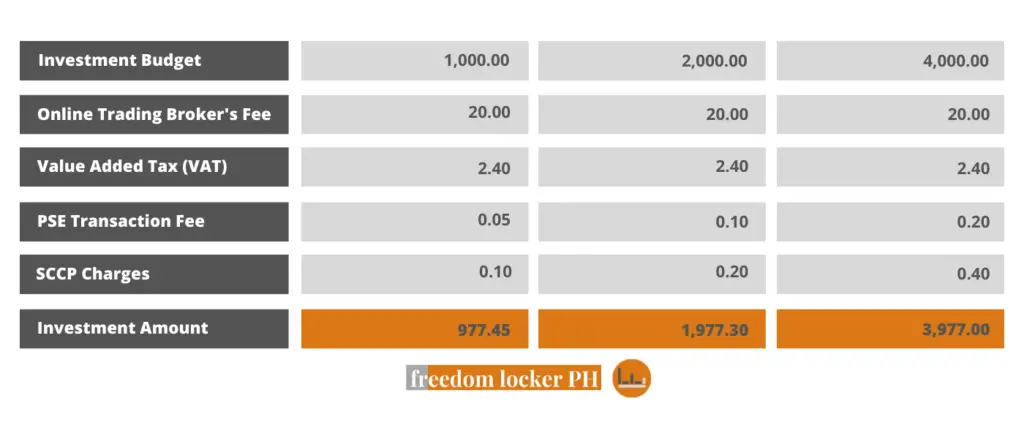

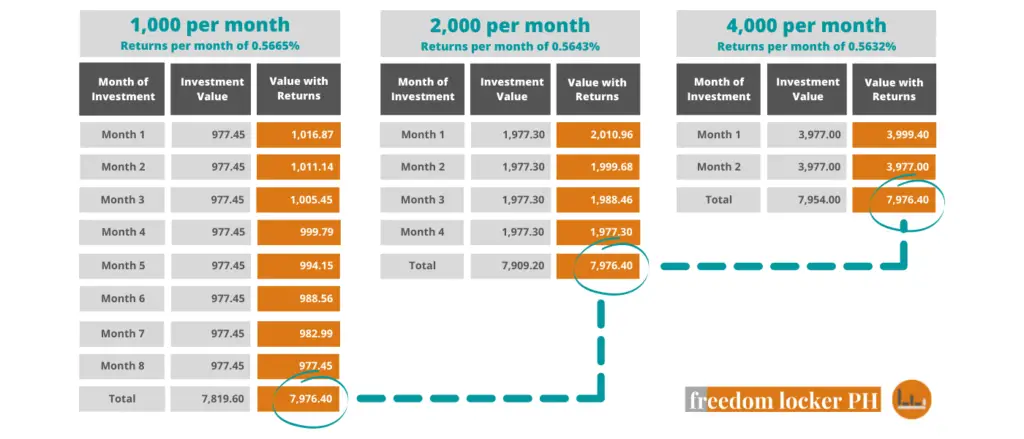

Sample breakeven point: PSE 8k Rule

Our imaginary investor can allocate 4,000 pesos per month. She, therefore, has two options:

- Option 1: Invest 4,000 pesos now and 4,000 next month

- Option 2: Invest 8,000 pesos next month

For analysis purposes, we’ll assume it’s possible to trade odd numbers such as 3,977, 1,977.30, and 977.45.

Option 1

For a 4,000 peso budget, her investment amount is 3,977 pesos (i.e., 23 pesos in total fees). If the stock market (or her specific stock) grows by 0.5632%, then by the start of month 2, her initial 3,977 pesos would’ve grown to 3,999.40.

3,977 x (1 + 0.5632%) = 3,999.40So by month 2, this totals to 7,976.40 pesos, or 3,999.40 pesos (month 1) plus her new investment of 3,977 pesos in month 2.

3,999.40 + 3,977 = 7,976.40(Read Finance for People Who Hate Math to learn about the time value of money principle for beginners.)

Option 2

If she waited 2 months and budgeted 8,000 pesos, fees would’ve been 23.60 pesos or a total investment amount of 7,976.40.

Checking fees:

- Gross trade amount = 7,976.40

- Broker’s Commission = 20

- VAT = 2.4

- PSE Transaction Fee = 0.40

- SCCP Charges = 0.80

- Total debit of 8,000 pesos.

Notice that the gross trade amount of 7,976.40 is exactly the same for both options.

At a monthly return of 0.5632%, the fees wouldn’t have mattered.

Anything above this monthly return means it’s better to invest sooner than later — you’d want to take advantage of the compounding returns ASAP.

Introducing the 7% Rule for investing in the PSE stock market

Through an iterative process of testing various monthly returns, I found 0.5632% to be the point at which the investor breaks even regardless of the option. (Meaning she gets the same results whether it’s option 1 or option 2 in our example.)

Earning 0.5632% per month gives us a compounded annual return of 6.97%. I also checked the points of indifference when investing 1,000 pesos for 8 months and 2,000 pesos for 4 months. The compound annual returns were 7.01% and 6.99%, respectively — 0.5665% per month and 0.5643% per month, respectively.

7% Rule: If the investor believes the annualized returns for the stock or stock market, whichever applies, is over 7.01%, 6.99%, and 6.97% for regular investments of 1,000, 2,000, and 4,000, respectively, then it makes sense to invest now and not wait to accumulate 8,000 pesos.

(The selection of 1,000, 2000, and 4,000 pesos is an arbitrary selection to make the computation easier. Monthly compounding is also an arbitrary choice for simplicity. Results will vary with varying assumptions.)

(Related: Peso-Cost Averaging Advanced Guide: Know if It Works for You)

PSE historical returns

How do our points of indifference, or breakeven returns, stack against actual returns?

I should preface this part with a customary spiel: Past performance is no guarantee of future results. But with no alternate course, I think it’s still interesting to see how the PSEi has done so far.

Using data from Yahoo Finance on the PSEi’s adjusted closing prices, the compound annual growth rate from February 1987 to February 2021 (i.e., available data from the source) was 7.88% — despite the Asian Financial Crisis, Global Financial Crisis, and COVID.

The compound annual ground rate up to 2019 was 8.62%. With an adjusted Buffett Indicator approach, it’s even possible to earn 19% p.a. as this backtest shows.

Interestingly, of the 34 full years covered in the data, exactly half had years over 7% and the other half below it.

(Related: FMETF: The Smart Way of Investing in the PSE Stock Market)

Sample impact when returns are over 7%

What if we use an annual return of 8.62% or 0.6914% per month?

If we invest 3,977 pesos (3,977 + fees = 4,000) and this grows by 0.6914%, the ending value after a month is 4,004.50 pesos. By the second month, our investment would’ve been 4,004.50 plus 3,977, or 7,981.50 pesos.

Assuming we waited to accumulate 8,000 pesos to save on fees, our investment by month 2 would’ve started at 7,976.40 (7,976.40 + fees = 8,000).

Under these assumptions, investing early is the better choice.

Conclusion: Do you need the 8k Rule?

My empathy is for new investors, and it’s unfortunate to see them resist investing because of the 8k Rule. So this point is specifically for people who hold off investing, waiting to accumulate 8k. (Many end up spending the money. See my tips on being disciplined with money.)

Again, if you have the capacity, then investing 8,000 pesos certainly optimizes your fees. But if capacity is limited, investing less than 8,000 pesos might make sense.

It comes down to your expectations. Do you believe annual returns will be more than 7%? Then take advantage of compounding returns and start investing. If you’re less optimistic, then consider waiting. Personally, I’d say time in the market over timing the market. Markets are unpredictable and our best bet is to increase our time in the market.

And if all this was confusing, here’s my concluding remark: Stop worrying about the 8k Rule.

Consider sharing this with friends unnerved by the 8k Rule when investing in the PSE stock market. Was this a refreshing point of view? Subscribe to my newsletter for fresh takes on finance, entrepreneurship, and real estate.

(Addendum: The 8k Rule is especially important for active traders. But even then I’d argue active trading isn’t for non-professionals.)

Hi Dan! Just wanted to say that I enjoy your articles. I think this is a nice take on the 8k rule which can help newbies who’s not looking to trade. Commissions are generally costly if you trade frequently, but matters less when you’re looking to hold for the long-term

Thank you! Your feedback means a lot. 🙂